Maine Identity Theft Checklist

Description

How to fill out Identity Theft Checklist?

It is feasible to dedicate several hours online searching for the valid document template that meets the local and federal requirements you require. US Legal Forms offers a vast array of valid forms that have been reviewed by experts.

You can conveniently download or print the Maine Identity Theft Checklist from our services. If you already possess a US Legal Forms account, you can Log In and click the Download button. After that, you can fill out, modify, print, or sign the Maine Identity Theft Checklist.

Every valid document template you acquire is yours permanently. To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple guidelines below: Initially, ensure you have selected the correct document template for the area/city of your choice. Review the form details to confirm you have chosen the right one. If available, utilize the Review button to examine the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- If you wish to find another version of your form, use the Search section to locate the template that fits your requirements and needs.

- Once you have identified the template you want, click Buy now to proceed.

- Select the payment plan you prefer, enter your information, and create an account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal account to purchase the valid form.

- Choose the format of your document and download it to your device.

- Make modifications to your document if necessary. You can fill out, edit, sign, and print the Maine Identity Theft Checklist.

- Download and print a multitude of document templates using the US Legal Forms Website, which provides the largest collection of valid forms.

Form popularity

FAQ

If your identity is stolen, identity theft insurance helps cover out-of-pocket expenses associated with restoring it. Covered expenses may include legal or administrative fees you need to pay for when restoring your identity.

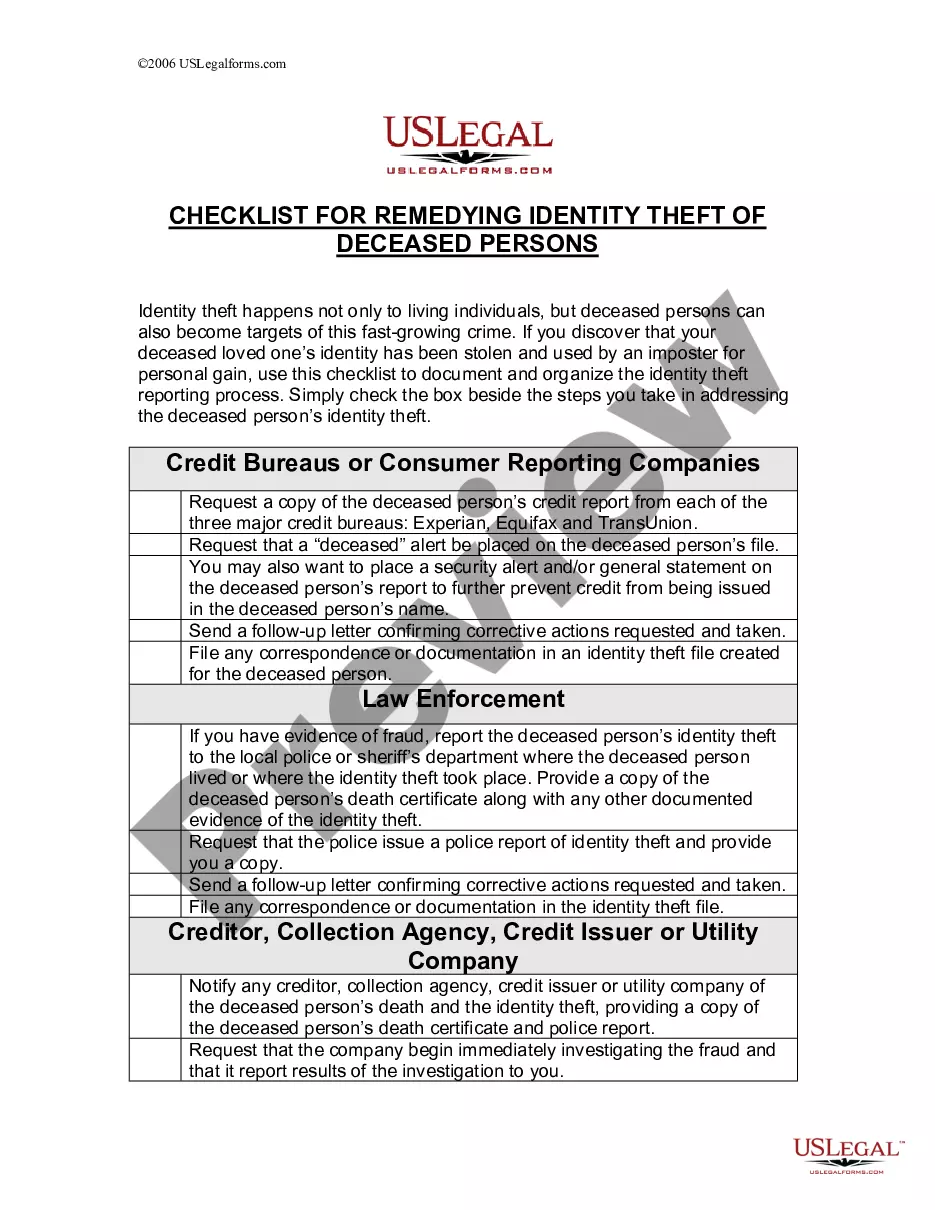

File a report with the Federal Trade Commission (FTC). If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law).

