Maine Software Product Sales Agreement

Description

How to fill out Software Product Sales Agreement?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

Through the website, you can discover numerous forms for business and personal purposes, categorized by groups, states, or keywords. You can quickly access the latest versions of documents like the Maine Software Product Sales Agreement in just a few seconds.

If you already have an account, Log In to download the Maine Software Product Sales Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Maine Software Product Sales Agreement. Each template included in your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Maine Software Product Sales Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

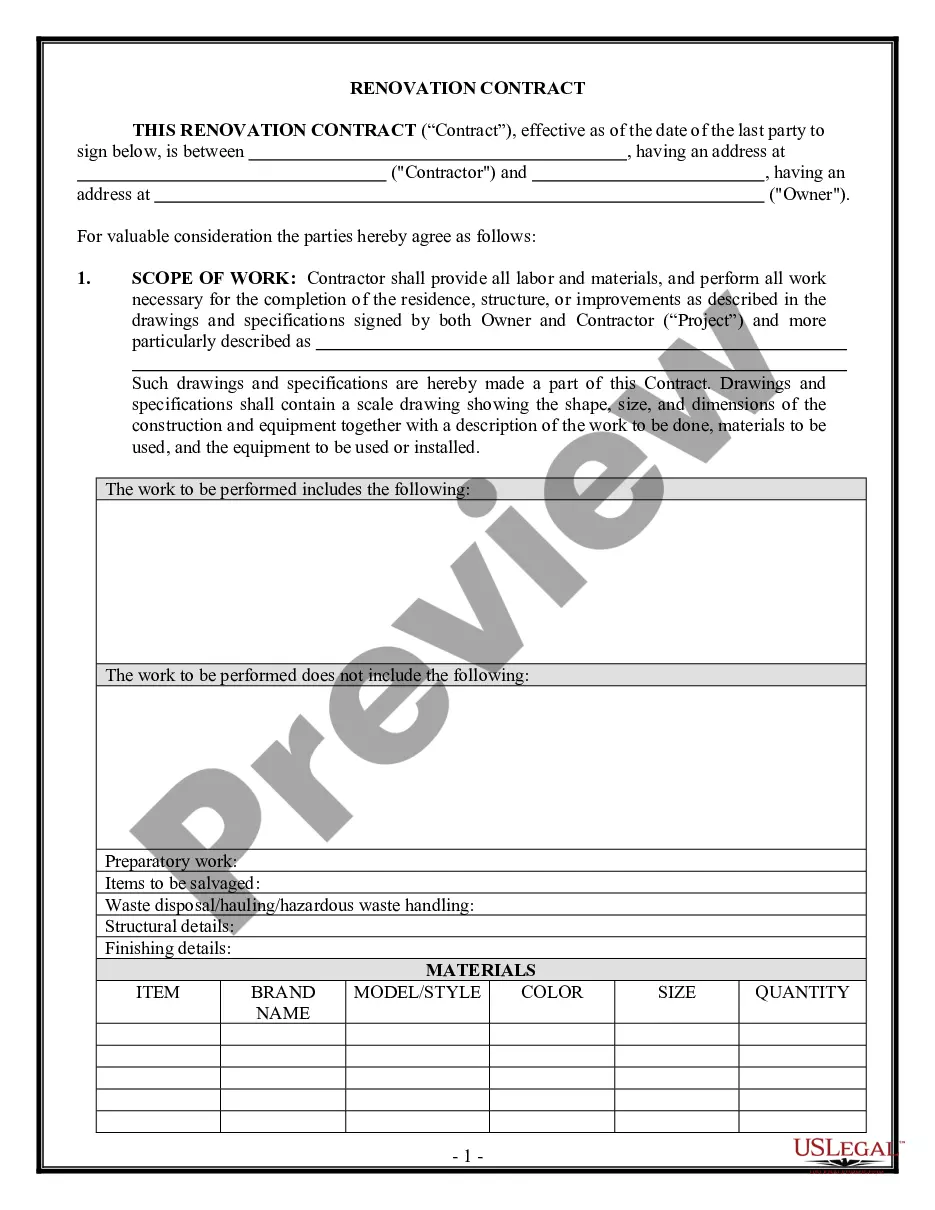

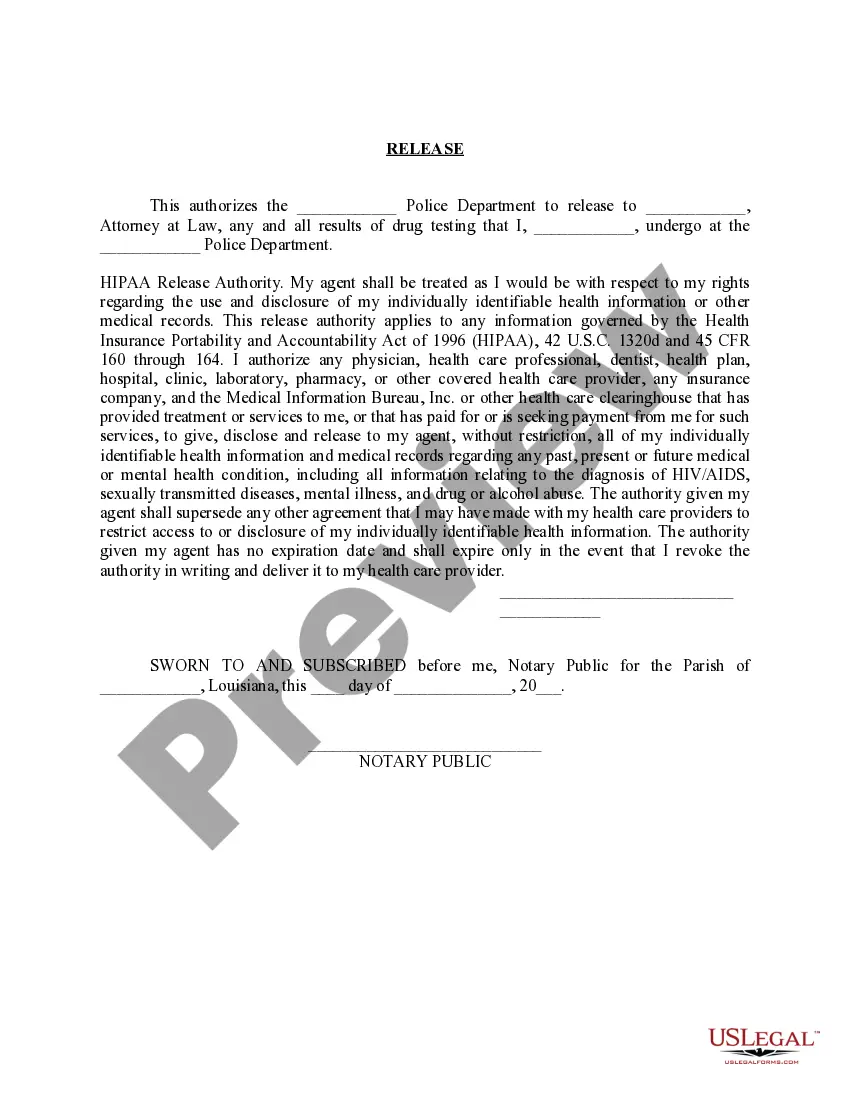

- Click the Preview button to review the form’s details.

- Examine the form information to confirm that you've chosen the appropriate template.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Is SaaS taxable in Maine? No. You don't owe tax for the sale of cloud software subscriptions to customers in Maine.

Sales of canned software - downloaded are subject to sales tax in Maine. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maine. Sales of custom software - downloaded are exempt from the sales tax in Maine.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.

The following services are subject to the Service Provider Tax in MaineAncillary Services.Rental of Video Media and Video Equipment.Rental of Furniture, Audio Media and Equipment pursuant to a Rental-Purchase Agreement.Telecommunications Services.Installation, Maintenance or Repair of Telecommunications Equipment.More items...

Goods that are subject to sales tax in Maine include physical property, like furniture, home appliances, and motor vehicles. Groceries, Prescription medicine, and gasoline are all tax-exempt.

Maine likely does not require sales tax on Software-as-a-Service. Why does Maine not require sales tax on Software-as-a-Service (SaaS)?

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Under the new law, a corporation has nexus with Maine if the corporation is organized or commercially domiciled in Maine or if, in Maine, any of the following thresholds are exceeded: $250,000 of property, $250,000 in payroll, $500,000 in sales in Maine, or 25% of the corporation's total property, payroll, or sales is

Maine likely does not require sales tax on Software-as-a-Service. Why does Maine not require sales tax on Software-as-a-Service (SaaS)?