Maine Disclosure and Consent for a Consumer Investigative Report and Release Authorization

Description

How to fill out Disclosure And Consent For A Consumer Investigative Report And Release Authorization?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can quickly obtain the latest versions of forms like the Maine Disclosure and Consent for a Consumer and Investigative Report and Release Authorization within moments.

If you already possess a subscription, Log In to download the Maine Disclosure and Consent for a Consumer and Investigative Report and Release Authorization from the US Legal Forms catalog. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Then, select the pricing plan you prefer and provide your information to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Edit. Fill out, revise, print, and sign the downloaded Maine Disclosure and Consent for a Consumer and Investigative Report and Release Authorization.

Each format you added to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Maine Disclosure and Consent for a Consumer and Investigative Report and Release Authorization with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to assist you get started.

- Ensure you have selected the correct form for your city/state.

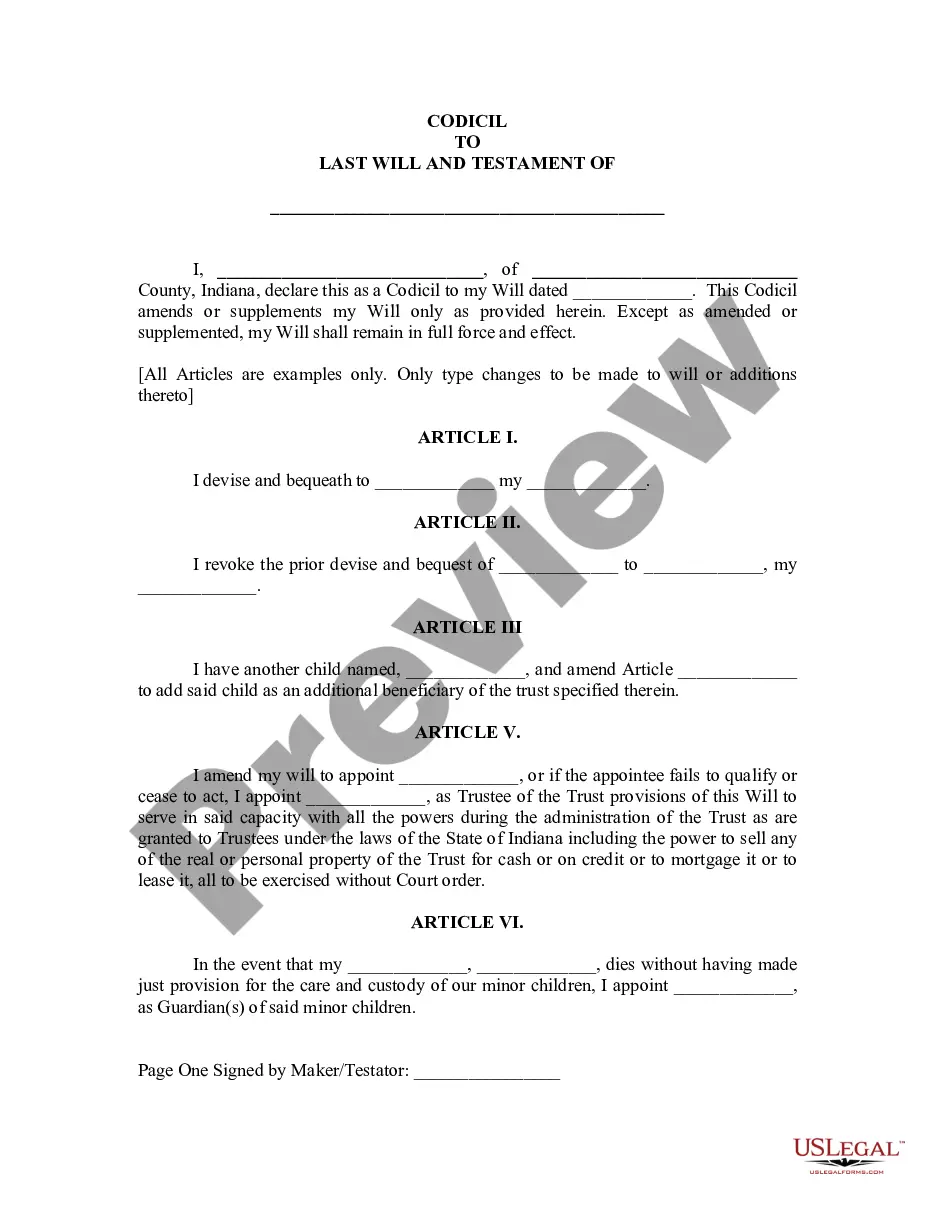

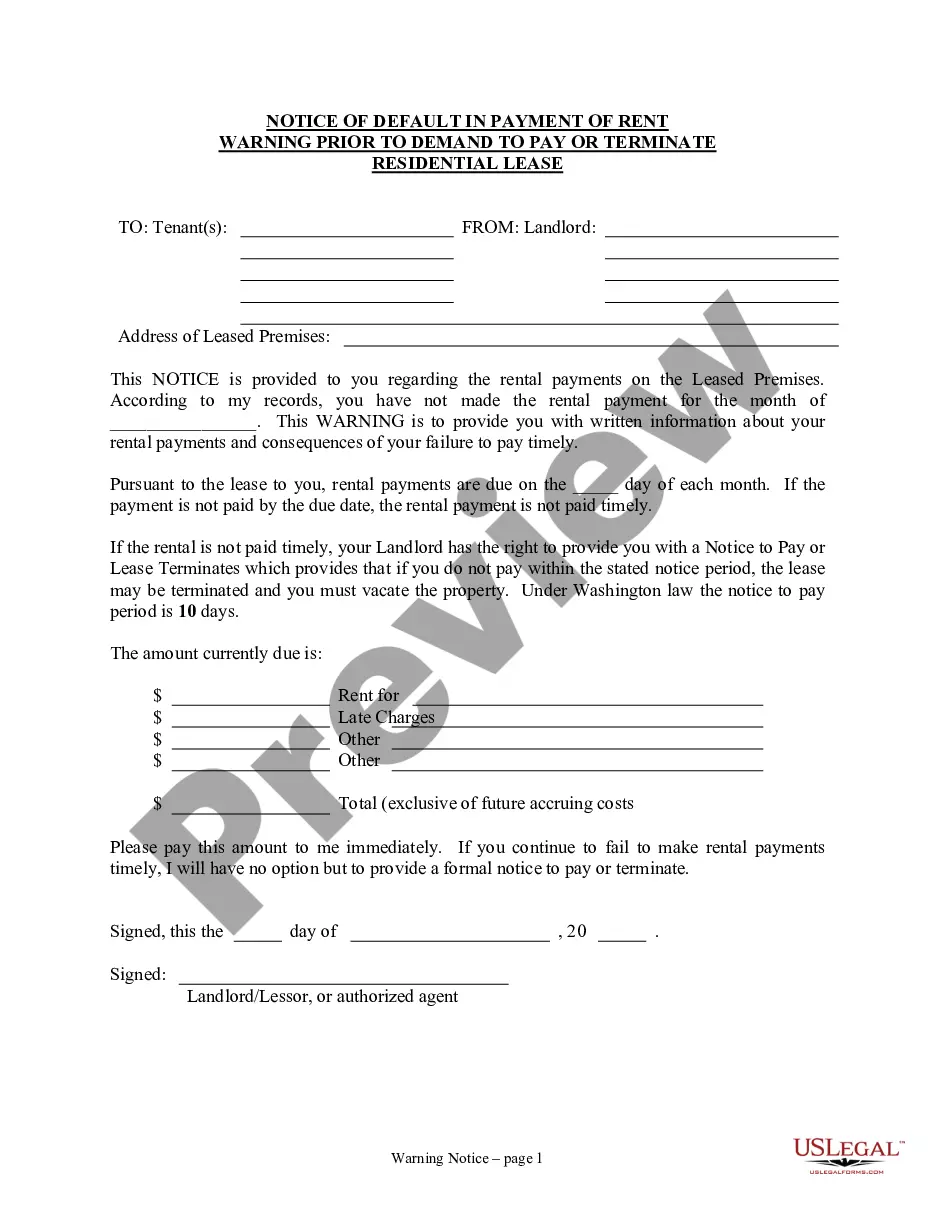

- Click the Preview button to examine the form's content.

- Review the form details to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy Now button.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

An investigative consumer reporting agency may require the consumer to furnish a written statement granting permission to the consumer reporting agency to discuss the consumer's file in such person's presence.

California Civil Code Section 1786.2 defines an investigative consumer report as a consumer report in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through any means.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

Unlike federal law, California law also requires new consent each time an investigative report is sought during employment if the report is for purposes other than suspicion of wrongdoing or misconduct. Employers must provide the applicant or employee with the opportunity to request a copy of the report.

An investigative consumer report is more like a detailed background check. Facts that create a picture of who you are as a person are included in this kind of report, and the gathering of that information might even include interviews with your neighbors, friends and associates.

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.

When you formally reject the applicant, you would be required to provide an adverse action notice. The applicants for a sensitive financial position have authorized you to obtain credit reports.