Maine Business Deductions Checklist

Description

How to fill out Business Deductions Checklist?

Finding the correct valid document template can be quite a challenge. Of course, there are numerous formats available online, but how do you obtain the authentic template you require.

Utilize the US Legal Forms website. The platform provides a wide range of formats, such as the Maine Business Deductions Checklist, that can be employed for business and personal purposes. All forms are reviewed by professionals to meet state and federal regulations.

If you are currently registered, sign in to your account and click the Download button to obtain the Maine Business Deductions Checklist. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Select the document format and download the legal document template to your device. Complete, modify, print, and sign the received Maine Business Deductions Checklist. US Legal Forms is the largest repository of legal templates where you can find various document formats. Use the service to obtain professionally crafted documents that comply with state requirements.

- First, ensure that you have selected the correct template for your area/state.

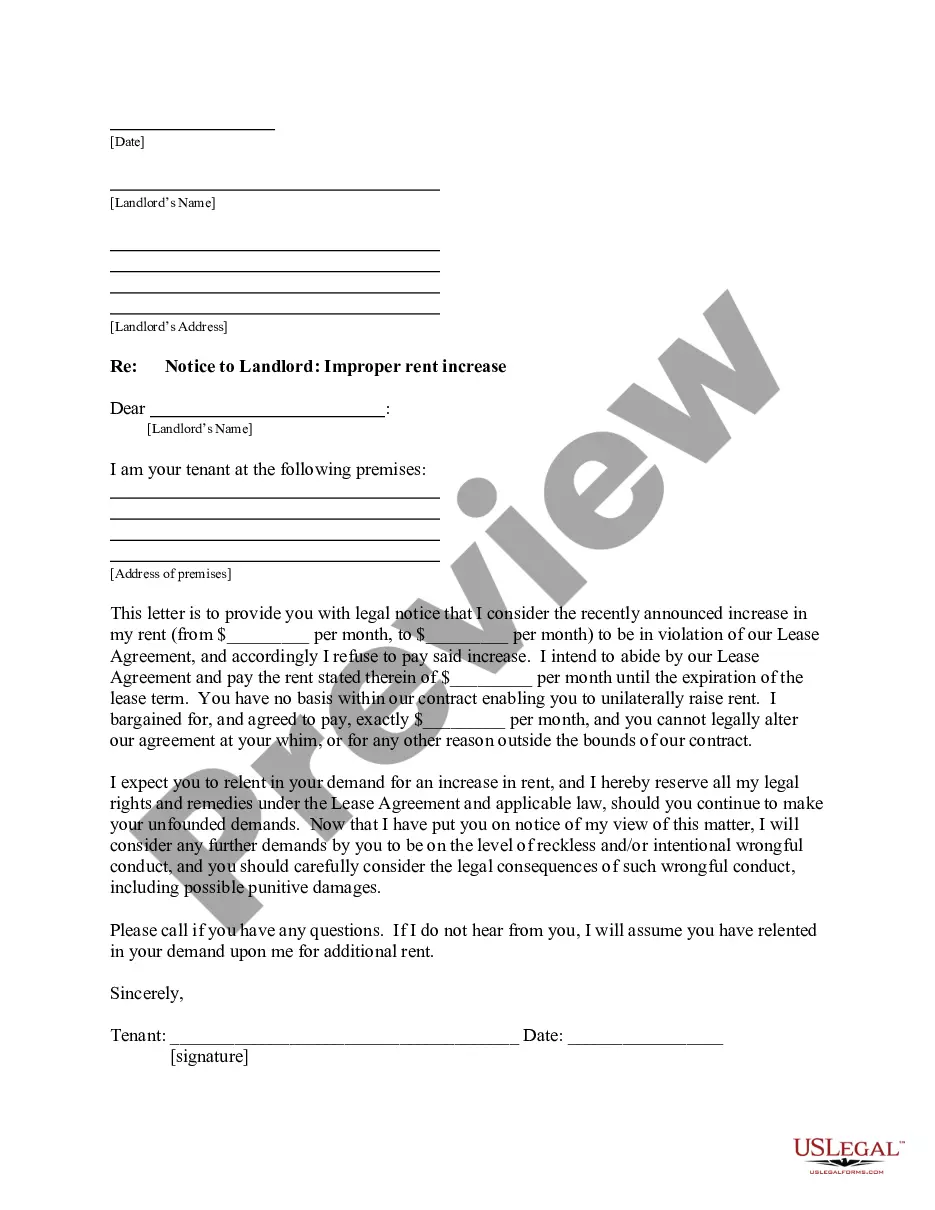

- You can examine the template by using the Preview button and reading the form descriptions to confirm it is suitable for you.

- If the template does not meet your requirements, utilize the Search field to find the appropriate template.

- Once you are confident that the template is correct, click the Get now button to acquire the template.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

You can often claim certain deductions without receipts if they fall under specific categories, such as the standard mileage rate for business travel or certain meal expenses. However, it is important to include them in your Maine Business Deductions Checklist to ensure you’re not missing out on potential savings. Be aware that while some deductions may not need receipts, accurate records of the expense type and amount are still necessary. Consider consulting tax professionals for guidance on this matter.

There are multiple expenses you can legally write off on your taxes, including business expenses, home office costs, and travel expenses, which are often outlined in your Maine Business Deductions Checklist. Each deduction reduces your taxable income, so knowing what applies to you is crucial. Keep detailed records and receipts, as they establish legitimacy for these deductions. Utilizing resources like uslegalforms can assist in navigating these rules effectively.

Yes, Maine does permit itemized deductions, but it is vital to consult your Maine Business Deductions Checklist to determine if itemizing is beneficial for you. Typically, taxpayers can choose between standard deductions or itemizing based on their financial situation. By itemizing, you may claim a variety of expenses, which can reduce your taxable income significantly. Make sure to assess all your eligible deductions for optimal tax savings.

