Maine Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

If you wish to complete, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available on the web.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Maine Declaration of Gift with Signed Acceptance by Donee in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the Maine Declaration of Gift with Signed Acceptance by Donee.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

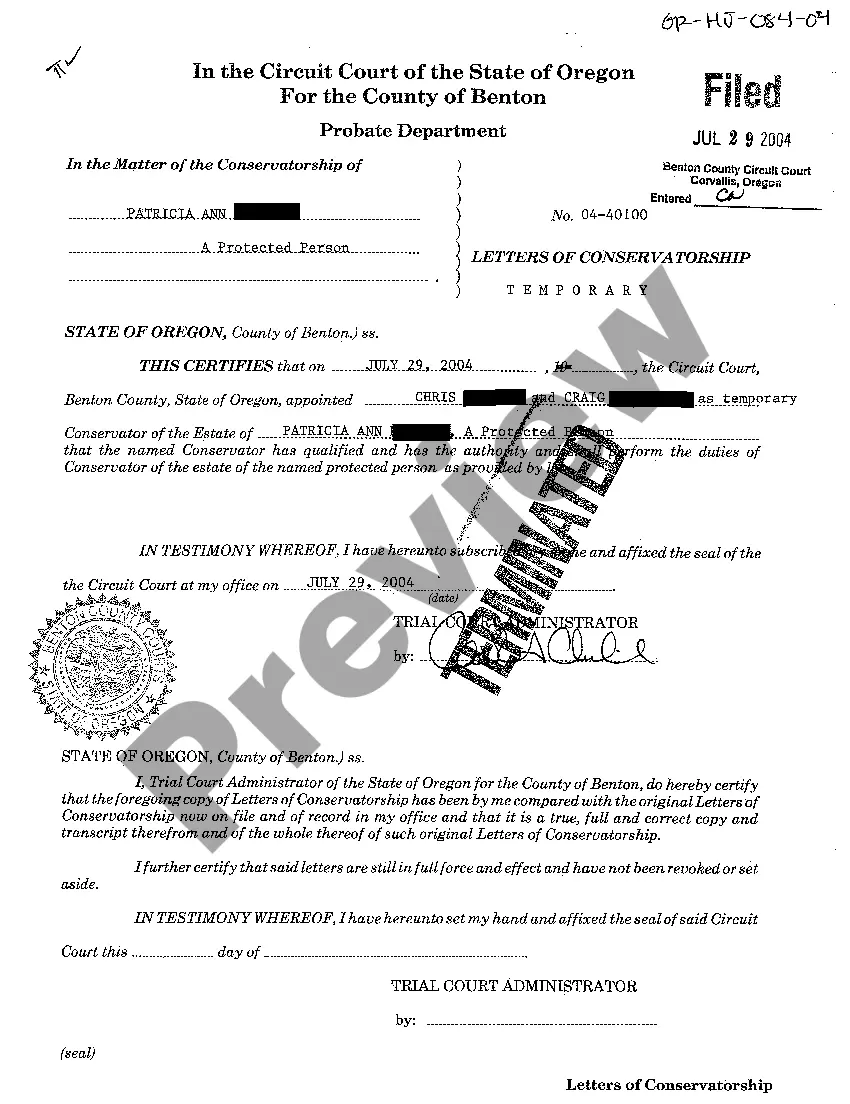

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to examine the details.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other forms in the legal document library.

Form popularity

FAQ

Acceptance of a gift by the donee can be done anytime during the lifetime of the donor. . Section 123 provides that for a gift of immovable property to be valid, the transfer must be effectuated by means of a registered instrument bearing the signature of the donor and attested by at least two witnesses."

According to Section 122 of the Act, the acceptance of a gift should be made while the donor is still capable of giving the gift and during the donor's lifetime. The donee should also accept the gift before he dies. If the donee dies before accepting such gift, then the gift becomes invalid (or void).

Registration of Gift DeedThe donor and donee should sign on all pages of the gift deed and must be attested by at least two witnesses. The donee must accept the gift in the lifetime of the donor and when the donor is of sound mind for it to be valid.

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

Section 122 of Transfer of Property Act defines a gift as the transfer of an existing moveable or immovable property. Such transfers must be made voluntarily and without consideration. The transferor is known as the donor and the transferee is called the donee. The gift must be accepted by the donee.

The person who makes a gift is known as the donor. The person who receives a gift is known as the donee. There are three basic time periods during which a person can make a gift.

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

The gift should be made without consideration. It should be voluntarily given by the donor. It should be accepted by the donee during his lifetime. If all these conditions are satisfied, it will be a valid gift.

The person gifting his/her property is called the donor, and the person accepting the gift is the donee. The donor must voluntarily gift the property to the donee without considering the gift to be valid under the Act. The donee should accept the gift within the lifetime of the donor for the gift to be legally valid.