This is a due diligence contract provision that a company will provide reimbursement for any losses that the director may incur in business transactions.

Maine Director Favorable Director Indemnification Agreement

Description

How to fill out Director Favorable Director Indemnification Agreement?

Are you currently in the position where you need documentation for either business or personal use on a daily basis.

There are numerous legal form templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, including the Maine Director Favorable Director Indemnification Agreement, designed to comply with federal and state regulations.

Once you find the suitable form, click Buy now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using PayPal or a credit card. Choose a convenient document format and download your copy. Access all the form templates you have purchased in the My documents menu. You can obtain another copy of the Maine Director Favorable Director Indemnification Agreement at any time if needed. Just access the appropriate form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal form templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maine Director Favorable Director Indemnification Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Retrieve the form you need and ensure it is for your correct state/area.

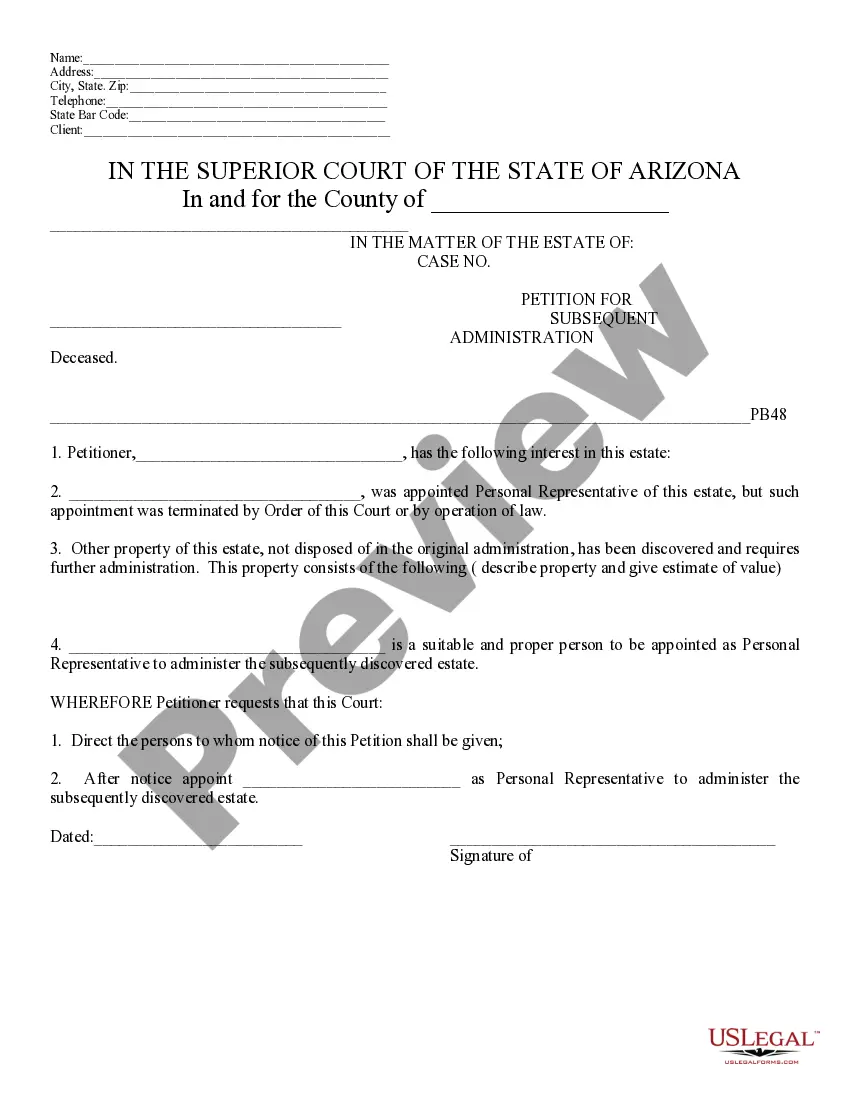

- Utilize the Review button to examine the form.

- Check the description to make sure you have selected the right template.

- If the form isn’t what you're seeking, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A director indemnification agreement is a legal framework that outlines how a company protects its directors from legal liability. Through a Maine Director Favorable Director Indemnification Agreement, businesses reassure directors that they will cover costs linked to litigation. This agreement fosters an environment where directors can make decisions freely, knowing that they have solid backing in adverse situations.

In some cases, stockholder approval may be necessary for an indemnification agreement to become effective. A Maine Director Favorable Director Indemnification Agreement may require this approval, especially when the terms significantly impact company finances or risk. It ensures transparency and fosters trust between directors and shareholders.

A company cannot indemnify its directors if they act in bad faith, engage in willful misconduct, or violate the law. In these instances, the protections outlined in a Maine Director Favorable Director Indemnification Agreement may not apply. This limitation ensures that directors remain accountable for their actions while still being supported in legitimate legal challenges.

A director indemnity agreement outlines the terms under which a company will protect its directors from legal costs or damages. This document typically forms part of a Maine Director Favorable Director Indemnification Agreement, guaranteeing that directors receive support when facing claims made against them. Such agreements are vital for maintaining trust and integrity in corporate governance.

Yes, directors can be indemnified under specific circumstances, allowing them to recover costs associated with legal actions. A Maine Director Favorable Director Indemnification Agreement provides this coverage, ensuring that directors are not personally responsible for expenses resulting from their decisions. This assurance encourages strong governance and confident leadership within a company.

An indemnification agreement aims to protect directors from personal financial loss due to legal actions or claims arising from their duties. With a Maine Director Favorable Director Indemnification Agreement, companies assure leaders that they will cover reasonable expenses incurred during litigation. This protection helps attract competent individuals for board positions by providing a safety net against potential risks.

Yes, a director can be indemnified under a Maine Director Favorable Director Indemnification Agreement. This type of agreement helps protect directors from legal liabilities that may arise during their service. It provides financial protection against costs, expenses, and damages incurred while performing their duties in good faith. By having such an agreement, directors can focus on their responsibilities without the constant worry of potential legal repercussions.