An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

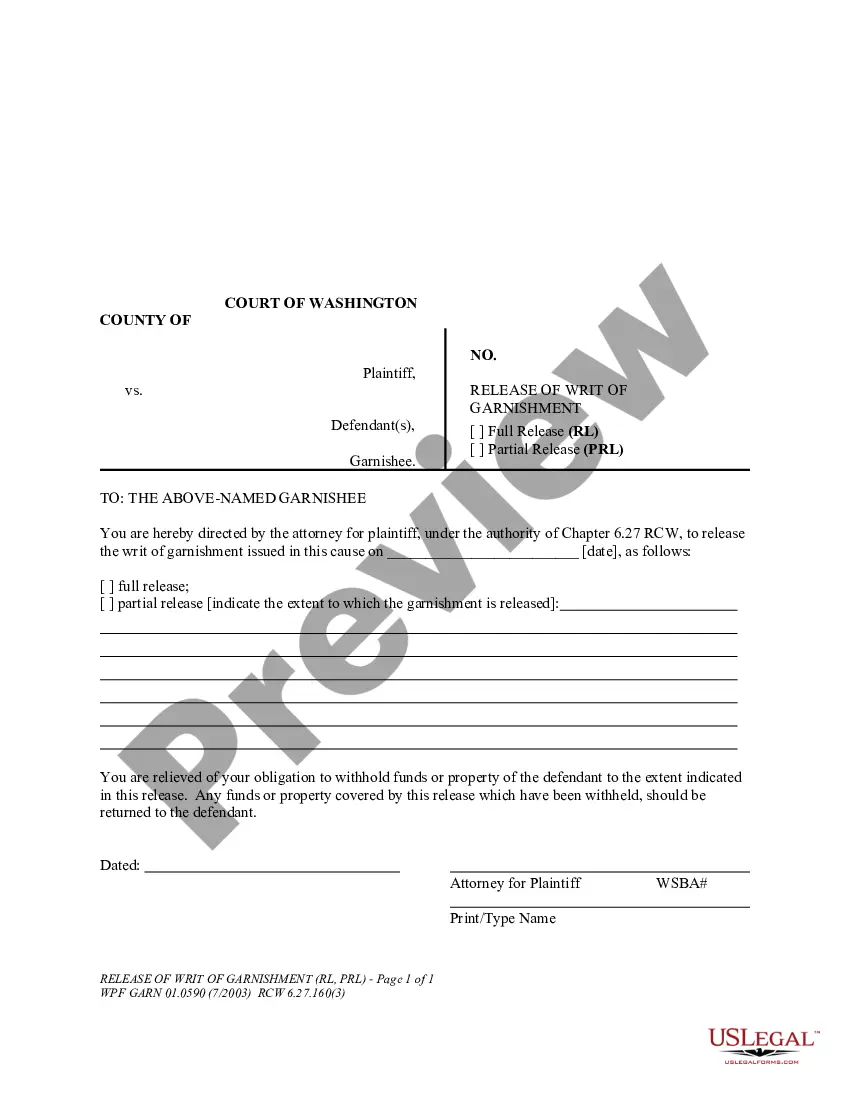

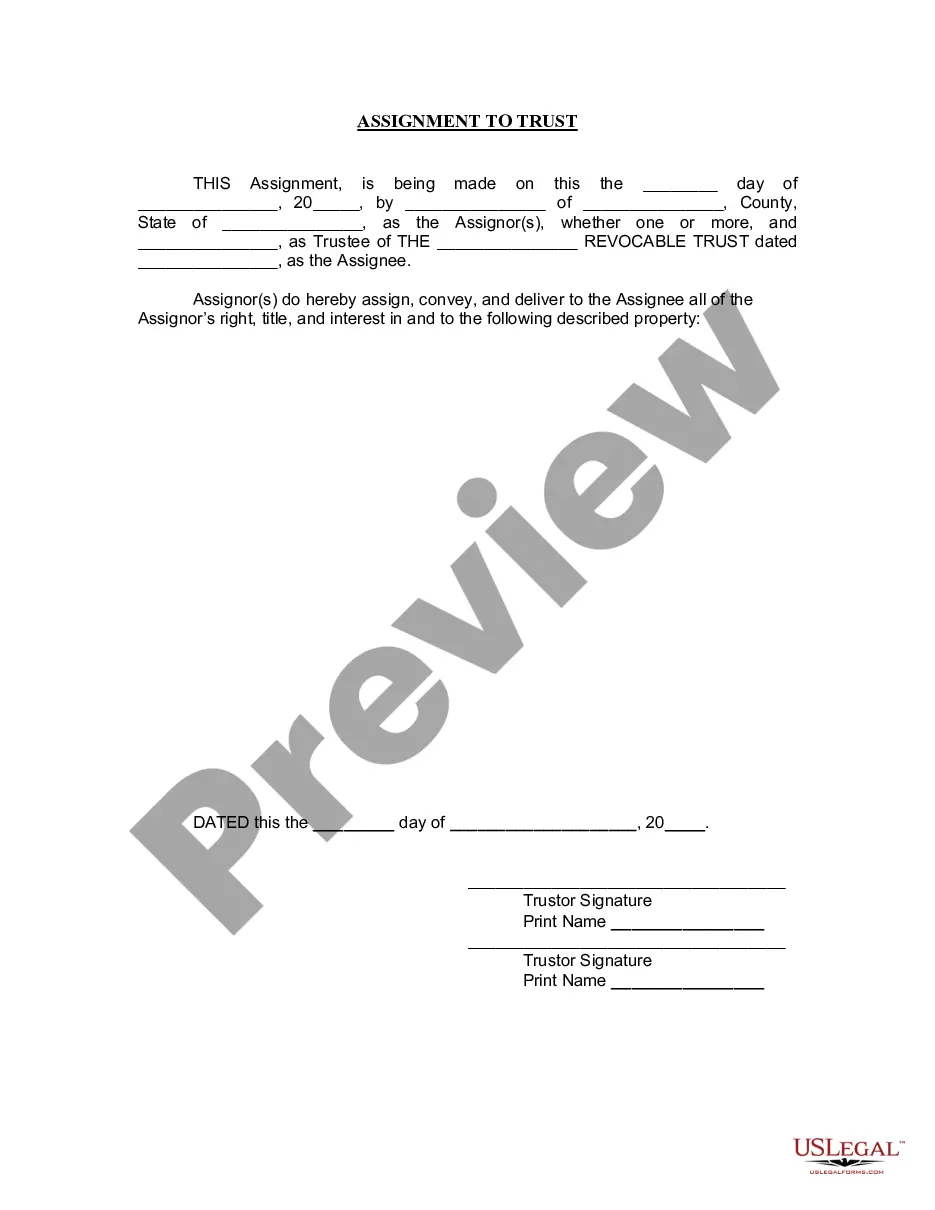

Maine Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

Choosing the right legitimate record design could be a have a problem. Needless to say, there are tons of templates available on the Internet, but how do you find the legitimate kind you require? Utilize the US Legal Forms web site. The assistance offers a huge number of templates, for example the Maine Petition to Require Accounting from Testamentary Trustee, that can be used for organization and private needs. All the kinds are checked by specialists and meet up with state and federal requirements.

When you are presently registered, log in in your profile and then click the Acquire key to find the Maine Petition to Require Accounting from Testamentary Trustee. Use your profile to search from the legitimate kinds you might have purchased in the past. Proceed to the My Forms tab of the profile and obtain yet another copy of your record you require.

When you are a new end user of US Legal Forms, listed here are simple directions that you can follow:

- Very first, make sure you have chosen the appropriate kind for your town/region. You can examine the form while using Review key and study the form description to ensure it is the best for you.

- If the kind is not going to meet up with your needs, take advantage of the Seach area to get the proper kind.

- Once you are positive that the form would work, select the Purchase now key to find the kind.

- Choose the pricing plan you need and enter the necessary information. Build your profile and pay money for the order making use of your PayPal profile or credit card.

- Pick the data file file format and acquire the legitimate record design in your system.

- Full, edit and printing and indicator the obtained Maine Petition to Require Accounting from Testamentary Trustee.

US Legal Forms may be the biggest catalogue of legitimate kinds for which you can see a variety of record templates. Utilize the service to acquire appropriately-created papers that follow state requirements.

Form popularity

FAQ

