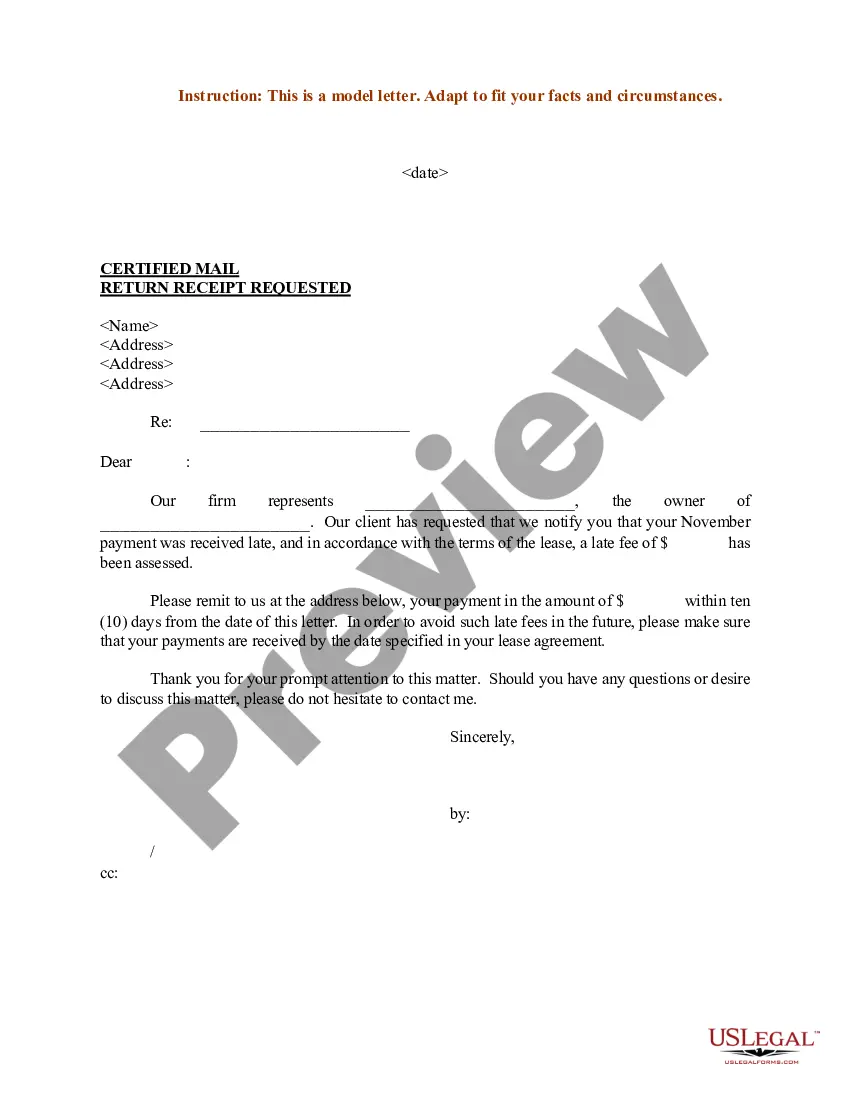

Maine Sample Letter for Late Fees

Description

How to fill out Sample Letter For Late Fees?

If you wish to obtain, secure, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Download now option. Choose the pricing plan you prefer and enter your credentials to register for the account. Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maine Sample Letter for Late Fees.

Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded in your account. Navigate to the My documents section and choose a form to print or download again. Stay competitive and download, and print the Maine Sample Letter for Late Fees with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to get the Maine Sample Letter for Late Fees with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to retrieve the Maine Sample Letter for Late Fees.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Maine generally imposes an income tax on all individuals that have Maine-source income.

If you are unable to pay the amount due in full, You may call Maine Revenue Services at (207) 621-4300 to discuss a payment plan.

All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. So, if you don't pay your real property taxes in Maine, the tax collector can sell your property, or a percentage of it, at a tax sale.

I request you to kindly consider my request and excuse us for the late payment of fees. I also request you to allow my son to continue to attend classes regularly. Looking forward to your response. Thank you for your time and kind consideration.

Late payment penalties After payment is 30 days late5% of tax outstanding5 months after above charge (6 months late)A further 5% of tax outstanding6 months after above charge (12 months late)A further 5% of tax outstanding

If a return is ?led after the due date, a late ?ling penalty is charged. The penalty is $25 or 10% of the tax due, whichever is greater.

The 2022 Maine personal exemption amount is $4,450 and the Maine basic standard deduction amounts are $12,950* for single and $25,900* for married individuals filing joint returns.

File is a convenient and accurate way to file your Maine individual income tax return. File using a participating preparer, purchase commercial software or a commercial website. Most of these options offer direct deposit of your refund, electronic funds withdrawal for a balance due return and even delayed debit.