This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Maine Partnership Data Summary

Description

How to fill out Partnership Data Summary?

Have you ever found yourself in a situation where you need to obtain documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of document templates, including the Maine Partnership Data Summary, which can be tailored to meet both federal and state requirements.

Once you have located the appropriate template, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for your order using PayPal or a credit card.

Select a suitable document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can acquire another copy of the Maine Partnership Data Summary at any time if needed. Simply select the required template to download or print the document.

Utilize US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Maine Partnership Data Summary template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the template you require and verify that it is for the correct state/region.

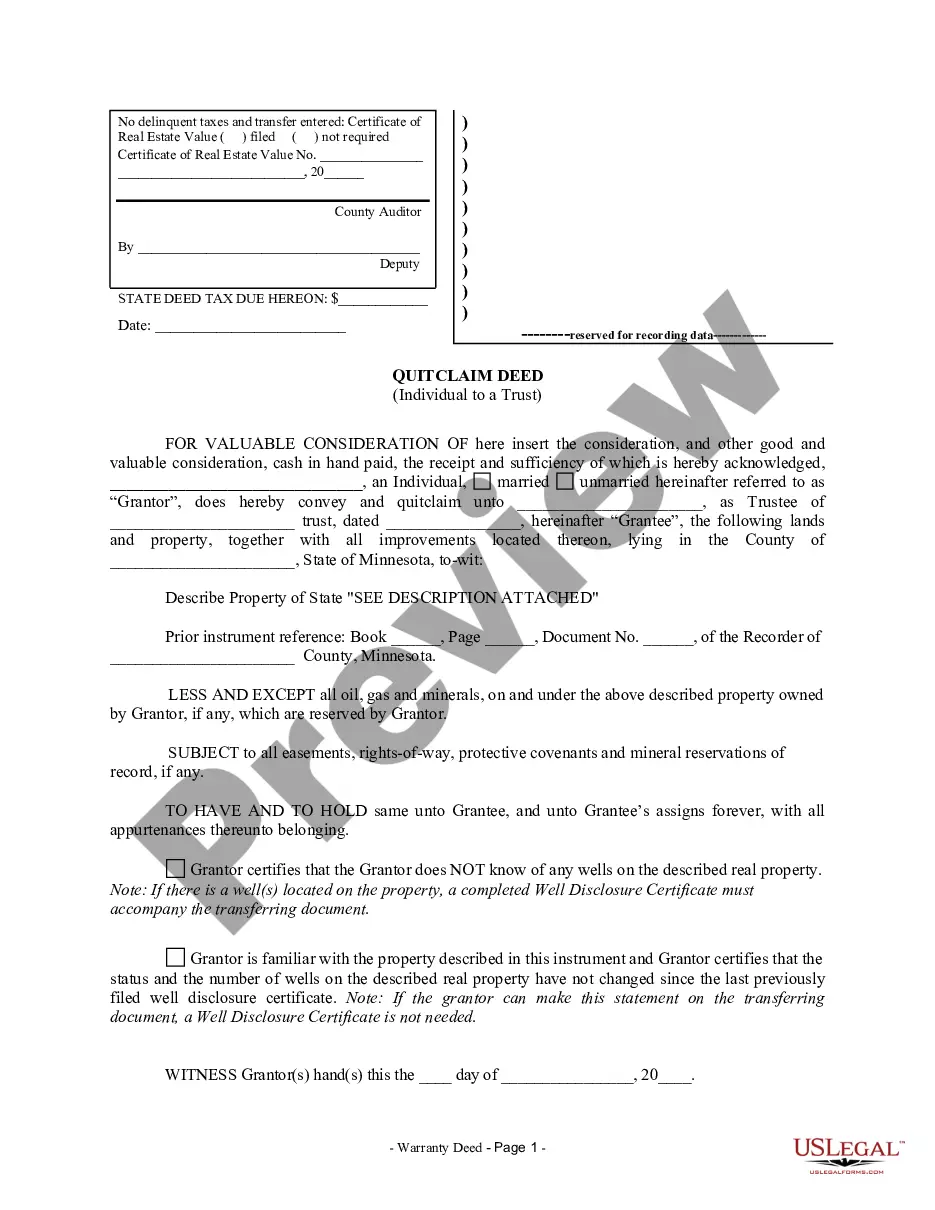

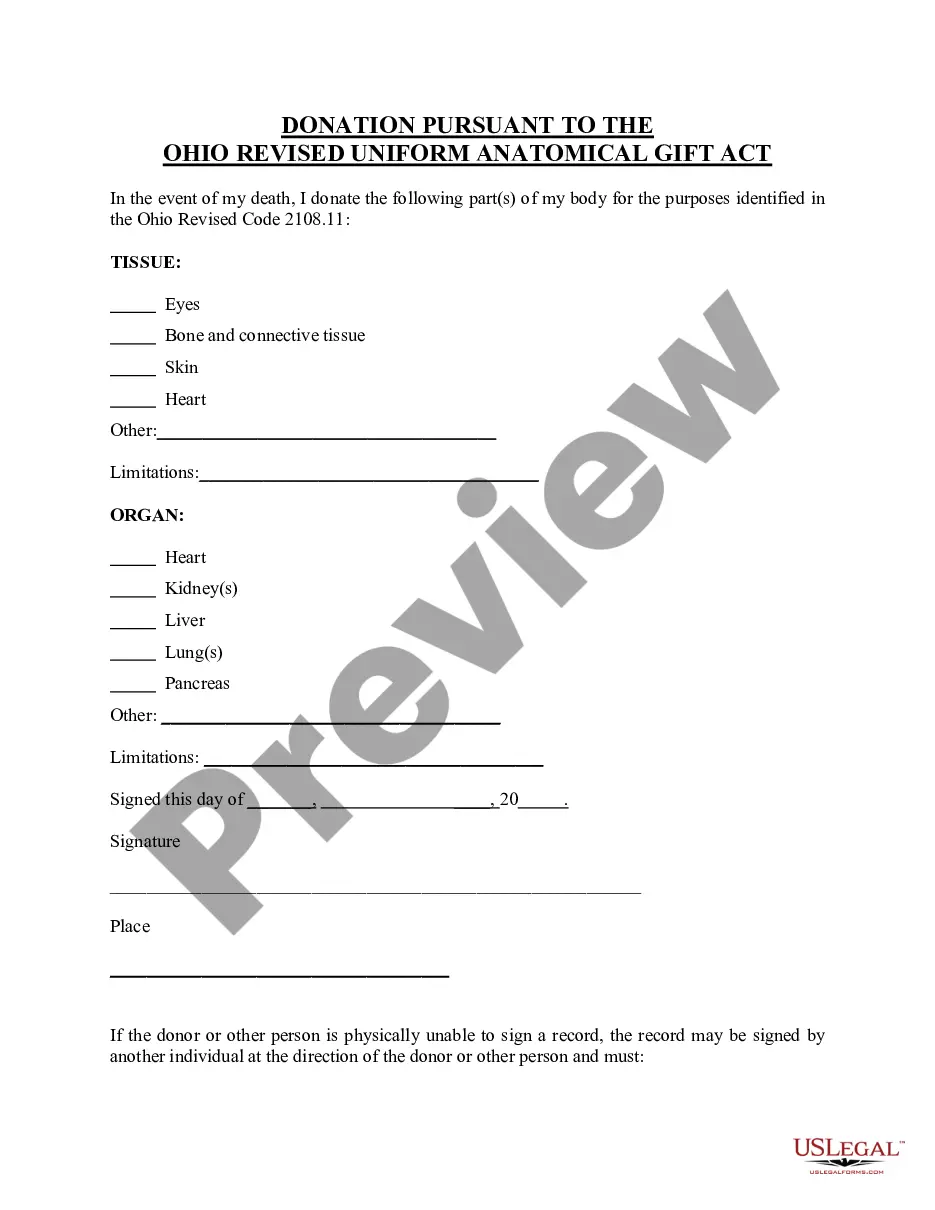

- Utilize the Review option to check the form.

- Read the description to ensure you have selected the correct template.

- If the template does not meet your needs, use the Search field to find a form that fits your requirements.

Form popularity

FAQ

To retrieve your Articles of Incorporation, first check with the Maine Secretary of State’s office as they maintain these records. You can conveniently request copies online or through the mail. This document is crucial for your business identity, and the Maine Partnership Data Summary can provide relevant insights into your incorporation status.

Yes, Articles of Incorporation are necessary for an LLC to establish its legal existence in Maine. These documents outline essential details about your business structure and operations. The Maine Partnership Data Summary can streamline your understanding of the requirements involved in setting up an LLC in the state.

Several factors contribute to big businesses leaving Maine, including economic conditions, tax rates, and labor availability. Companies often seek environments that offer better resources and support for growth. Understanding these trends can help you make informed decisions, which the Maine Partnership Data Summary might shed light on regarding business demographics.

