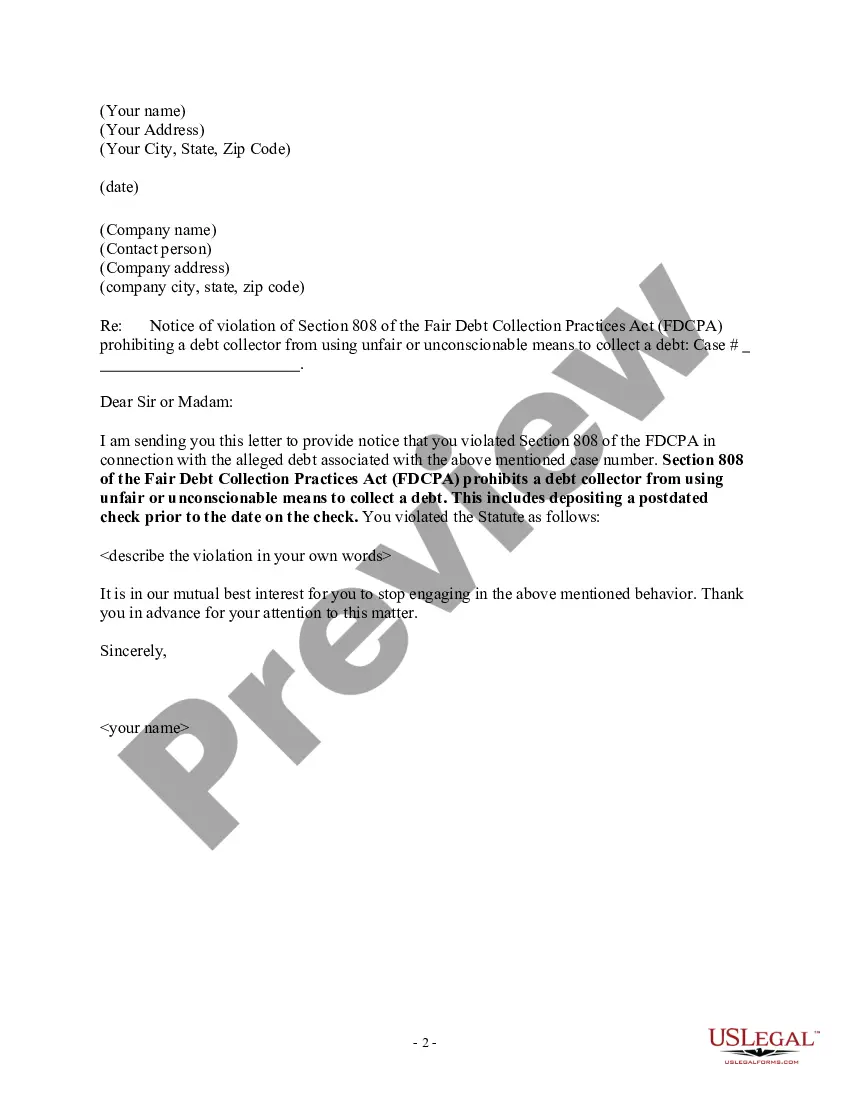

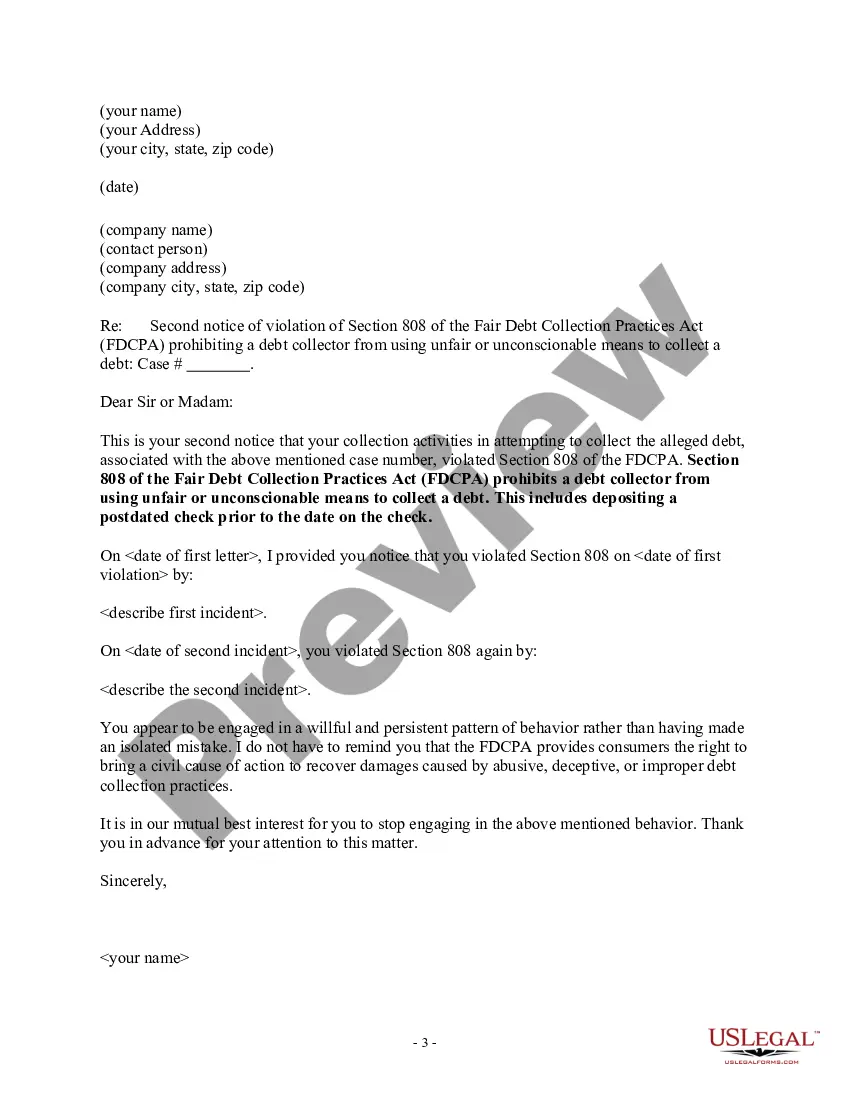

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Maine Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

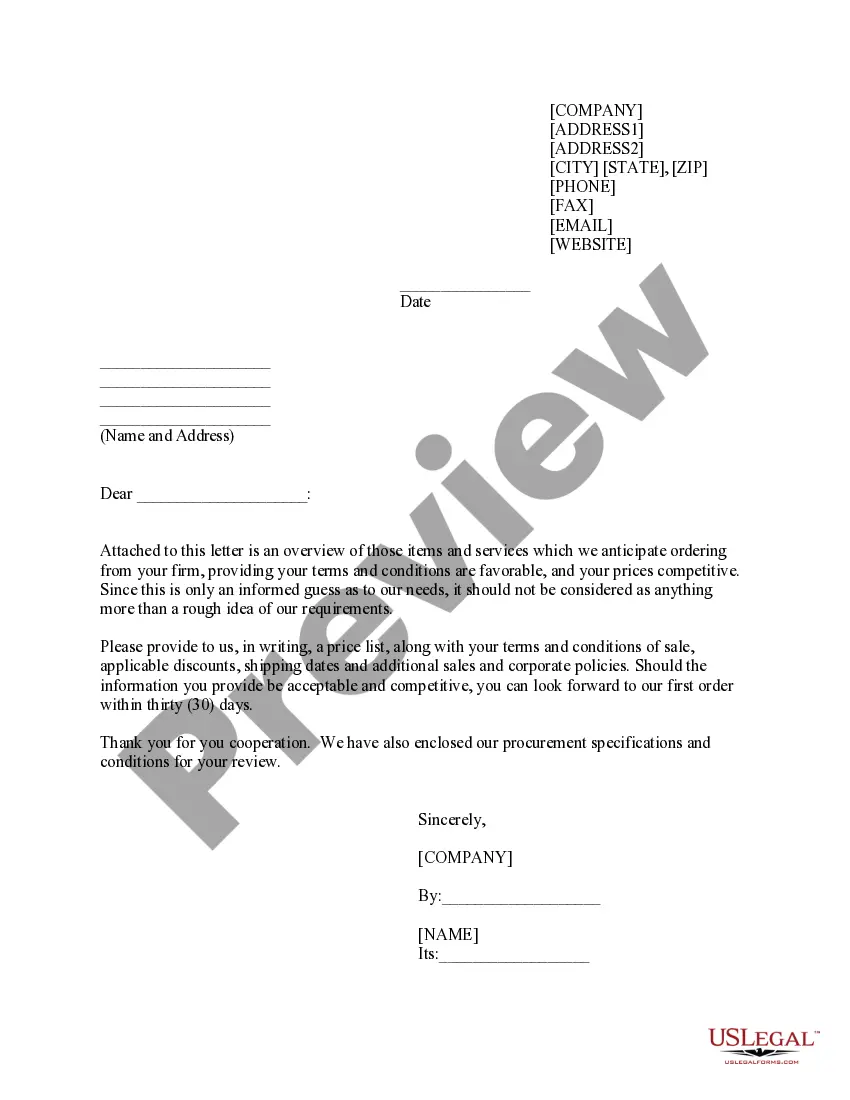

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you secure the legal document you need? Utilize the US Legal Forms website.

The platform offers an extensive array of templates, such as the Maine Notice to Debt Collector - Depositing a Postdated Check Before the Date on the Check, which can be utilized for business and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Maine Notice to Debt Collector - Depositing a Postdated Check Before the Date on the Check. Use your account to access the legal documents you have previously purchased. Visit the My documents section of your account to get another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received Maine Notice to Debt Collector - Depositing a Postdated Check Before the Date on the Check. US Legal Forms is the premier library of legal documents where you can find a multitude of document templates. Take advantage of the service to download professionally created documents that comply with state standards.

- First, ensure you have chosen the correct document for your area/county.

- You can browse the document using the Preview feature and review the document description to confirm it is suitable for you.

- If the document does not meet your requirements, use the Search area to find the appropriate document.

- Once you are certain that the document is correct, click the Purchase now button to obtain the document.

- Select the pricing plan you desire and input the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

So, yes, you can deposit a post-dated check before the date shown, but it isn't advised. Be prepared for the possibility that the check funds won't be available. Not only do you not want to incur an insufficient funds fee, you don't want to go through the trouble of obtaining a reissued check.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

If the bank does not spot that the cheque has been post-dated, the cheque would then probably be paid before you intended or returned unpaid if you have insufficient funds in your account. This could potentially incur you charges and cause inconvenience to the recipient.