Maine Job Description Format IV

Description

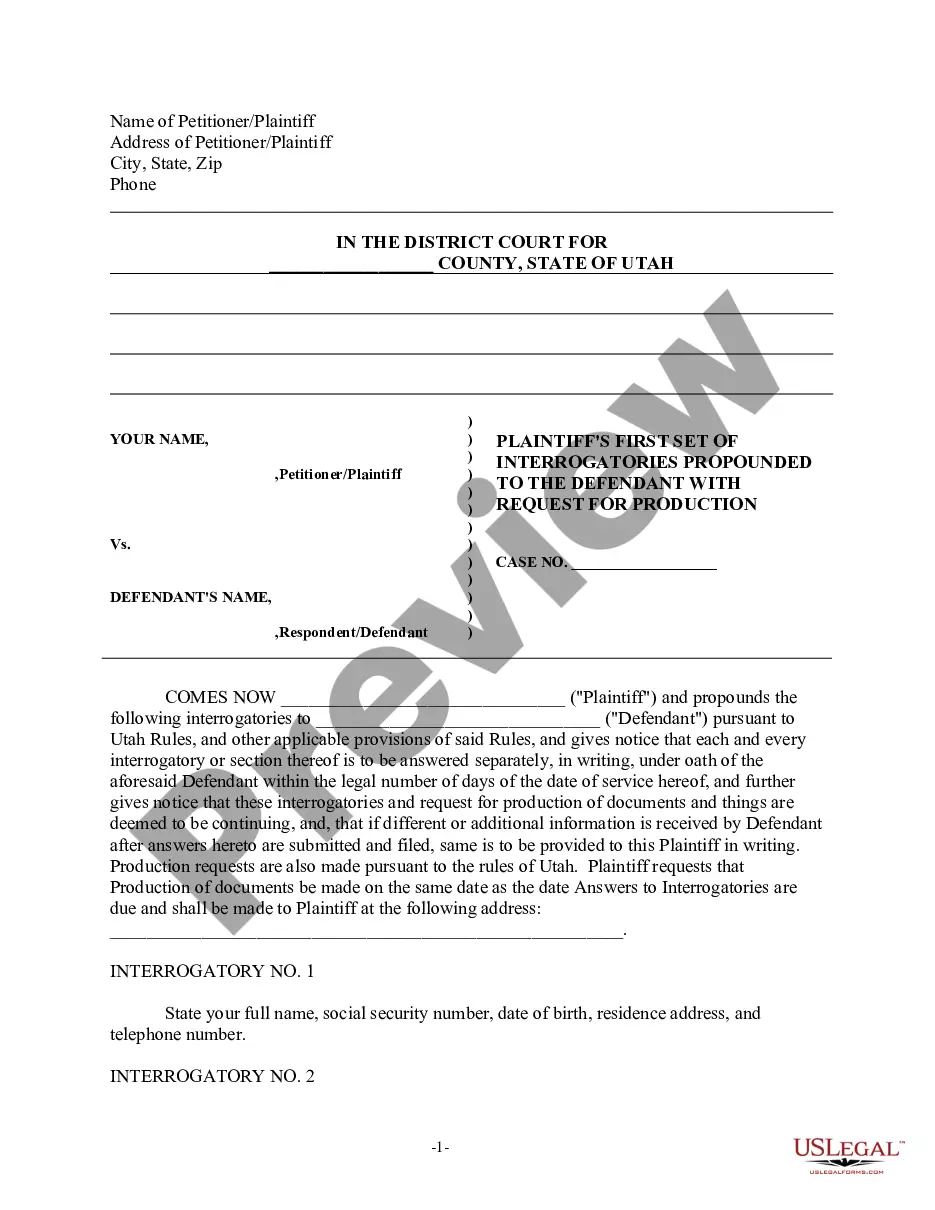

How to fill out Job Description Format IV?

You might spend hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers numerous legal documents that have been reviewed by experts.

You can easily download or print the Maine Job Description Format IV from my service.

If available, make use of the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Maine Job Description Format IV.

- Each legal document template you purchase becomes your property for a long term.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the respective button.

- If this is your first time using the US Legal Forms website, follow the basic guidelines below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Check the document summary to confirm that you have selected the right form.

Form popularity

FAQ

A job description contains the following components: job title, job purpose, job duties and responsibilities, required qualifications, preferred qualifications and working conditions.

State Unemployment NumberAn Employer Account Number (EAN), formerly called an Unemployment Insurance Account Number/Code (UIAN), is required for all employers having a location or employees in Maine. For new policies where the employer is a new entity, the EAN may not be known at the time of submission.

The program is funded by Unemployment premiums paid by employers based on the amount of wages paid for covered employment. The Unemployment Premium or "tax" is paid on the first $12,000 only in gross wages an employer pays to an individual in a calendar year.

You can also file electronically using the MRS Internet filing program (Maine I-file). If you pay with a check you'll need to print out and use a payment voucher. Larger employers are required to pay by Electronic Funds Transfer (EFT). Other employers can pay electronically via EFT or Automated Clearing House (ACH).

5 Tips for Explaining Why You're Looking for a New JobYou've Outgrown the Position. Gone are the days when people stay with one company their entire career.Explain What Problems You'll Solve.You're Changing Careers.It's the Next Logical Step.Tell Them This Is Your Dream Role or Company.Here's Why.

On Jan. 31, 2020, USCIS published the Form I-9 Federal Register notice announcing a new version of Form I-9, Employment Eligibility Verification, that the Office of Management and Budget approved on Oct.

Give a positive answer Whatever your reason for looking for a job, apply the same principle by positioning your response into a positive and opportunity-driven statement: I'm looking for an opportunity where I can put those abilities to work for a mission I'm passionate about.

Unemployment insurance payments are taxable. When you file for unemployment, you have the option to choose to have taxes taken out at the time benefits are paid. If you opt to have the deductions taken out of your unemployment benefits, the standard deduction used is 10% for Federal Taxes and 5% for State Taxes.

The revised Form I-9, bearing an October 31, 2022 expiration date in its upper right corner, is available for use beginning January 31, 2020 and its use is mandatory beginning (employers may continue to use the prior version of Form I-9 (Rev. 07/17/17 N) until April 30, 2020).

Maine, like many other states, has established supplemental state funding to ensure continued service to workers and employers and preserve program integrity. The assessment for UPAF is 0.13% of taxable wages reported on line 5.