Maine Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

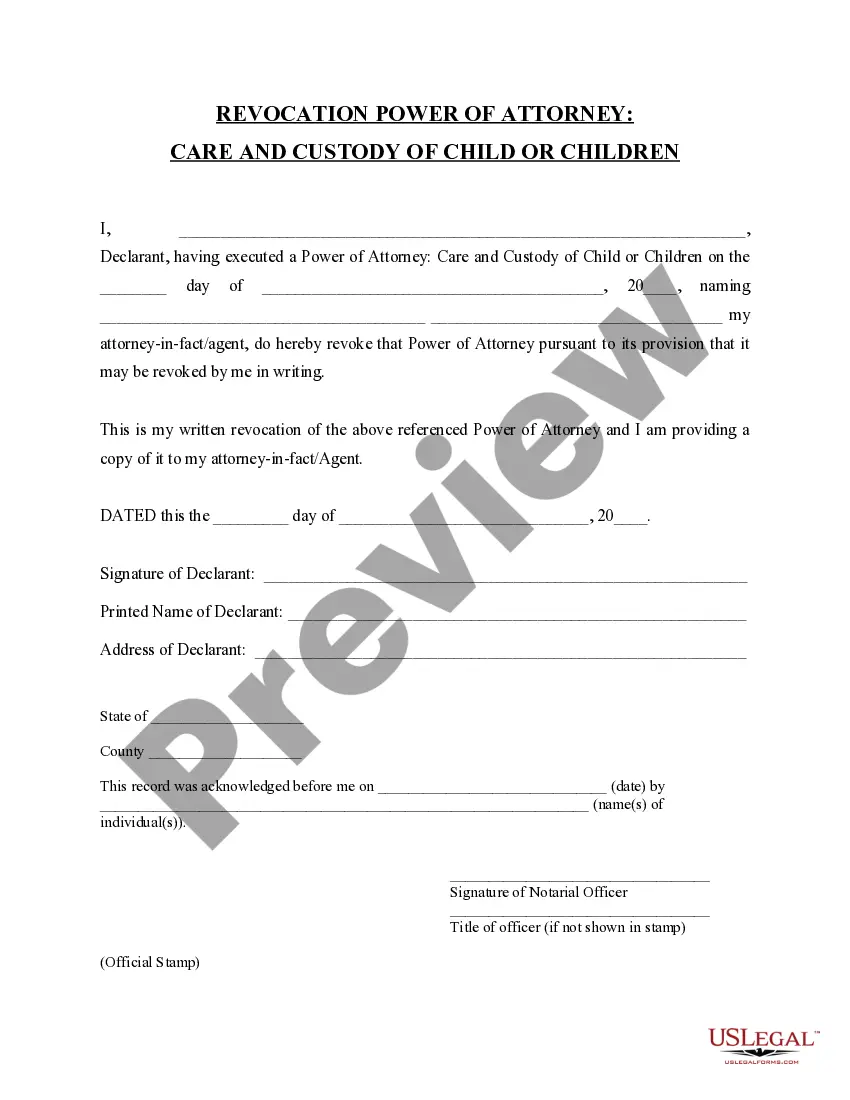

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

If you wish to complete, download, or print authorized record templates, use US Legal Forms, the most important variety of authorized varieties, that can be found on-line. Take advantage of the site`s basic and hassle-free look for to get the files you need. Different templates for company and person uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to get the Maine Sample Letter for Request of State Attorney's opinion concerning Taxes with a few mouse clicks.

When you are currently a US Legal Forms customer, log in to the account and click the Obtain switch to obtain the Maine Sample Letter for Request of State Attorney's opinion concerning Taxes. You can also entry varieties you earlier delivered electronically within the My Forms tab of your own account.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for the appropriate city/region.

- Step 2. Utilize the Review solution to look over the form`s information. Don`t forget to read the outline.

- Step 3. When you are unsatisfied using the kind, utilize the Search industry towards the top of the monitor to discover other variations of your authorized kind format.

- Step 4. When you have discovered the form you need, click the Acquire now switch. Pick the prices plan you like and add your credentials to sign up for an account.

- Step 5. Procedure the deal. You may use your bank card or PayPal account to accomplish the deal.

- Step 6. Select the structure of your authorized kind and download it on the product.

- Step 7. Full, modify and print or signal the Maine Sample Letter for Request of State Attorney's opinion concerning Taxes.

Every authorized record format you purchase is your own forever. You might have acces to each and every kind you delivered electronically within your acccount. Click the My Forms segment and decide on a kind to print or download once more.

Remain competitive and download, and print the Maine Sample Letter for Request of State Attorney's opinion concerning Taxes with US Legal Forms. There are thousands of skilled and express-certain varieties you can use for the company or person needs.

Form popularity

FAQ

In calculating a property tax rate, the legislative body of the municipality (town meeting or council) determines the amount of revenue to be raised by the property tax to fund municipal services. The Assessor then divides that amount by the total local assessed valuation to get the local tax rate.

Tax Differences New Hampshire is famous for having no state income or sales tax, making it an attractive option for those looking to save money on taxes. In contrast, Maine has a 5.5% sales tax and a state income tax, which can be a factor to consider when choosing where to live.

?You must let the assessor inside your home.? If you do not want us inside your home, that is your right. If you do not want us measuring your home, please let us know. Just remember the 706-A, if you refuse entry and do not provide us with any information your right to an appeal/abatement will be voided.

If you did not pay enough estimated tax or have enough tax withheld from your earnings by any due date for paying estimated tax, you may be subject to a penalty. For calendar year 2022, the underpayment penalty is 5%, compounded monthly. For calendar year 2023, the underpayment penalty is 7%, compounded monthly.

All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. So, if you don't pay your real property taxes in Maine, the tax collector can sell your property, or a percentage of it, at a tax sale.

The State Property Tax Deferral Program is a lifeline loan program that can cover the annual property tax bills of Maine people who are ages 65 and older or are permanently disabled and who cannot afford to pay them on their own.

Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence.

If a return is ?led after the due date, a late ?ling penalty is charged. The penalty is $25 or 10% of the tax due, whichever is greater.