Maine Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the best assortment of legal forms that are accessible online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

A range of templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords. Utilize US Legal Forms to locate the Maine Assignment of Money Due with just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Finalize and obtain, and print the Maine Assignment of Money Due with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download option to obtain the Maine Assignment of Money Due.

- You can also access forms you previously stored from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

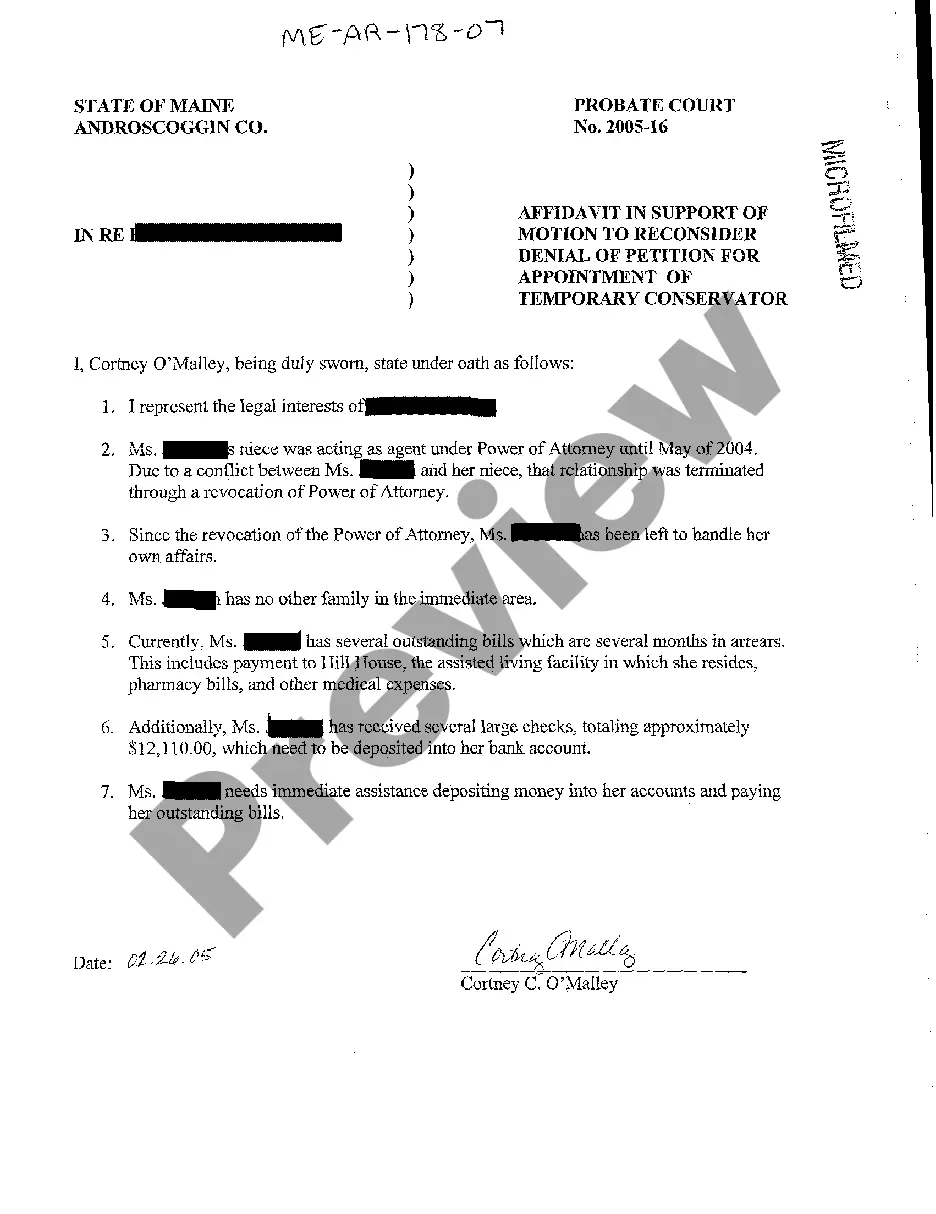

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the outline.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now option. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Maine Assignment of Money Due.

Form popularity

FAQ

In Maine, residents aged 65 and older may qualify for a property tax exemption, which can significantly reduce their property tax burden. However, this does not mean you stop paying property taxes entirely; it simply lowers the amount you owe. Knowing your eligibility for exemptions can be beneficial when managing a Maine Assignment of Money Due. For detailed guidance on this topic, consider exploring uslegalforms.

In Maine, if you underpay your taxes, you may face penalties and interest on the unpaid amount. The penalty often varies based on the amount underpaid and the duration of the underpayment. This could affect your financial standing, especially when dealing with a Maine Assignment of Money Due. To ensure compliance and avoid penalties, uslegalforms can provide helpful resources and forms.

In Maine, the dormancy period for unclaimed property is typically three years. This means that if there has been no activity on a financial account or property for three years, it may be considered unclaimed. Understanding this period is crucial, especially when dealing with a Maine Assignment of Money Due. If you need assistance navigating these regulations, consider using platforms like uslegalforms to find the right solutions.

Yes, you can file a Maine extension electronically through the Maine Department of Revenue's online services. This process allows you to submit your request for an extension for your Maine Assignment of Money Due quickly and easily. By filing electronically, you can ensure that your extension is processed promptly, which can help you avoid any potential late fees. It is a convenient option that many taxpayers find beneficial.

Summary: The statute of limitations on debt in Maine is 6 years. You can use SoloSuit to beat your debt collector. In Maine, the statute of limitations on debt is six years after the date of the debtor's last activity on the debt.

Statute of limitations on debt for all states StateWrittenOralCalifornia4 years2Colorado6 years6Connecticut6 years3Delaware3 years346 more rows ?

At regular intervals not to exceed 16 days, every employer must pay in full all wages earned by each employee. Each payment must include all wages earned to within 8 days of the payment date. Payments that fall on a day when the business is regularly closed must be paid no later than the following business day.

How long can a debt collector legally pursue old debt? The exact time period varies by state but typically falls somewhere between three and six years.

A debt collector may not commence a collection action more than 6 years after the date of the consumer's last activity on the debt. This limitations period applies notwithstanding any other applicable statute of limitations, unless a shorter limitations period is provided under the laws of this State.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.