This form is used to request a list of industrial and operational documents and information from a company.

Maine Prioritized Industrial Operational Due Diligence Information Request List

Description

How to fill out Prioritized Industrial Operational Due Diligence Information Request List?

Locating the appropriate legal document template can be a challenge.

Naturally, there are numerous templates available online, but how can you find the legal form you need? Use the US Legal Forms website.

The platform offers thousands of templates, including the Maine Prioritized Industrial Operational Due Diligence Information Request List, which you can use for business and personal purposes. All forms are vetted by experts and meet both state and federal requirements.

If the form does not meet your requirements, use the Search field to find the right document. Once you are sure the form is suitable, click the Get now button to acquire the form. Choose your desired pricing plan and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template for your needs. Complete, modify, print, and sign the obtained Maine Prioritized Industrial Operational Due Diligence Information Request List. US Legal Forms is the largest repository of legal documents where you can find a variety of file templates. Use the service to obtain professionally crafted documents that conform to state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Maine Prioritized Industrial Operational Due Diligence Information Request List.

- Use your account to review the legal forms you've previously ordered.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct form for your state/region.

- You can browse the form using the Review option and read the form description to confirm it is the right one for you.

Form popularity

FAQ

The first step in developing a due diligence audit checklist involves identifying the specific objectives of your audit. You can utilize the Maine Prioritized Industrial Operational Due Diligence Information Request List to highlight key areas that need assessment. This ensures that your checklist is tailored to meet your unique needs and maximizes its effectiveness in the due diligence process.

To obtain a due diligence report, begin by identifying the type of assessment you need and the professionals who can provide it. You can collect required information using the Maine Prioritized Industrial Operational Due Diligence Information Request List for a systematic approach. Additionally, platforms like uslegalforms can connect you with professionals who can deliver these reports efficiently.

Generally, licensed professionals, such as lawyers or certified public accountants, can issue a due diligence report. These experts are knowledgeable about the necessary regulations and best practices. Utilizing the Maine Prioritized Industrial Operational Due Diligence Information Request List ensures that the report is both accurate and compliant.

Professionals in various fields, such as finance, legal, and compliance, typically prepare a due diligence report. These experts gather and analyze relevant data to assess the subject of the report comprehensively. When you need a thorough understanding, leveraging the Maine Prioritized Industrial Operational Due Diligence Information Request List can streamline this preparation process.

Filing due diligence involves compiling all necessary documents and information related to your assessment. Utilize the Maine Prioritized Industrial Operational Due Diligence Information Request List to systematically organize your findings and ensure completeness. After gathering all relevant reports and analyses, submit your due diligence documents through the proper channels defined by regulatory or investor requirements. By following these steps, you streamline the process and maintain transparency in your financial dealings.

