Maine Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

Selecting the appropriate legally authorized document template can be a challenge. Clearly, there is an abundance of templates available online, but how do you find the legal form you require? Turn to the US Legal Forms website.

The platform provides thousands of templates, including the Maine Limited Endowment to Educational, Religious, or Charitable Organization, which can serve both business and personal purposes. All forms are reviewed by specialists and comply with state and federal standards.

If you are already registered, Log In to your account and click the Acquire button to obtain the Maine Limited Endowment to Educational, Religious, or Charitable Organization. Use your account to check the legal forms you have previously ordered. Navigate to the My documents section of your account to download another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, and print, then sign the received Maine Limited Endowment to Educational, Religious, or Charitable Organization. US Legal Forms is the top directory of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted documents that adhere to state regulations.

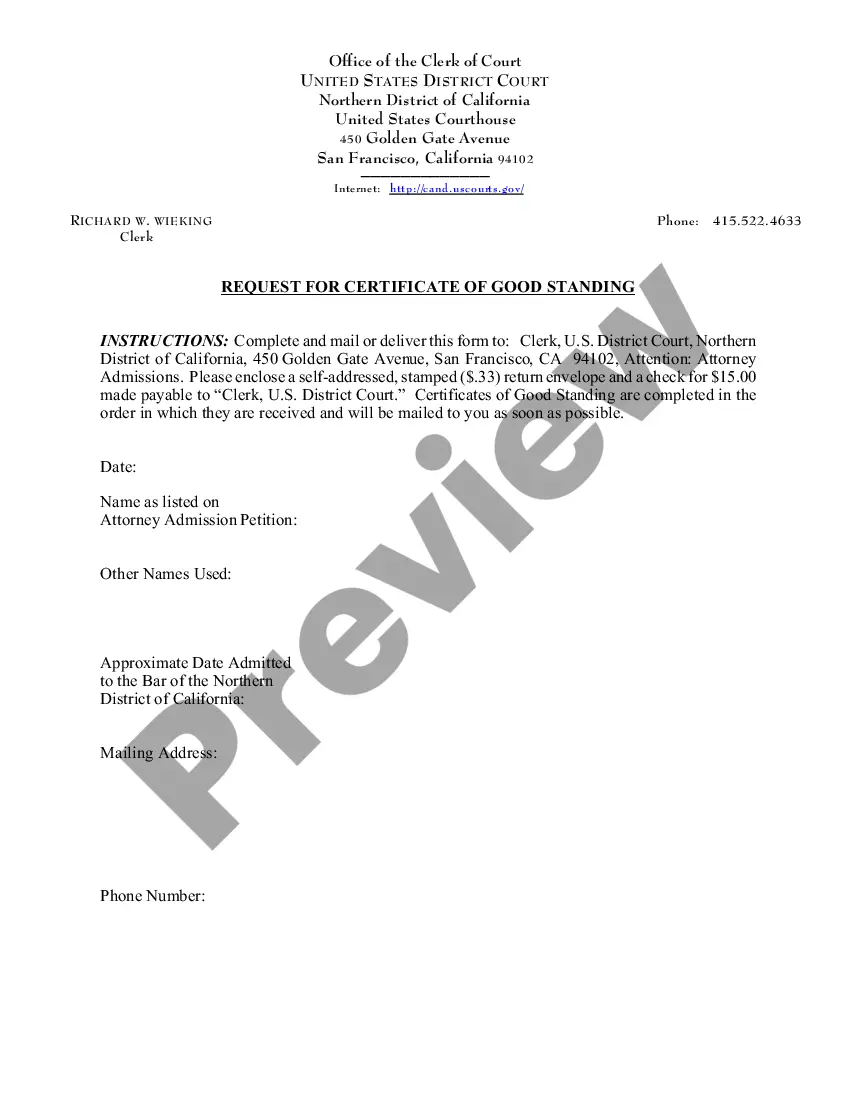

- First, ensure you have selected the correct form for your location/region.

- You can preview the form using the Preview button and review the form description to confirm its suitability for your needs.

- If the form does not meet your requirements, utilize the Search field to find the correct document.

- Once you are convinced the form is appropriate, click the Buy now button to acquire it.

- Choose your desired pricing plan and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

Securing endowment funds often involves creating a comprehensive fundraising strategy. Start by identifying potential donors and building relationships based on shared goals. Additionally, explore legal platforms like uslegalforms to streamline the process of setting up a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, ensuring compliance with all necessary regulations.

To obtain endowment funds, you typically need to establish a relationship with donors who align with your institution's mission. You can also apply for grants or consider setting up fundraising campaigns to support your cause. Engaging with uslegalforms can help you navigate the legal requirements and documentation associated with establishing a Maine Restricted Endowment to Educational, Religious, or Charitable Institution.

The Uniform Prudent Management of Institutional Funds Act (UPMIFA) governs how institutions manage their endowment funds. It provides a framework that promotes the responsible investment and spending practices for various institutions, including those with Maine Restricted Endowments to Educational, Religious, or Charitable Institutions. By adhering to UPMIFA, entities can ensure their financial practices align with best practices for sustainability.

The 4% rule is a commonly accepted financial guideline for the annual withdrawal from an endowment fund, allowing for sustainable growth while providing funds for current needs. It suggests that, by withdrawing 4% of the endowment's value each year, institutions can support their missions without depleting their funds. For a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, adhering to this rule facilitates long-term stability.

