This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Member's General Proxy for Meetings of the Members of a Nonprofit Corporation

Description

How to fill out Member's General Proxy For Meetings Of The Members Of A Nonprofit Corporation?

If you aim to finalize, acquire, or produce valid document templates, utilize US Legal Forms, the largest selection of valid forms that can be accessed online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and titles, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment method you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Maine Member's General Proxy for Meetings of the Members of a Nonprofit Corporation in just a few clicks.

- If you are already a US Legal Forms subscriber, sign in to your account and tap the Obtain button to receive the Maine Member's General Proxy for Meetings of the Members of a Nonprofit Corporation.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

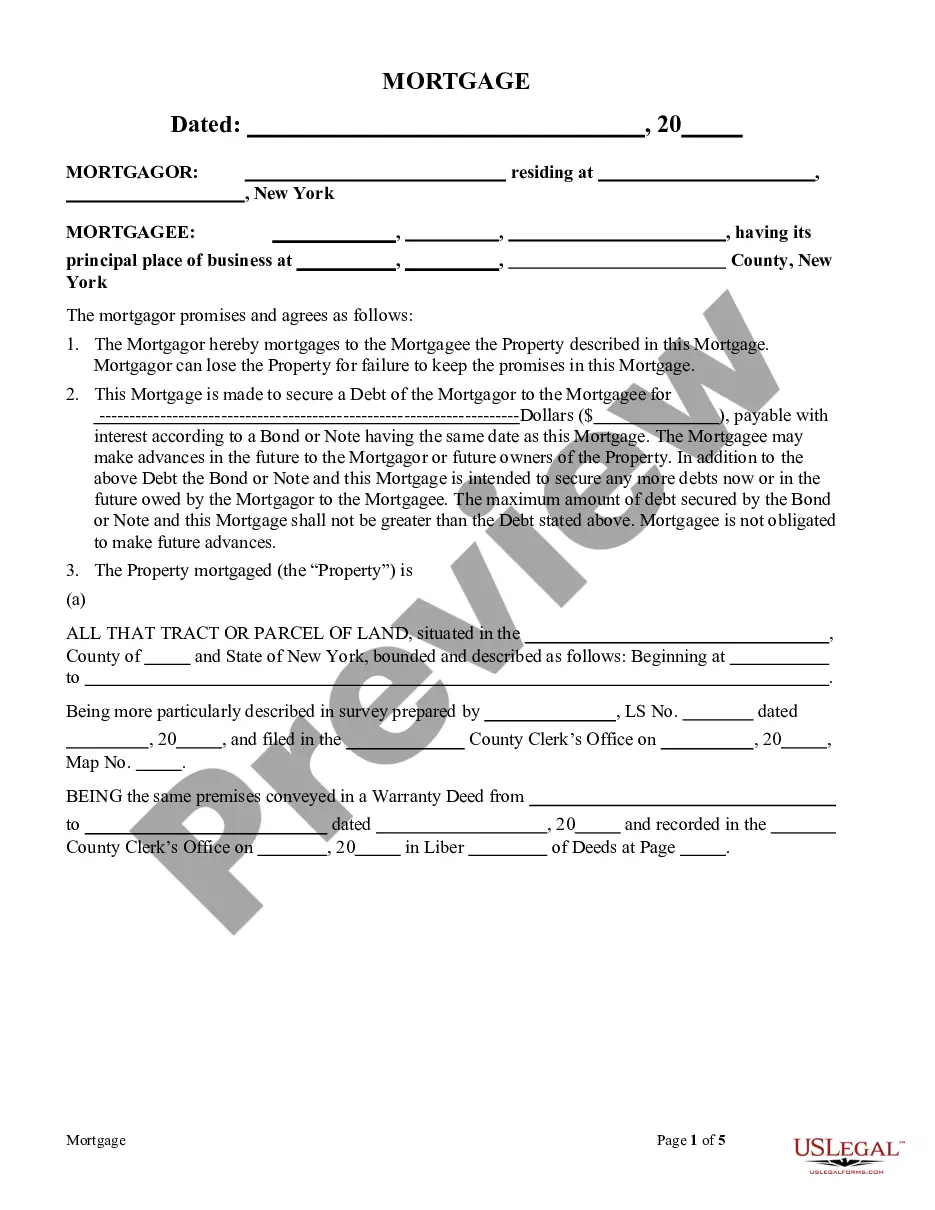

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not pleased with the form, use the Search field at the top of the screen to find alternative versions in the legal form catalog.

Form popularity

FAQ

How do I start a nonprofit organization?Step 1: Do Your Homework. Conduct a needs analysis.Step 2: Build a Solid Foundation. Draft your mission statement.Step 3: Incorporate Your Nonprofit.Step 4: File for 501(c)(3) Tax-Exempt Status.Step 5: Ongoing Compliance.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

How to Start a Nonprofit in MaineName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

The three main documents: the articles of incorporation, the bylaws, and the organizational meeting minutes; the nonprofit's directors' names and addresses (or the members' names and addresses if your nonprofit is a membership organization); and.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your Maine Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.Step 7: Apply for 501(c)(3)

No, a nonprofit organization is not a C corporation. As mentioned above, nonprofits operate under section 501(c) of the Internal Revenue Code and many of them operate under a tax exempt status. C Corporations pay taxes under Chapter C of the IRS tax code, which is where the name comes from.

O The names of the initial members of the board of directors (D.C. law provides that a nonprofit corporation must have a minimum of three directors);

Nonprofits must have at least three board members when they form.

To register your nonprofit corporation as a charity in Maine, you'll need to do the following:Complete the Charitable Organization Application.Attach a list of directors/officers to application.Attach a list of individual(s) responsible for managing contributions to the application.More items...