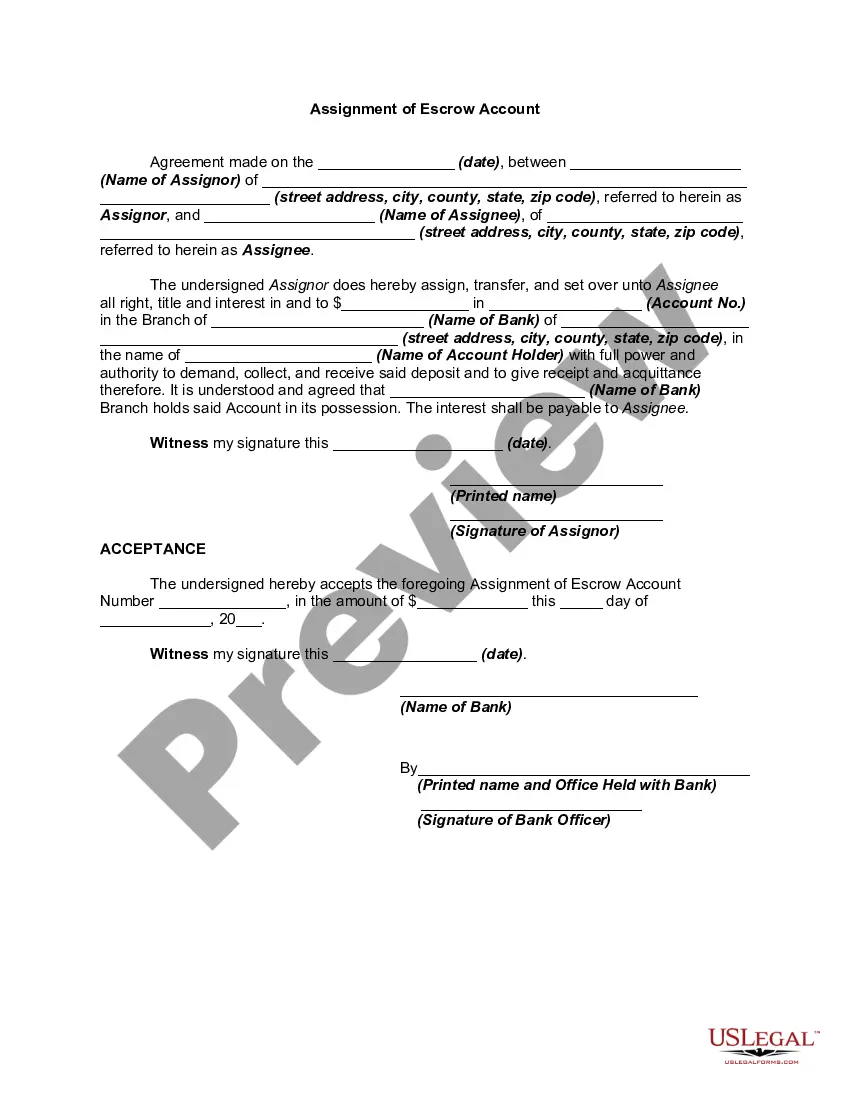

Grantor assigns all of his/her rights in a real estate purchase contract to a certain trust department. Grantor also directs the trust department to apply escrowed funds held under the exchange agreement to the purchase of property covered by the assigned contract.