To obtain a copy of your articles of incorporation in Maine, you should contact the Maine Secretary of State's office. You may request a copy through their online portal or directly by mail. By accessing your articles, you'll gain insight into your business structure, which is often summarized in the Maine Partnership Data Summary.

You can look up public records in Maine by utilizing the Maine State Archives or the appropriate government agency depending on the type of record. Many documents are accessible online, offering a convenient way to find information. Additionally, the Maine Partnership Data Summary can guide you to specific records pertaining to business entities.

To look up a Maine LLC, you can visit the Maine Secretary of State's website. There, you will find the business entity search feature, which allows you to enter the LLC name or number. You'll quickly access the Maine Partnership Data Summary related to that LLC, providing you with essential registration details and status.

Question 4 on the partnership return typically asks for partner-specific information, including each partner's share of profits and losses. Accurate reporting is vital to ensure compliance with both federal and Maine state regulations. Partners should review their allocation agreements and any changes throughout the year. For a comprehensive understanding, the Maine Partnership Data Summary can be an excellent resource.

To effectively complete Form 1065, partnerships need essential information such as the partnership’s name, address, and Employer Identification Number (EIN). Additionally, partners’ details, income, deductions, and the allocation of profits and losses must be included. Ensuring accuracy in this data is crucial for a smooth filing process. Refer to the Maine Partnership Data Summary for further insights regarding specific needs.

Yes, Maine requires partnerships to file a tax return specific to partnerships. This return may differ from federal requirements, so partners should stay informed about state laws. Filing accurately ensures compliance and avoids potential penalties. The Maine Partnership Data Summary provides detailed guidance on the state’s filing processes.

The 7 year rule generally refers to the period in which certain partnership tax records must be kept. Partnerships are encouraged to retain records for at least seven years to ensure compliance with IRS requirements. This retention period helps in case of an audit or if questions arise regarding past filings. The Maine Partnership Data Summary emphasizes the importance of maintaining accurate records throughout this period.