Maine LLC Operating Agreement for Husband and Wife

Description

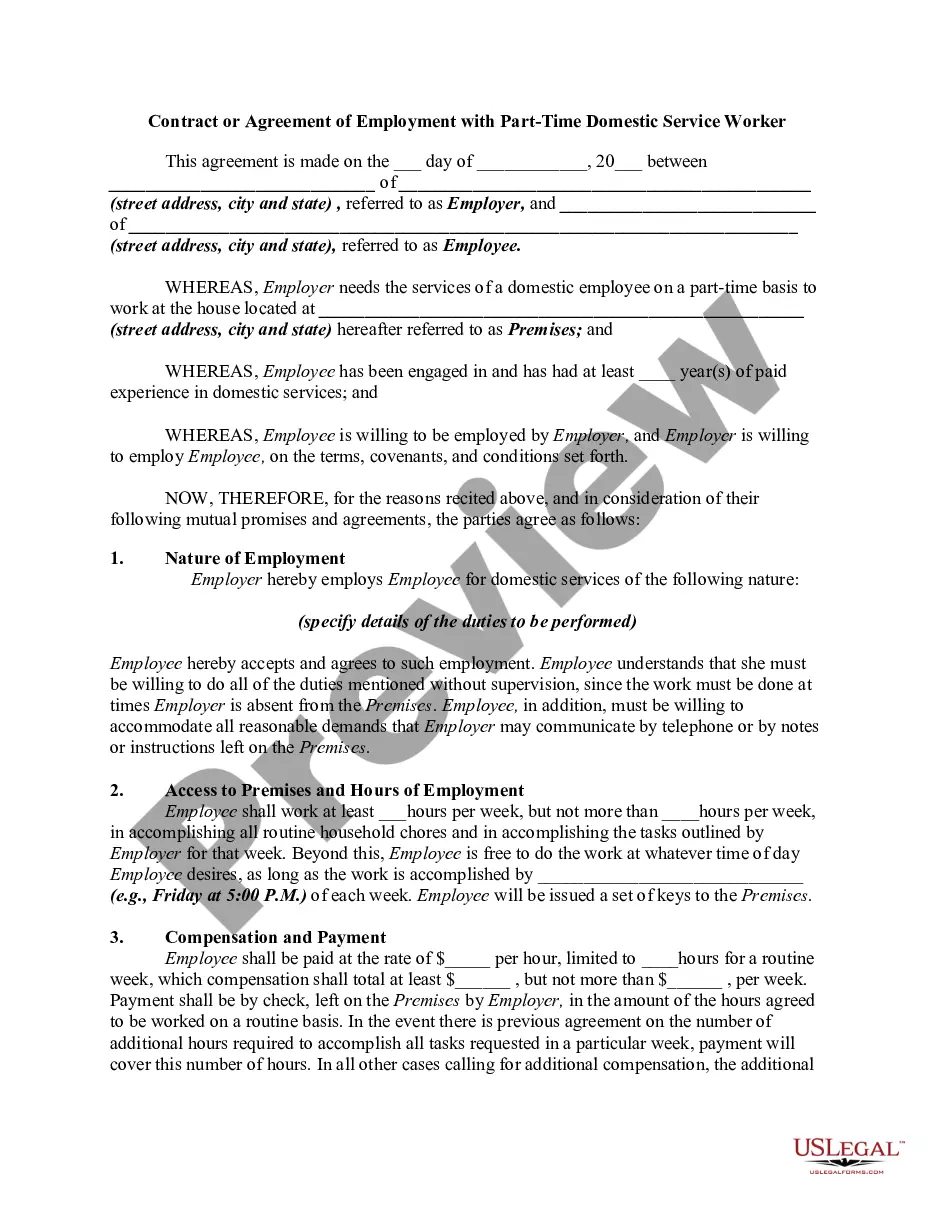

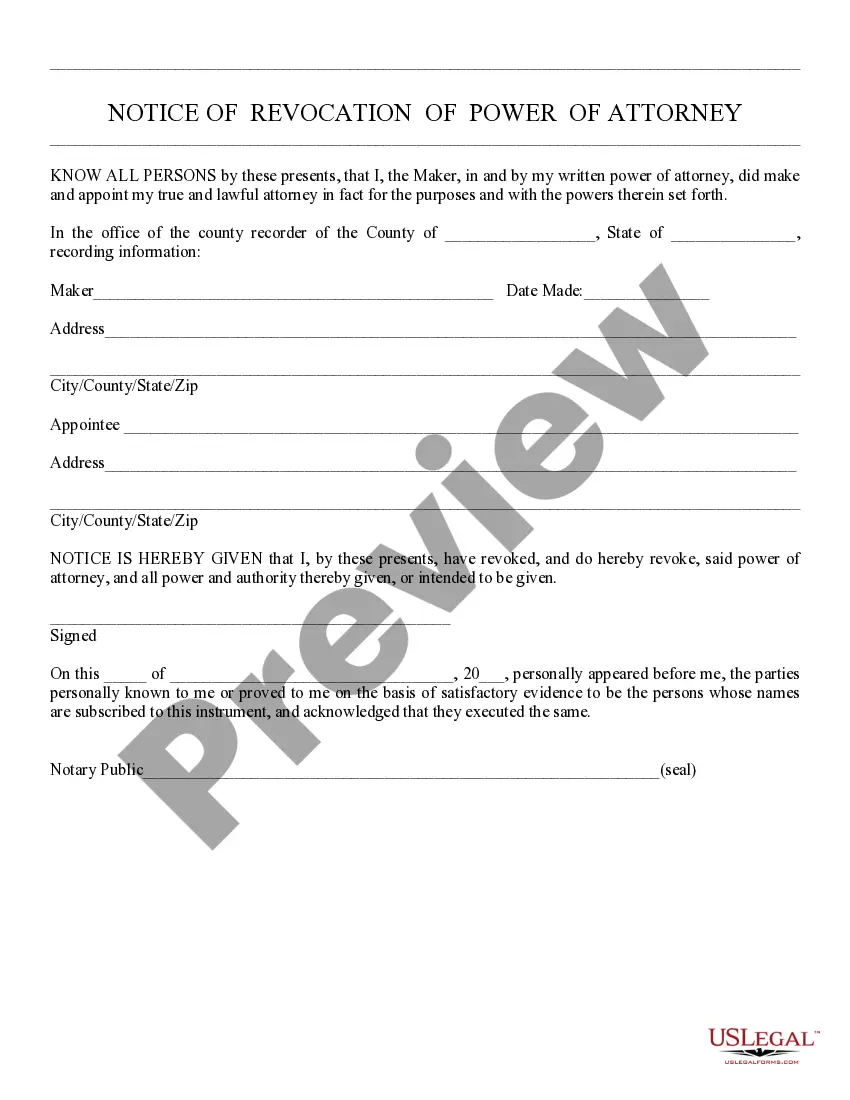

How to fill out LLC Operating Agreement For Husband And Wife?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal form templates that you can download or print.

By utilizing the website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords.

You can quickly locate the most recent versions of forms like the Maine LLC Operating Agreement for Married Couples.

Review the form description to confirm that you have selected the accurate form.

If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you already have an account, Log In and download the Maine LLC Operating Agreement for Married Couples from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click on the Preview option to review the form's content.

Form popularity

FAQ

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

The business must be owned by a husband and wife as community property under the laws of a state, foreign country or possession of the United States. Nobody other than both spouses would be considered owners for federal tax purposes and, The business is not treated as a corporation under federal law.

How Your LLC Will Be Taxed. Owners pay self-employment tax on business profits. Owners pay state income tax on any profits, minus state allowances or deductions. Owners pay federal income tax on any profits, minus federal allowances or deductions.

Follow these steps for a smooth process when you add an owner to an LLC.Understand the Consequences.Review Your Operating Agreement.Decide on the Specifics.Prepare and Vote on an Amendment to Add Owner to LLC.Amend the Articles of Organization (if Necessary)File any Required Tax Forms.

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business. However, there are some occasions where it may be helpful or necessary to include your spouse.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

Prepare an Operating AgreementAn LLC operating agreement is not required in Maine, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Banker suggests that answering "yes" to one or more question; it may be time to dissolve your partnership.Review your partnership agreement.Consult your state's statutes.Schedule a meeting with your business partner.File Articles of Dissolution.Divide the partnership assets equitably.