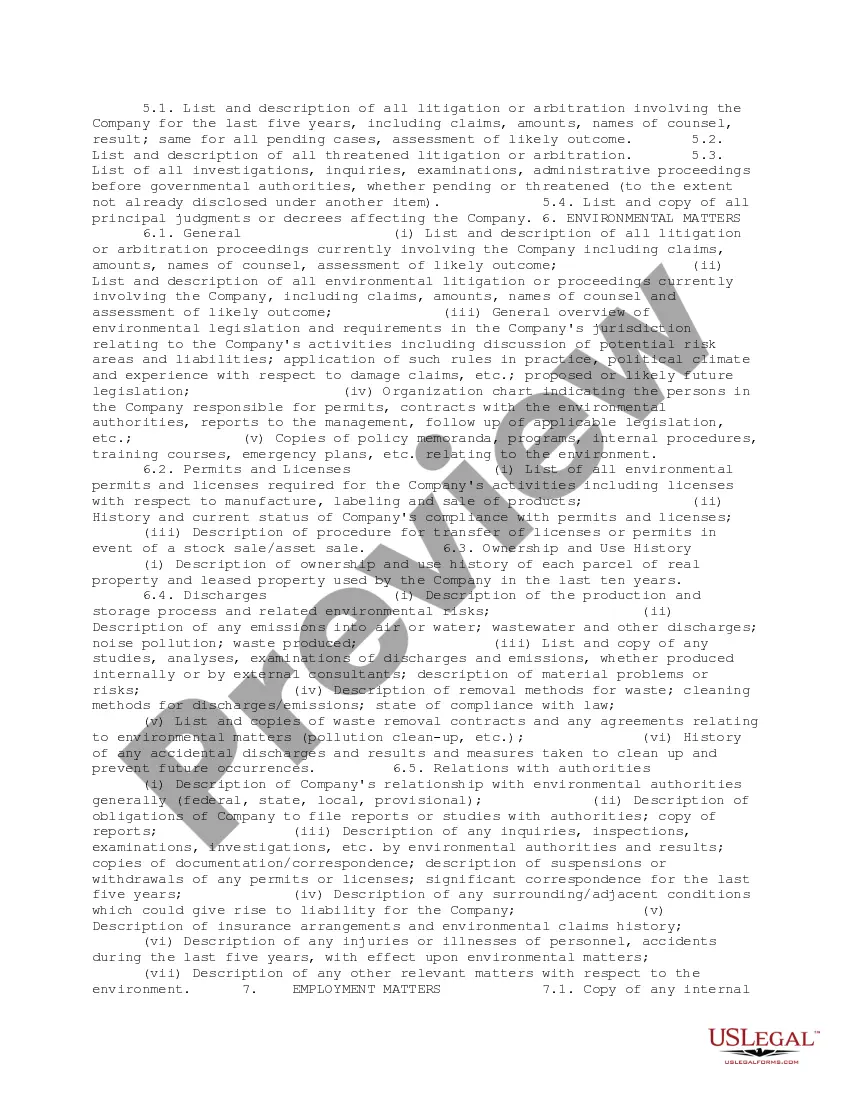

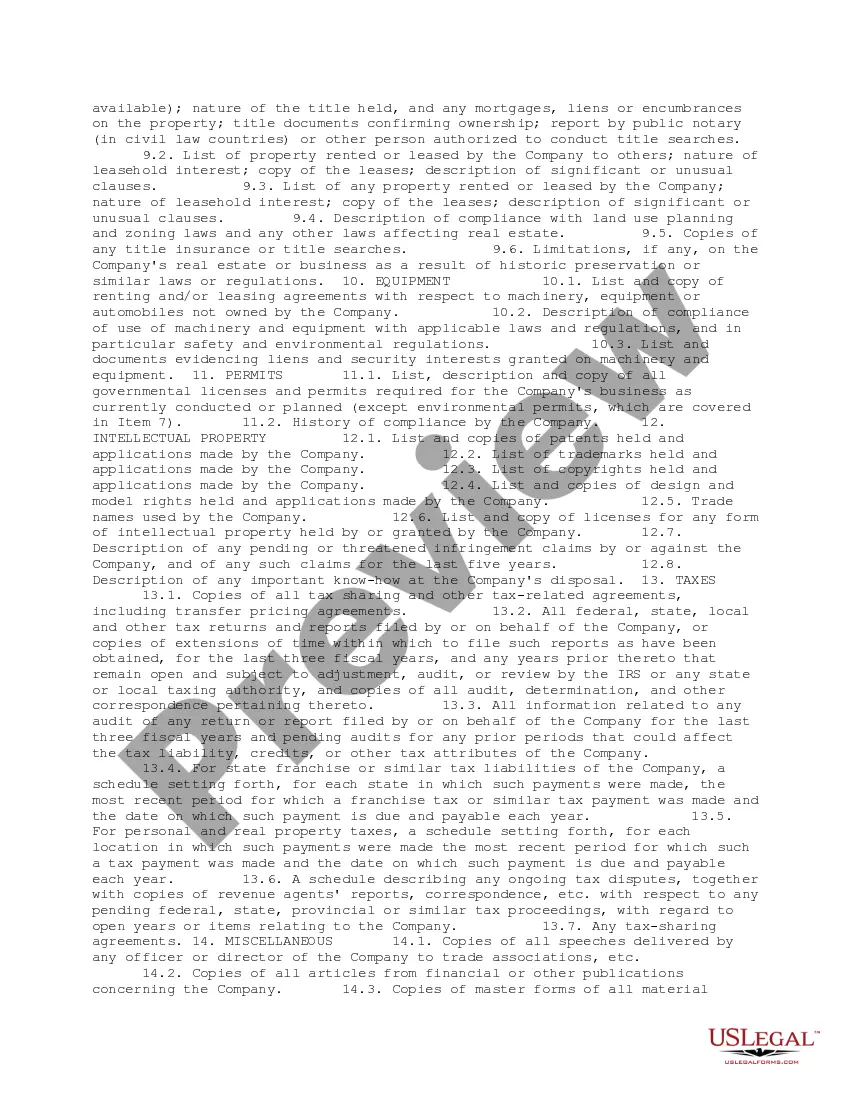

To conduct operational due diligence effectively, start by gathering comprehensive information using the Maine Prioritized Industrial Operational Due Diligence Information Request List. This list provides essential categories and documents that help you assess the operational health and risks of a business. Next, focus on analyzing the data collected to identify any potential operational gaps or issues that could impact performance. Finally, ensure you integrate findings into your decision-making process to enhance investment strategies.

Yes, a buyer can back out after due diligence if they discover significant issues that affect the viability of the transaction. It is essential for buyers to thoroughly assess findings during this phase. By utilizing the Maine Prioritized Industrial Operational Due Diligence Information Request List, buyers gain valuable insights that can influence their final decision.

A due diligence request refers to the inquiry made by a buyer to a potential seller for specific information and documentation related to the business. This step is crucial for verifying facts and claims made by the seller. Using the Maine Prioritized Industrial Operational Due Diligence Information Request List ensures that all relevant aspects are addressed, providing a solid foundation for the negotiation process.

A red flag during due diligence is an alarming indicator that suggests potential risk or issues within the target business. Examples of red flags include poor financial performance, inconsistent records, or legal disputes. Being aware of these indicators while reviewing the Maine Prioritized Industrial Operational Due Diligence Information Request List can help buyers make more conscious and informed decisions.

The 4 P's of due diligence consist of Product, People, Processes, and Projections. These elements cover the essential aspects that need to be reviewed when evaluating a business. Utilizing the Maine Prioritized Industrial Operational Due Diligence Information Request List enables buyers to systematically analyze each of these areas, ensuring a well-rounded assessment.