Maine Worksheet - Self-Assessment

Description

How to fill out Worksheet - Self-Assessment?

Are you in a situation where you need documentation for either business or specific purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones isn’t straightforward.

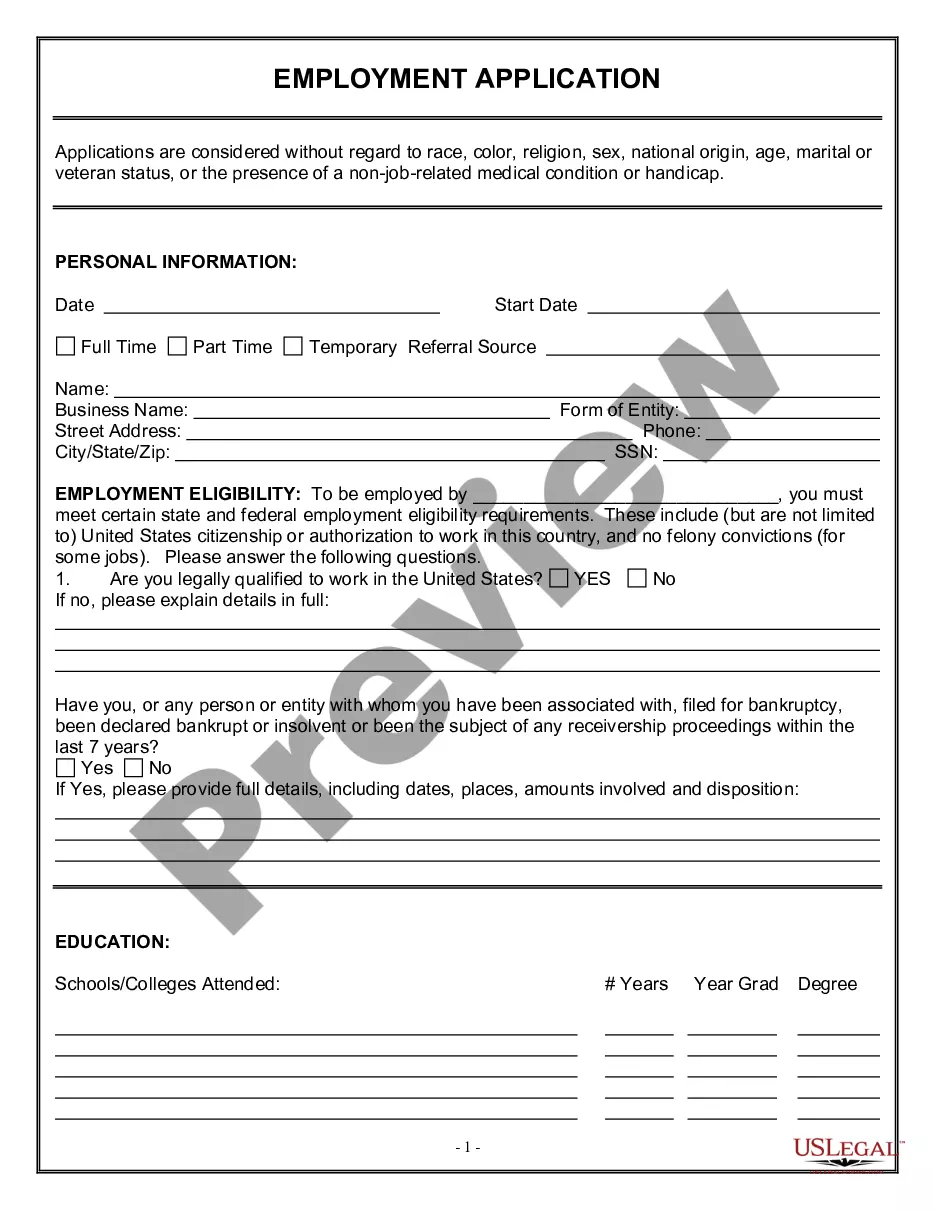

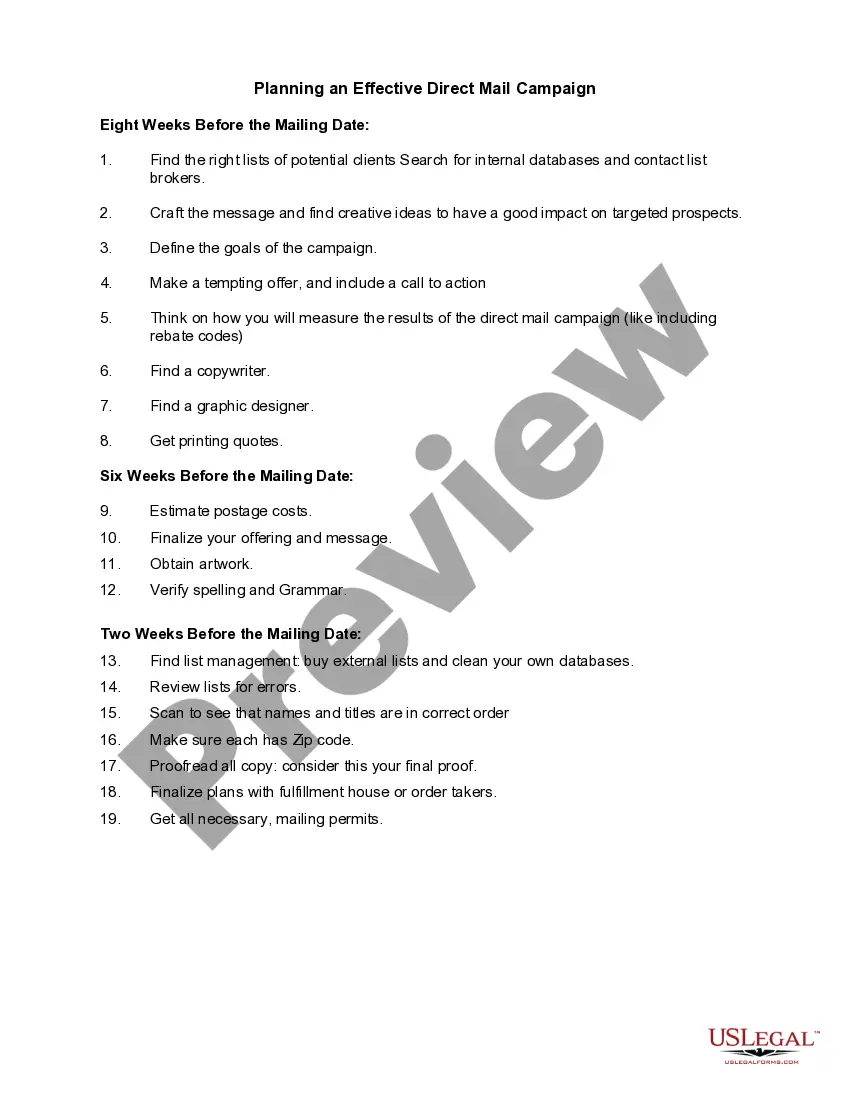

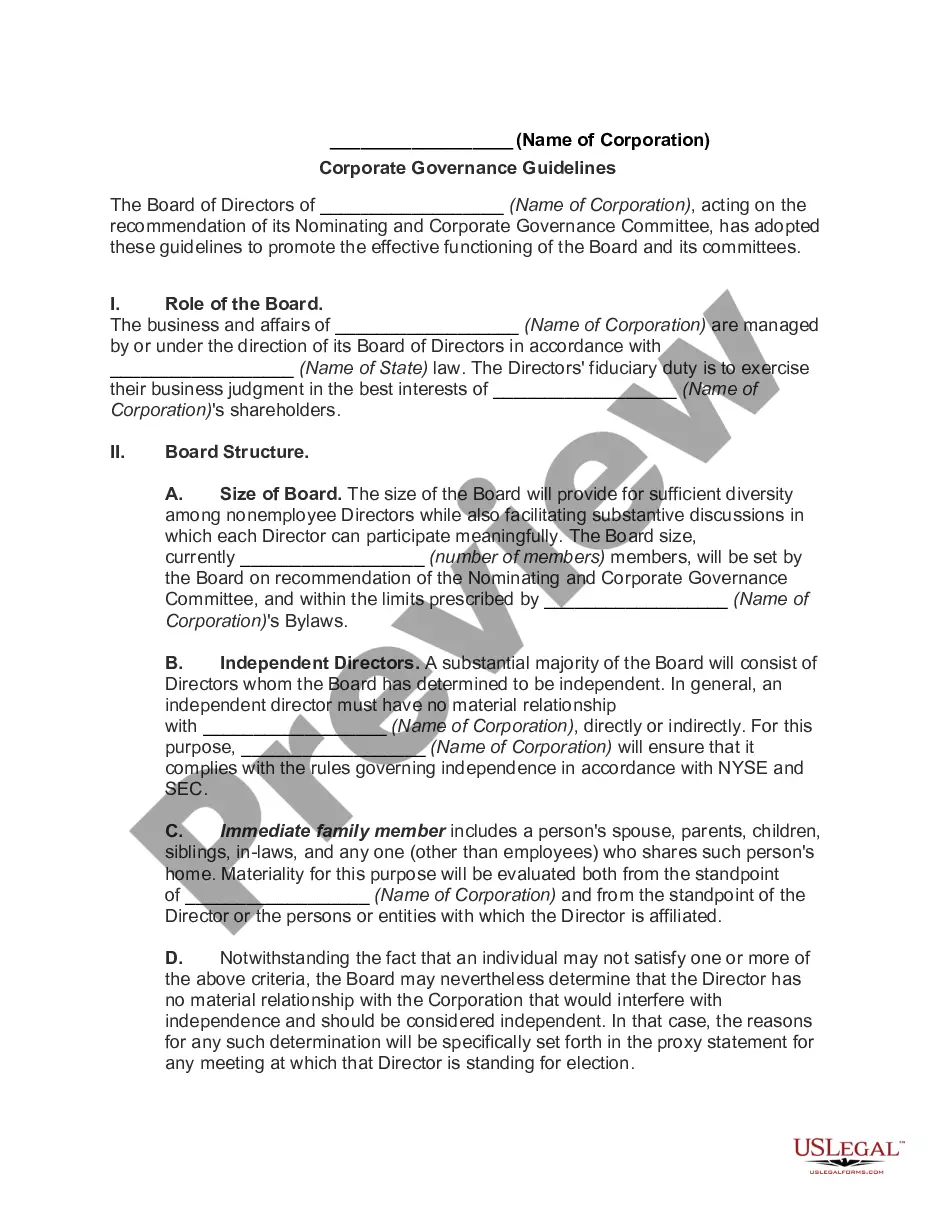

US Legal Forms offers thousands of form templates, such as the Maine Worksheet - Self-Assessment, which are designed to meet state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Maine Worksheet - Self-Assessment template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct state/region.

- Use the Preview button to review the document.

- Check the details to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search box to find the form that suits your needs and requirements.

Form popularity

FAQ

You can obtain a self-assessment worksheet through the Maine Revenue Services website or platforms like USLegalForms, which offer comprehensive forms and guides. These resources provide convenient access to