Maine Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

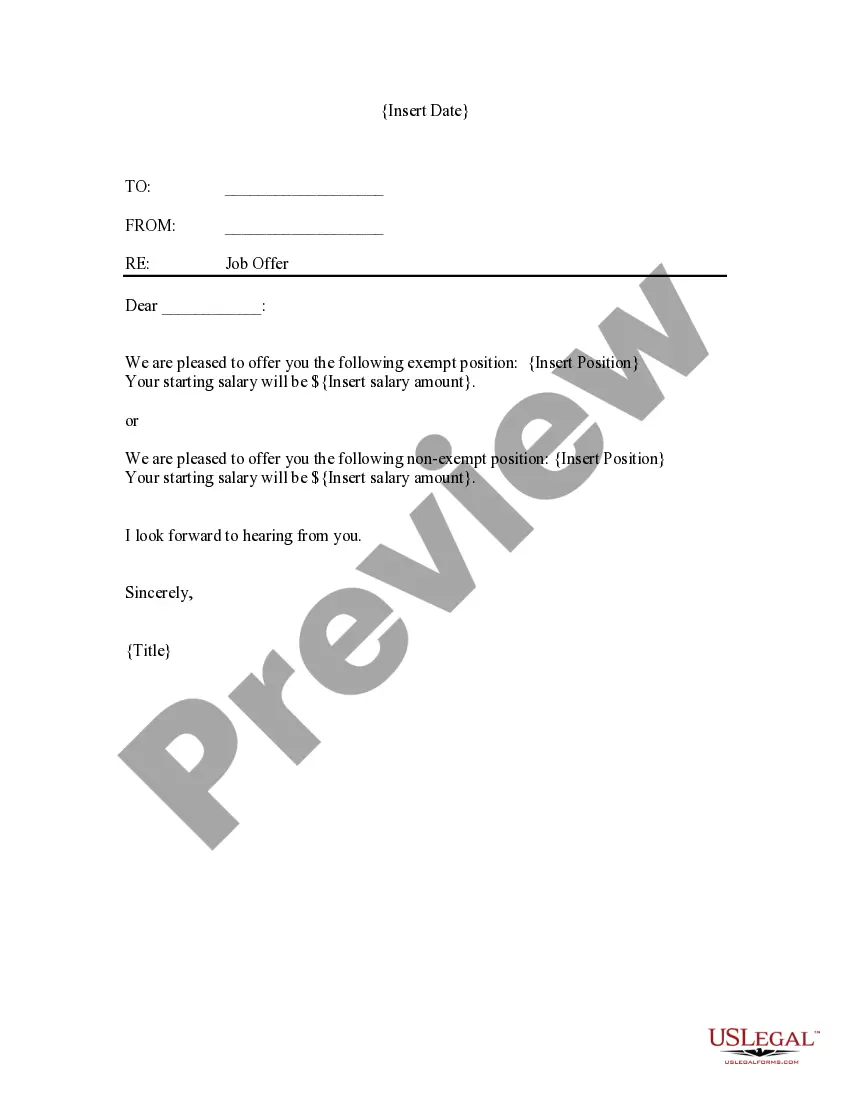

How to fill out Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

Selecting the appropriate legitimate document format can be challenging. Of course, there are numerous templates available online, but how would you find the correct version you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Maine Letter to Credit Reporting Agency or Bureau Concerning Known Imposter Identity Fraud, that you can utilize for business and personal purposes. All of the forms are reviewed by specialists and meet federal and state regulations.

If you are currently registered, Log In to your account and click the Acquire button to locate the Maine Letter to Credit Reporting Agency or Bureau Concerning Known Imposter Identity Fraud. Use your account to view the legitimate forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure you have chosen the correct form for your city/state. You can preview the document using the Review button and read the form details to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are confident that the form is suitable, click on the Buy now button to obtain the document. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legitimate document format to your device. Complete, modify, and print and sign the received Maine Letter to Credit Reporting Agency or Bureau Concerning Known Imposter Identity Fraud.

Make the most of the US Legal Forms service to access reliable and valid legal documents tailored to your needs.

- US Legal Forms is the largest collection of legitimate documents where you can find numerous document templates.

- Utilize the service to download professionally crafted papers that comply with state regulations.

- Access a wide variety of forms for both personal and business needs.

- Take advantage of expert-reviewed documents to ensure legal compliance.

- Easily navigate through your account to manage and retrieve previous downloads.

- Follow simple guidelines to ensure you select the right form for your requirements.

Form popularity

FAQ

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. What To Do If Your Identity Is Stolen - Identity Crimes - Utica University utica.edu ? institutes ? cimip ? idcrimes ? sto... utica.edu ? institutes ? cimip ? idcrimes ? sto...

Initial fraud alerts You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year. After one year, the initial fraud alert will expire and be removed.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Once you have a fraud alert on your credit report place, a business must verify your identity before it issues new credit in your name. The alert remains active for a year and can be renewed by you for up to seven years. What to Do If Your Identity Is Stolen - Texas Attorney General Texas Attorney General (.gov) ? identity-theft Texas Attorney General (.gov) ? identity-theft

Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department. Lessons From the Field - Steps for Victims of Identity Theft or ... Office for Victims of Crime (.gov) ? files ? xyckuh226 ? files ? pubs Office for Victims of Crime (.gov) ? files ? xyckuh226 ? files ? pubs

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. How do I dispute an error on my credit report? consumerfinance.gov ? ask-cfpb ? how-do-i... consumerfinance.gov ? ask-cfpb ? how-do-i...