What does identity theft insurance not cover? It's important to note that these insurance policies typically don't cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. They typically reimburse you only for the costs of the reporting and recovery process.

Information Thieves Can Use to Steal Your Identity Name and Address. There's not much a thief can do with only your name and address, which are easy-to-find pieces of information. ... Social Security Number. ... Banking Information. ... Cellphone Number. ... Passwords. ... Credit Card Information.

You should review your bank account statements regularly; if you see unknown purchases, that could be a sign that your identity has been stolen. Check credit reports. Similarly, monitor your credit reports from all three credit-reporting bureaus for any unknown accounts or inaccurate information.

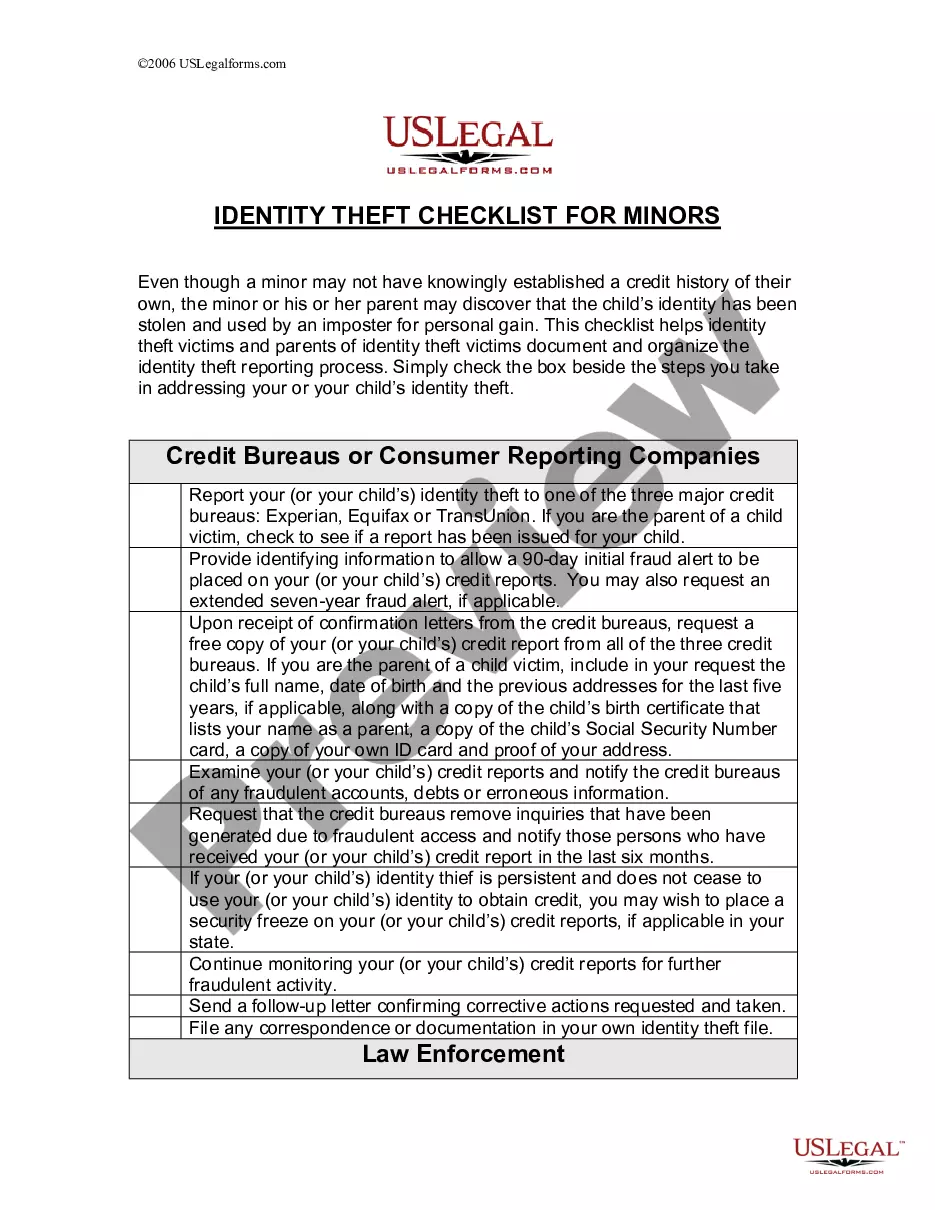

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

Identity theft insurance typically covers only expenses that happen after the identity theft?like your legal fees, lost wages and application fees. It won't cover direct financial losses you incurred as a result of the identity theft, like fraudulent charges on your credit card.

Most of us know the importance of making our passwords and PINs secure and keeping them out of fraudsters' hands. But even simple details such as your full name, date of birth and address can be used to commit identity fraud. Often criminals don't need to look very hard to find out where you live or when you were born.