A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Maine Notice to Debt Collector - Falsely Representing a Document's Authority

Description

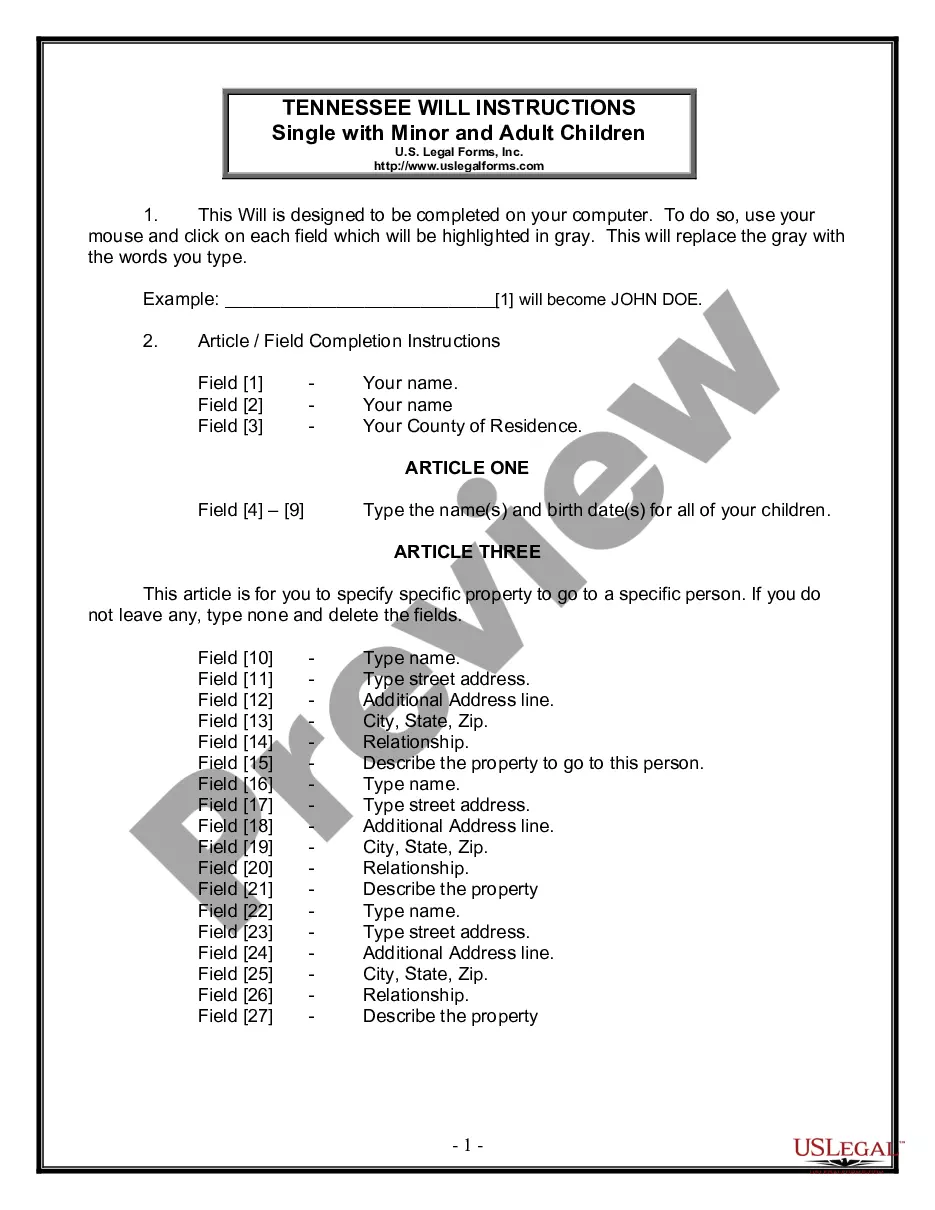

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

If you want to be thorough, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to locate the documents you require. Numerous templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to find the Maine Notice to Debt Collector - Falsely Representing a Document's Authority in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Maine Notice to Debt Collector - Falsely Representing a Document's Authority. Every legal document template you purchase is yours indefinitely. You have access to every document you acquired in your account. Click the My documents section and choose a form to print or download again.

- If you are already a US Legal Forms customer, Log In to your account and click the Get button to download the Maine Notice to Debt Collector - Falsely Representing a Document's Authority.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct town/region.

- Step 2. Use the Review option to review the content of the form. Don't forget to check the summary.

- Step 3. If you are not satisfied with the template, utilize the Search box at the top of the screen to find alternative versions in the legal form catalog.

- Step 4. After you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

ResponsibilitiesKeep track of assigned accounts to identify outstanding debts.Plan course of action to recover outstanding payments.Locate and contact debtors to inquire of their payment status.Negotiate payoff deadlines or payment plans.Handle questions or complaints.Investigate and resolve discrepancies.More items...

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

The court can make an order that the employer deduct an amount from the debtor's salary (emoluments attachment order) and pay it towards his debt. If the debtor has money in a savings or investment account, an application can be made whereby the bank is order to pay the amount directly over to the creditor.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.