The 5 rule for endowment refers to a guideline suggesting that institutions allocate 5% of their endowment's total market value for spending each year. This approach helps maintain the principal of the endowment while providing necessary funds for operations. In the context of a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, this rule helps support essential functions, ensuring these organizations can thrive sustainably.

The restricted fund method involves tracking contributions that are earmarked for specific purposes. Organizations must adhere strictly to the donor's wishes, ensuring funds are utilized appropriately. This method is crucial for maintaining transparency and accountability, particularly for organizations managing a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, as it builds trust with donors and stakeholders.

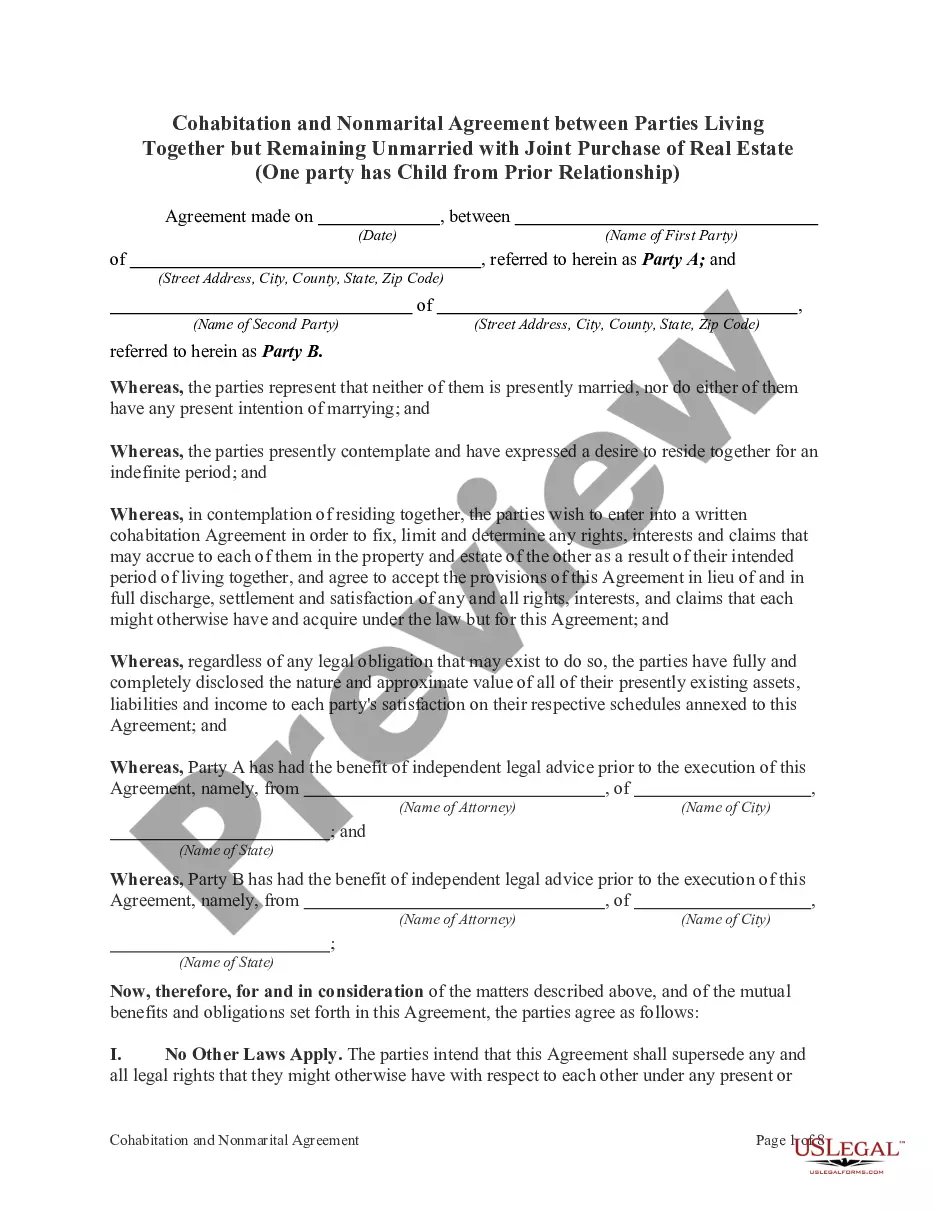

A restricted endowment fund is a type of fund that ensures a portion of the contributions is retained as principal, while the accrued income supports designated needs. This approach is particularly beneficial for nonprofits or organizations seeking consistent funding for specific initiatives. When considering a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, ensure that the fund’s stipulations align with your organization’s objectives.

A restricted endowment is an investment fund where the donor specifies how the income generated must be utilized. This often means funds are dedicated solely to specific purposes, like educational, religious, or charitable institutions. In the context of a Maine Restricted Endowment to Educational, Religious, or Charitable Institution, these restrictions guide the organization in fulfilling community needs while ensuring proper fund management.

A designated fund is meant for a specific purpose chosen by the donor, while a restricted fund has limitations set by the donor regarding its usage. Understanding this distinction is important, especially in the context of a Maine Restricted Endowment to Educational, Religious, or Charitable Institution. In both cases, funds are typically managed to ensure they fulfill the donor’s intentions effectively.

Setting up an endowment fund for your church starts with defining its purpose and goals. You will need to draft the fund's governing documents, outlining how the funds will be used, and establish an investment strategy. Collaborate with a financial advisor or endowment specialist to ensure compliance with local laws, particularly those relating to a Maine Restricted Endowment to Educational, Religious, or Charitable Institution.