Maine Statement of Reduction of Capital of a Corporation

Description

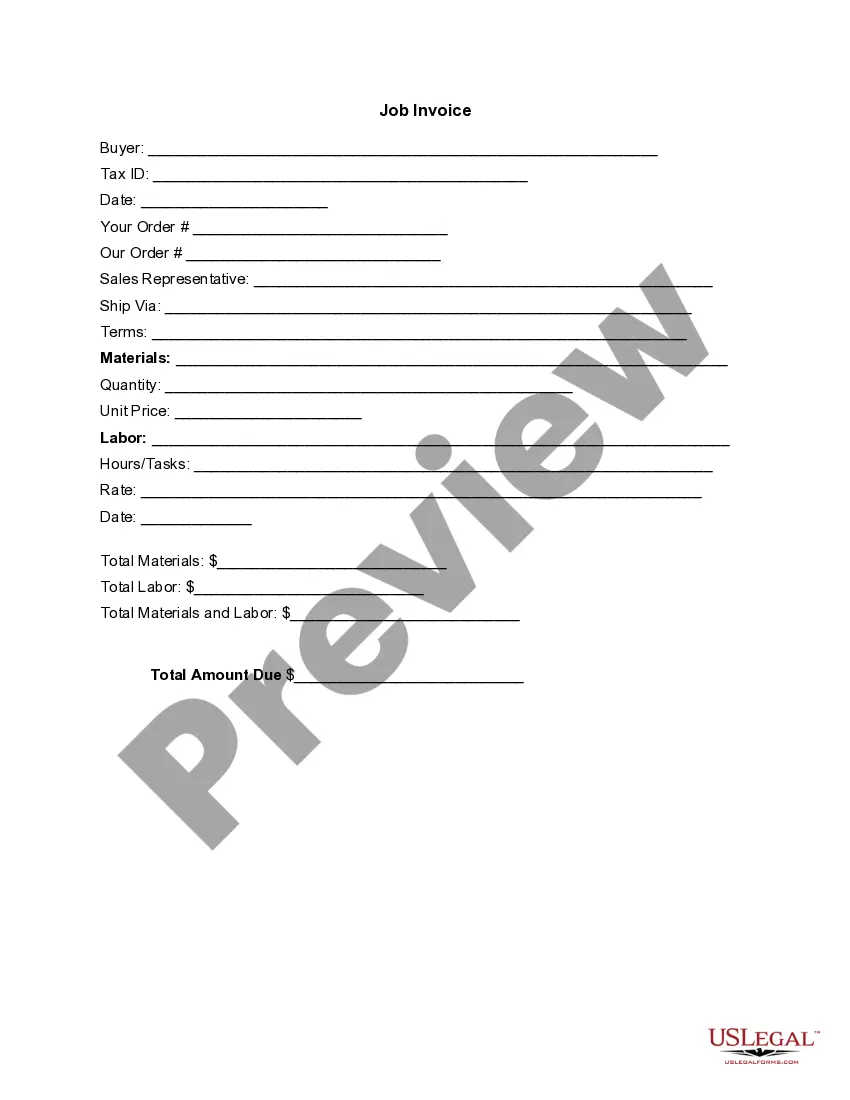

How to fill out Statement Of Reduction Of Capital Of A Corporation?

It is possible to commit hours on-line looking for the legal record web template that suits the state and federal demands you will need. US Legal Forms offers thousands of legal types which are reviewed by specialists. You can actually download or printing the Maine Statement of Reduction of Capital of a Corporation from our assistance.

If you already possess a US Legal Forms profile, it is possible to log in and click on the Download switch. Following that, it is possible to full, edit, printing, or sign the Maine Statement of Reduction of Capital of a Corporation. Every legal record web template you purchase is the one you have permanently. To acquire one more copy of the obtained kind, go to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms internet site for the first time, keep to the basic recommendations beneath:

- First, be sure that you have selected the correct record web template to the region/town that you pick. Read the kind information to ensure you have selected the proper kind. If accessible, use the Review switch to look throughout the record web template also.

- If you would like discover one more version in the kind, use the Research field to get the web template that meets your requirements and demands.

- Once you have discovered the web template you desire, click on Purchase now to proceed.

- Choose the pricing prepare you desire, type in your references, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to pay for the legal kind.

- Choose the formatting in the record and download it in your device.

- Make changes in your record if necessary. It is possible to full, edit and sign and printing Maine Statement of Reduction of Capital of a Corporation.

Download and printing thousands of record templates making use of the US Legal Forms Internet site, which provides the greatest collection of legal types. Use specialist and express-certain templates to handle your organization or personal requires.

Form popularity

FAQ

The state of Maine charges a $175 filing fee for the Certificate of Organization, with a standard filing time of about 14 days.

National per capita general revenues were $12,277. Maine uses all major state and local taxes. After federal transfers, Maine's largest sources of per capita revenue were property taxes ($2,863) and individual income taxes ($1,522).

All income derived from or connected with the carrying on of a trade or business within Maine is Maine-source income.

Non-resident return This is for taxpayers that are Non-residents of Maine. The taxpayer lives in a state other than Maine, they have earned some of their income in Maine. Consequently, they owe Maine Non-resident income tax.

Income Tax Brackets Single FilersMaine Taxable IncomeRate$0 - $22,9995.80%$23,000 - $54,4496.75%$54,450+7.15%

State Income Tax Sourcing refers to a state's tax rules for assigning business income and receipts from sales to the jurisdiction that is entitled to tax the income.

Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes. Maine's tax system ranks 35th overall on our 2023 State Business Tax Climate Index.