Maine Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Selecting the ideal sanctioned document format can be challenging.

Clearly, there is a range of templates accessible online, but how can you locate the authorized form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward steps for you to follow: First, ensure you have selected the correct form for your city/state. You can browse the form using the Preview button and review the form description to confirm it is the right one for you. If the form does not meet your expectations, utilize the Search field to find the appropriate form. When you are certain that the form is suitable, click the Buy now button to purchase the form. Choose the pricing plan you prefer and input the required information. Create your account and finalize your order using your PayPal account or credit card. Select the document format and download the authorized document format to your device. Complete, modify, and print and sign the received Maine Notice of Default on Promissory Note Installment. US Legal Forms is the largest database of legal forms where you can discover various document templates. Use the platform to download professionally crafted documents that adhere to state requirements.

- The service offers a vast collection of templates, such as the Maine Notice of Default on Promissory Note Installment, suitable for both business and personal needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Maine Notice of Default on Promissory Note Installment.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents section of your account to download another copy of the form you require.

Form popularity

FAQ

To issue a default notice for a Maine Notice of Default on Promissory Note Installment, you must first verify that the borrower has indeed defaulted on the payment terms. Gather all relevant documents, including the promissory note and payment records. Next, draft a notice that clearly states the amount owed, the payment due date, and the consequences of not addressing the default. You can use platforms like USLegalForms to access templates that ensure your notice complies with Maine laws and includes all necessary information.

The remedies for default on a promissory note often include the right to collect owed payments, initiate foreclosure, or pursue legal action for recovery. It's important to review your Maine Notice of Default on Promissory Note Installment to determine the specific remedies outlined in the agreement. Additionally, considering open communication with the borrower may lead to an agreeable resolution. Utilize resources from USLegalForms to explore your legal options effectively.

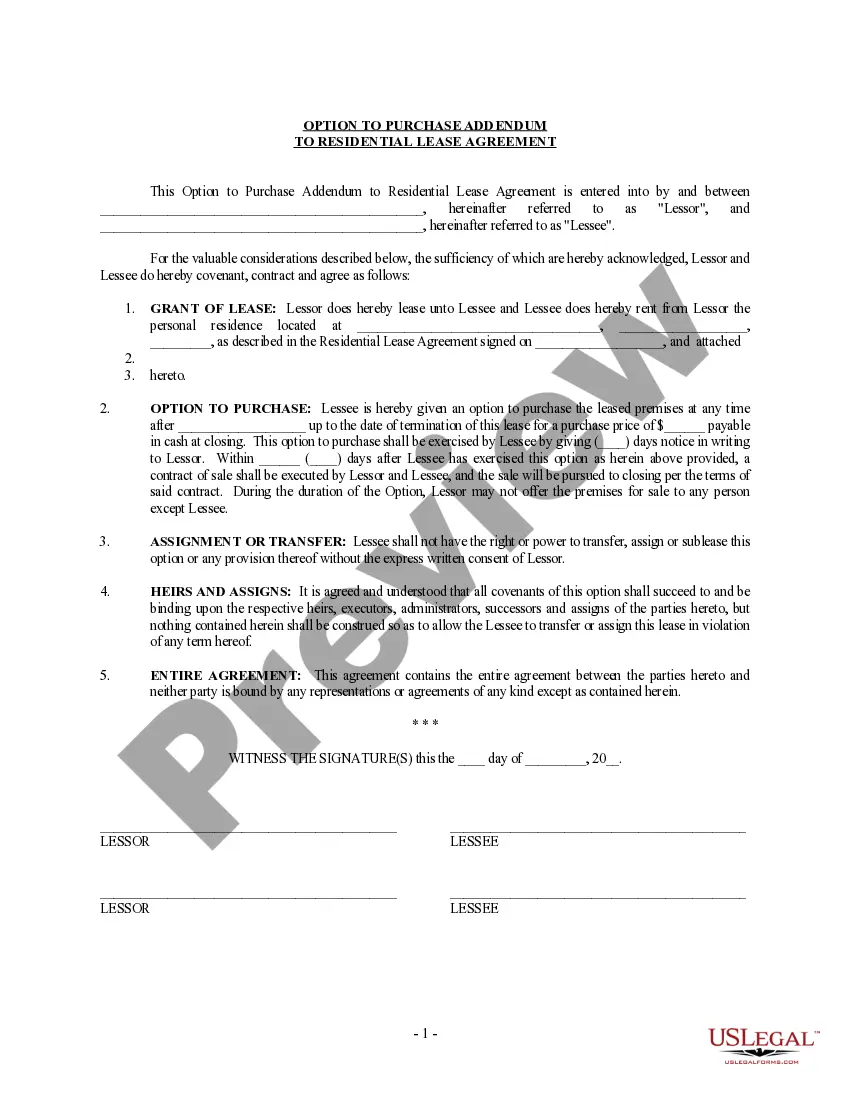

A Maine Notice of Default on Promissory Note Installment typically appears as a formal letter that includes clear headings, a date, and addresses both parties involved. It contains a statement of the default, the specific terms violated, and any applicable consequences or actions that can be taken. The document should be straightforward and professional, allowing the borrower to understand the importance of their prompt response. Visit USLegalForms for examples to guide your drafting.

When someone defaults on a promissory note, first issue a Maine Notice of Default on Promissory Note Installment to officially notify them of the breach. Next, review the terms of the agreement to understand your options for remediation. Depending on local laws, you might consider seeking legal counsel to discuss potential actions. Platforms like USLegalForms can provide the necessary documentation and support during this process.

To issue a Maine Notice of Default on Promissory Note Installment, draft the notice with all necessary information, then send it via certified mail to ensure proper delivery. This step is crucial as it provides proof that the borrower received the notice. Additionally, keeping copies for your records is important for future reference. Consider checking USLegalForms for guidance on issuing notices correctly.

To write a Maine Notice of Default on Promissory Note Installment, begin with a clear statement indicating the purpose of the document. Include the names of the parties involved, the dates of the agreement, and the specific terms that have been violated. Finally, outline the consequences of the default and provide a deadline for the borrower to rectify the situation. If you need additional help, consider using templates from USLegalForms to streamline the process.

Receiving a default notice, particularly a Maine Notice of Default on Promissory Note Installment, is a serious matter. It indicates that you are in default on your payments and prompts immediate action. You should review your financial situation, consult with legal or financial experts, and respond to the notice to avoid further consequences.

If someone defaults on a promissory note, immediate communication is essential. Discuss the overdue payments and potential solutions, which might include restructuring the payment terms. Additionally, consider issuing a Maine Notice of Default on Promissory Note Installment to formalize the situation and encourage swift resolution.

To find properties associated with a Maine Notice of Default on Promissory Note Installment, you can start by checking local county records or online real estate platforms. Many websites provide listings of properties in default or foreclosure. Moreover, working with a real estate agent familiar with default notices can be an effective strategy.

When someone defaults on a promissory note, it triggers specific legal and financial consequences. The lender may issue a Maine Notice of Default on Promissory Note Installment to formally acknowledge the non-payment. If the issue remains unresolved, the lender may pursue foreclosure or seek other legal remedies to recover their funds.