Maine Assignment and Instruction to Apply Escrowed Funds

Description

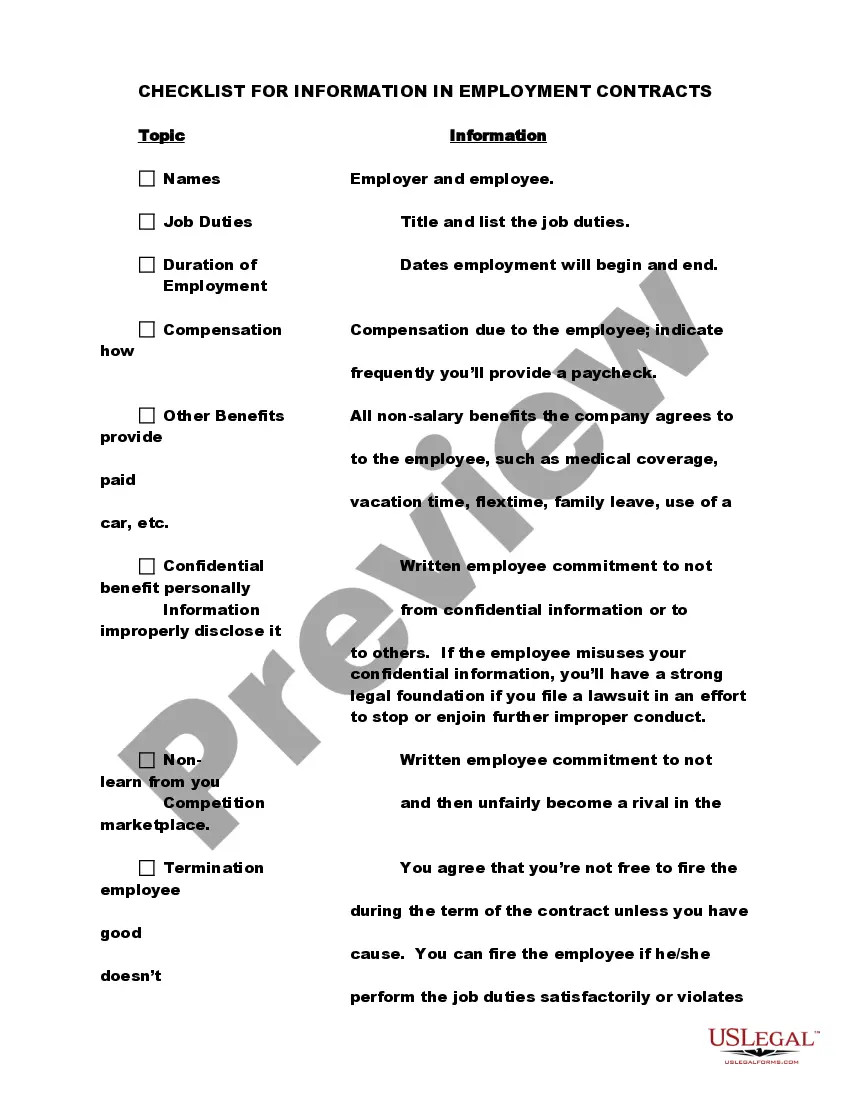

How to fill out Assignment And Instruction To Apply Escrowed Funds?

You may spend several hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

It is easy to obtain or create the Maine Assignment and Instruction to Apply Escrowed Funds from their service.

If available, utilize the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Maine Assignment and Instruction to Apply Escrowed Funds.

- Every legal document template you acquire is yours permanently.

- To get another copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/area of your choice.

- Review the form details to ensure you have selected the correct document.

Form popularity

FAQ

In simpler terms, an escrow account is a third party account where funds are kept before they are transferred to the ultimate party. It provides security against scams and frauds especially with high asset value and dispute-prone sectors like Real Estate.

The first option is to apply for a loan once a deal is complete and the funds and property held in the escrow account are distributed to the appropriate parties. Another option is to seek out a third party lending company that advances money against property or funds held in escrow.

Funds or assets held in escrow are temporarily transferred to and held by a third party, usually on behalf of a buyer and seller to facilitate a transaction. "In escrow" is often used in real estate transactions whereby property, cash, and the title are held in escrow until predetermined conditions are met.

When you refinance your mortgage, the title company typically opens an escrow account, the key function of which is to facilitate the process of paying off your old loan with the proceeds of the new loan. The account is designed to hold any good-faith deposit that you put into the deal.

An escrow account is a separate account managed by a lender to collect advance insurance payments and tax payments from a homeowner. Usually, a lender will add up the total amount due for these payments in a year, divide it by 12, and tack on that extra amount to each mortgage payment.

When you borrow money from a bank or a direct mortgage lender, you'll usually be given an escrow account. This account is where the lender will deposit the part of your monthly mortgage payment that covers taxes and insurance premiums.

When you borrow money from a bank or a direct mortgage lender, you'll usually be given an escrow account. This account is where the lender will deposit the part of your monthly mortgage payment that covers taxes and insurance premiums.

You'll submit a cashier's check or arrange a wire transfer to meet the remaining down paymentsome of which is covered by your earnest moneyand closing costs, and your lender will wire your loan funds to escrow so the seller and, if applicable, the seller's lender, can be paid.

How to Add Money to an Escrow AccountContact the lender for payment information. You'll need the escrow account number, as well as a payment address.Mail or hand-deliver the payment to the lender. Include your account number on the check.Confirm by phone that the payment was received. Even banks make mistakes.

An escrow account is essentially a savings account that's managed by your mortgage servicer. Your mortgage servicer will deposit a portion of each mortgage payment into your escrow to cover your estimated property taxes and your homeowners and mortgage insurance premiums. It's that simple.