Under current Maine law, creditors have a maximum time limit of 9 months from the date of death to present their claims to the Personal Representative. The 9-month period can be shortened if you provide a written notice to the creditor and request that the creditor promptly file the claim.

Once the assets have been distributed, the Personal Representative prepares a final account of all income, expenses, and distributions, and distributes the account to the beneficiaries. Finally, the Personal Representative closes the estate by filing a "Sworn Statement" with the Probate Court.

Probate can be a lengthy process in Maine. It generally takes a minimum of six to twelve months, but it can extend beyond that, often lasting a year or more. Complex estates or disputes among beneficiaries can further lengthen the process.

Certain kinds of property can be passed without going through probate. Property owned with a ?Right of Survivorship? automatically transfers to the joint owner at death and that person owns the property fully. Property can also pass through a Trust established during the decedent's lifetime.

If the person died without a will, you can still proceed with informal probate if there is no dispute regarding the identity of the heirs. Formal probate means that the estate must be opened by filing a petition for a hearing before the probate court and can mean continued involvement of the court.

To start the probate process, you need to file an ?Application for Probate? in the probate court in the county where the decedent lived. In Maine, each county has its own probate court. If there is a Will, it needs to be submitted to the probate court. The probate judge will decide whether or not the Will is valid.

Listed below are some of the non-probate assets available in Maine. Any property in a living trust. Life insurance policies. 401(k)s, IRAs, other retirement accounts. Securities in transfer-on-death accounts. Pay-on-death bank accounts. Joint tenancy real property.

In Maine, if an estate is worth no more than $40,000, it is considered a ?small estate.? Small estates can be wrapped up quickly by filing a document called a ?Small Estate Affidavit.? This is usually a simple process, but there are some legal steps that must be taken before you can wrap up a small estate.