A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Maine Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

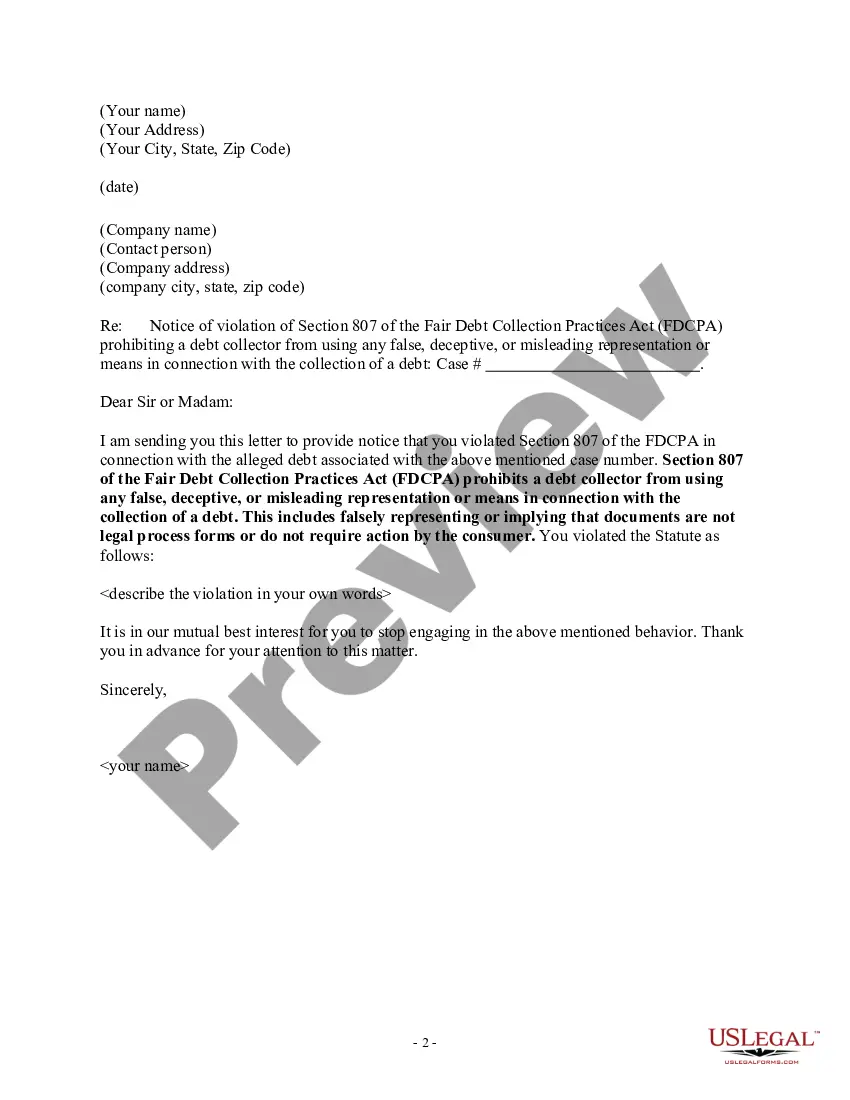

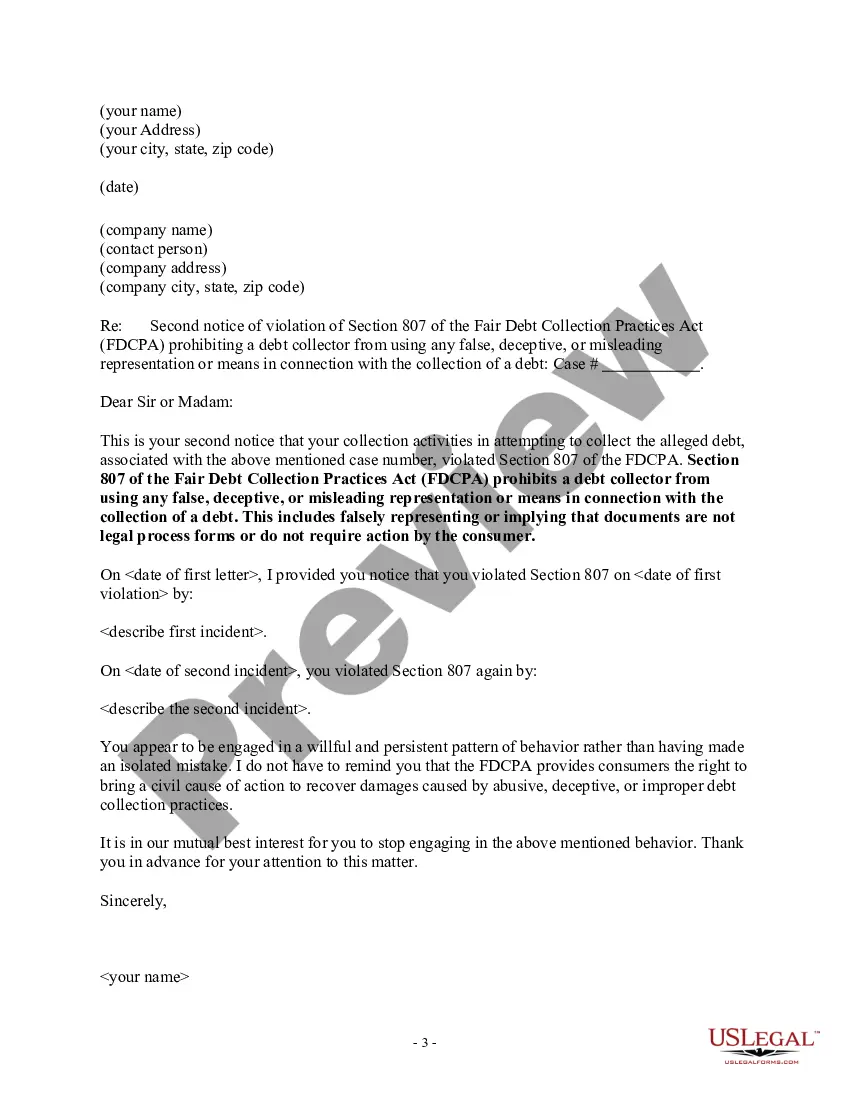

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Have you found yourself in a scenario where you require paperwork for both business or particular purposes virtually every working day? There are numerous official document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides a vast selection of form templates, including the Maine Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, which are generated to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess your account, simply Log In. After that, you can download the Maine Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action template.

- Find the form you need and verify it is for the correct city/state.

- Utilize the Preview button to examine the document.

- Review the description to ensure you have selected the appropriate form.

- If the document is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you locate the right form, click Buy now.

- Choose the pricing plan you want, fill in the required details to set up your account, and complete your payment using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The commonly referenced 11-word phrase to stop debt collectors is: 'I do not acknowledge this debt and request validation.' This statement alerts collectors that you question the validity of the debt, and it requires them to provide proof. Using this phrase can help shield you from continued harassment while you seek clarity. It aligns well with protections outlined in the Maine Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.