Maine Minimum Checking Account Balance - Corporate Resolutions Form

Description

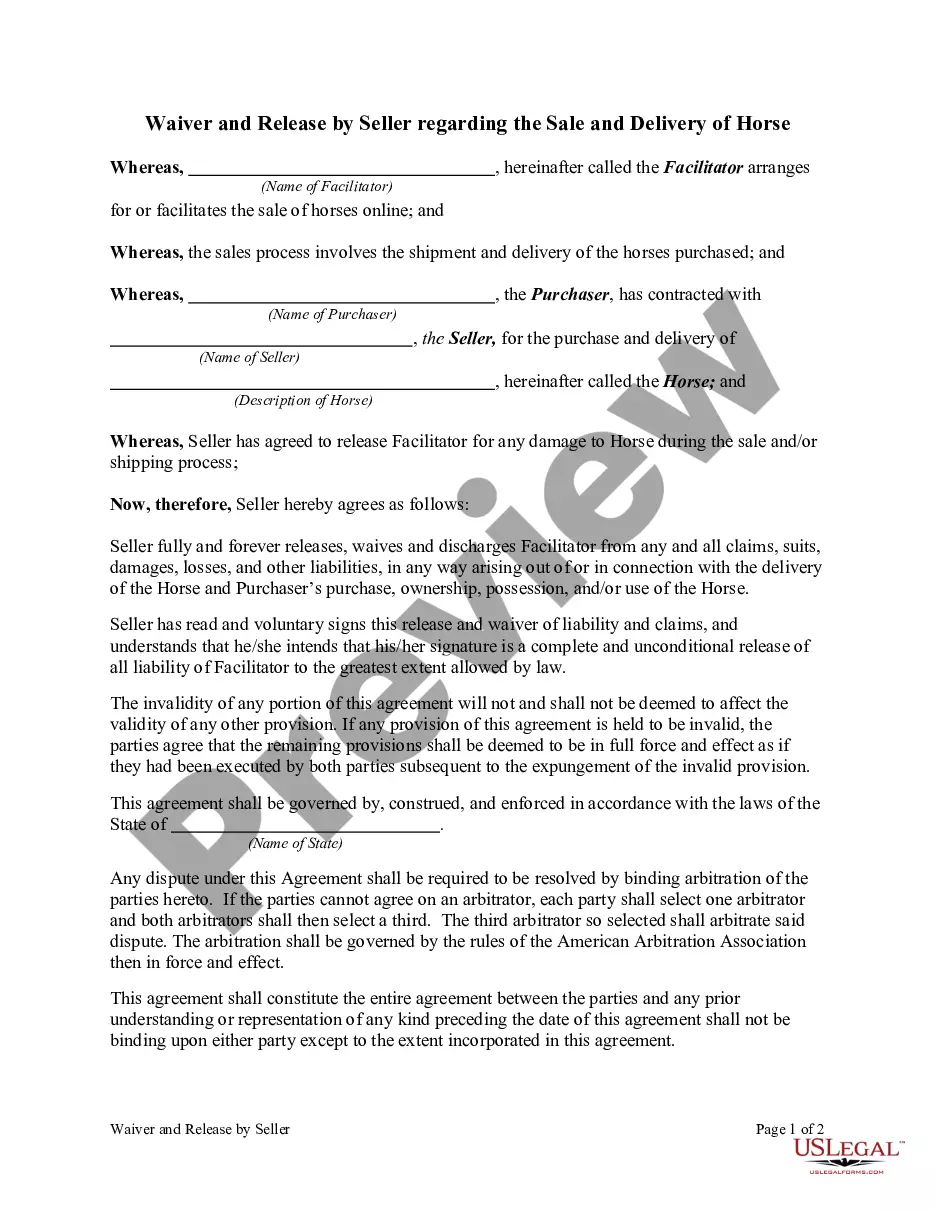

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Are you currently in the situation where you require documents for either business or personal reasons every single day.

There are numerous legal document templates accessible online, but locating ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, including the Maine Minimum Checking Account Balance - Corporate Resolutions Form, which can be printed to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or Visa/MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Minimum Checking Account Balance - Corporate Resolutions Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Utilize the Review button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you are seeking, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Your Maine charter number is located on your business's formation documents or can be retrieved from the Maine Secretary of State’s office. If you can't find your documents, you may search online for your company using their business database. Remember, this number is important for completing your Maine Minimum Checking Account Balance - Corporate Resolutions Form efficiently.

To look up an LLC in Maine, visit the Maine Secretary of State’s website and use their business entity search tool. Enter the name of the LLC you’re searching for; this will provide you with official details. Knowing how to find your LLC information is crucial, particularly when managing your Maine Minimum Checking Account Balance - Corporate Resolutions Form.

You can find your articles of incorporation number on the official documents filed with the Maine Secretary of State. If you have lost these documents, don't worry. You can also access this information online through the Secretary of State’s website. This number is essential, especially when filling out forms like the Maine Minimum Checking Account Balance - Corporate Resolutions Form.

Maine does require LLCs to file an annual report with the Secretary of State. This report helps the state keep accurate records of each business entity's status. Timely filing of your annual report is crucial to avoid penalties or losing your LLC status. The Maine Minimum Checking Account Balance - Corporate Resolutions Form can simplify your financial management when preparing for your annual reporting obligations.

Yes, in Maine, LLCs must file an annual report every year to maintain good standing. This report includes important information such as the business address and registered agent details. Keeping your LLC updated ensures compliance with state laws. Utilizing the Maine Minimum Checking Account Balance - Corporate Resolutions Form can assist you in tracking your business finances throughout this process.

To change a registered agent in Maine, you need to submit a form to the Secretary of State. This process requires providing details about the new registered agent and ensuring they consent to the appointment. By keeping your records updated, you protect your LLC’s status and communication channels. The Maine Minimum Checking Account Balance - Corporate Resolutions Form is a valuable resource during this transition.

In Maine, limited liability companies (LLCs) are typically treated as pass-through entities for tax purposes. This means that profits and losses pass through to the owners' personal tax returns. Additionally, members can elect to be taxed as a corporation if it benefits their financial situation. By staying informed about the Maine Minimum Checking Account Balance - Corporate Resolutions Form, you can maintain compliance and manage your finances effectively.

While having a lawyer is not a requirement to start an LLC in Maine, it can be beneficial for specific legal advice. Many people successfully navigate the process without legal assistance by using resources available on platforms like US Legal. This platform offers guidance and essential forms, including the Maine Minimum Checking Account Balance - Corporate Resolutions Form, making it easier for you to complete the required steps confidently.

The timeframe to establish an LLC in Maine can vary. Typically, if you file online, you might receive approval in just a few business days. However, paper filings may take longer. Utilizing the US Legal platform can expedite your process by providing immediate access to essential forms like the Maine Minimum Checking Account Balance - Corporate Resolutions Form, enabling you to submit your application promptly.

Starting your own LLC in Maine involves a few key steps. First, choose a unique name for your LLC and ensure it complies with Maine's naming laws. Next, file the necessary formation documents with the Maine Secretary of State. Consider using the US Legal platform to access resources and templates, including the Maine Minimum Checking Account Balance - Corporate Resolutions Form, which can help streamline the process.