the Maine Worksheet - Self-Assessment, ensuring you have the tools necessary for accurate tax filing. Make sure to download the correct version based on your tax situation.

When filing a return, you can take advantage of Maine's standard deduction and exemptions. For a single filer, you can claim a deduction of $12,950, while married taxpayers can take the $25,900 deduction. For exemptions, single taxpayers can claim $4,450, married filers have an $8,900 exemption.

Maine generally imposes an income tax on all individuals that have Maine-source income. The income tax rates are graduated, with rates ranging from 5.8% to 7.15% for tax years beginning after 2015. The rates ranged from 0% to 7.95% for tax years beginning after December 31, 2012 but before January 1, 2016.

Individual Income Tax IMPORTANT. The 2021 Maine personal exemption amount is $4,300 and the Maine basic standard deduction amounts are $12,550 for single and $25,100 for married individuals filing joint returns.

The 2020 Maine personal exemption amount is $4,300 (up from $4,200), and the Maine basic standard deduction amounts are $12,400 (up from $12,200) for single and $24,800 (up from $24,400) for married individuals filing joint returns.

The 2020 Maine personal exemption amount is $4,300 (up from $4,200), and the Maine basic standard deduction amounts are $12,400 (up from $12,200) for single and $24,800 (up from $24,400) for married individuals filing joint returns.

The 2019 standard deduction is increased to $24,400 for married individuals filing a joint return; $18,350 for head-of-household filers; and $12,200 for all other taxpayers. Under the new law, no exceptions are made to the standard deduction for the elderly or blind.

Wages, business income, and capital gains from sources within Maine are Maine income even if you received the income as a nonresident. All part-year residents, nonresidents and "safe harbor" residents must send a copy of their federal return with their Maine return.

Maine.gov/revenue or enclose (do not staple or tape) a check or money order payable to Treasurer, State of Maine with your return. Include your complete name, address and telephone number on your check or money order.