Pass-through businesses, including sole proprietorships, partnerships, S corporations, and some LLCs, can qualify for a 20% deduction. This deduction applies to qualified business income, making it essential to identify eligible income when you prepare your Maine Business Deductions Checklist. Knowing the requirements for this deduction can lead to substantial tax savings and improve your overall financial health. Consult with uslegalforms for additional guidance on optimizing your business structure for tax deductions.

To deduct business expenses, your costs must meet certain criteria. Generally, these expenses need to be ordinary and necessary for your business operations. Keeping a thorough Maine Business Deductions Checklist helps ensure you don't miss any qualifying expenses, such as equipment costs, travel expenses, and advertising. Being aware of these requirements will help you maximize your deductions come tax time.

Many business owners overlook the home office deduction when filing their taxes. This deduction allows you to claim a portion of your home expenses, such as utilities and internet, as business expenses. By including this in your Maine Business Deductions Checklist, you can significantly reduce your taxable income. Understanding this deduction can unlock savings that many fail to realize.

Items that are 100% tax deductible often include certain business expenses, like various operating costs or equipment purchased for your business. Donations to qualified charitable organizations also typically fall into this category. To ensure you capture every eligible deduction, referring to the Maine Business Deductions Checklist can streamline the process and maximize your deductible items.

To fill out a standard deduction, you must first determine your filing status and then locate the standard deduction amount that applies to you. You can simply enter this amount on your tax return form in the designated area. By following the Maine Business Deductions Checklist, you will also discover other potential deductions to enhance your overall tax savings.

For residents of Maine, the standard deduction aligns with federal deductions for most individuals. In 2023, it typically mirrors the federal amounts, depending on your filing status. To optimize your tax strategy, consider utilizing the Maine Business Deductions Checklist to identify potential deductions that can further benefit your business.

The five standard deduction amounts vary based on your filing status. For the tax year 2023, they are $13,850 for single filers, $27,700 for married couples filing jointly, $13,850 for married individuals filing separately, $20,800 for heads of households, and $1,750 for qualifying widow(er)s. Using the Maine Business Deductions Checklist can help you understand how these deductions apply to your business.