Maine Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Real Property - Schedule A - Form 6A - Post 2005?

Have you been inside a situation in which you will need papers for sometimes enterprise or personal uses just about every day time? There are tons of authorized papers web templates available on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms gives thousands of type web templates, such as the Maine Real Property - Schedule A - Form 6A - Post 2005, which can be created in order to meet federal and state demands.

When you are presently familiar with US Legal Forms internet site and have an account, basically log in. After that, it is possible to download the Maine Real Property - Schedule A - Form 6A - Post 2005 web template.

If you do not come with an profile and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you need and ensure it is to the right city/state.

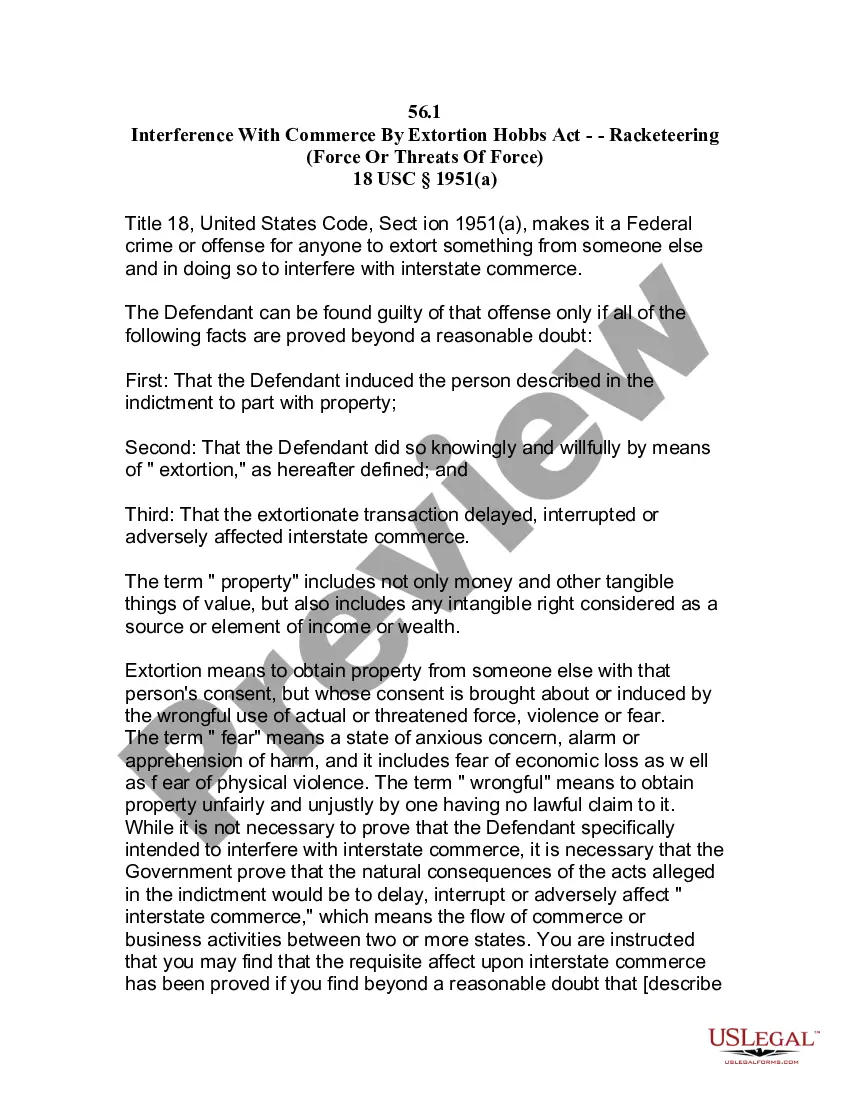

- Make use of the Review switch to check the shape.

- Read the outline to ensure that you have selected the right type.

- In the event the type is not what you are trying to find, make use of the Lookup industry to find the type that suits you and demands.

- Whenever you get the right type, simply click Buy now.

- Choose the pricing plan you need, complete the desired details to produce your bank account, and buy the order with your PayPal or charge card.

- Select a hassle-free paper structure and download your duplicate.

Discover all the papers web templates you may have purchased in the My Forms food selection. You can obtain a further duplicate of Maine Real Property - Schedule A - Form 6A - Post 2005 at any time, if necessary. Just click on the essential type to download or printing the papers web template.

Use US Legal Forms, probably the most substantial variety of authorized varieties, in order to save efforts and stay away from faults. The services gives skillfully manufactured authorized papers web templates that can be used for a selection of uses. Produce an account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

1. What is Maine real estate withholding? Maine law requires, at the time of closing on total considerations of $100,000 or more, that every buyer of real property must withhold 2.5% of the consideration from any nonresident individual, estate, or business seller.

1. to impose and collect (a tax, tariff, fine, etc) 2. to conscript (troops) for service. 3.

A levy is the legal seizure of property to satisfy an outstanding debt. If you fail to pay your taxes, the Internal Revenue Service may respond by levying your tax return or property. Tax authorities can also levy other assets, such as bank accounts, rental income, or retirement accounts.

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt.

?You must let the assessor inside your home.? If you do not want us inside your home, that is your right. If you do not want us measuring your home, please let us know. Just remember the 706-A, if you refuse entry and do not provide us with any information your right to an appeal/abatement will be voided.

Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

Here are the main options. Pay the Tax Debt in Full. ... Set up an Installment Agreement. ... Submit an Offer in Compromise. ... Set Up a Partial Payment Installment Agreement (PPIA) ... Get Currently Not Collectible Status. ... Explain the Levy Is Causing Financial Hardship. ... Prove Your Assets Have No Equity. ... File Bankruptcy.