This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Maine Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

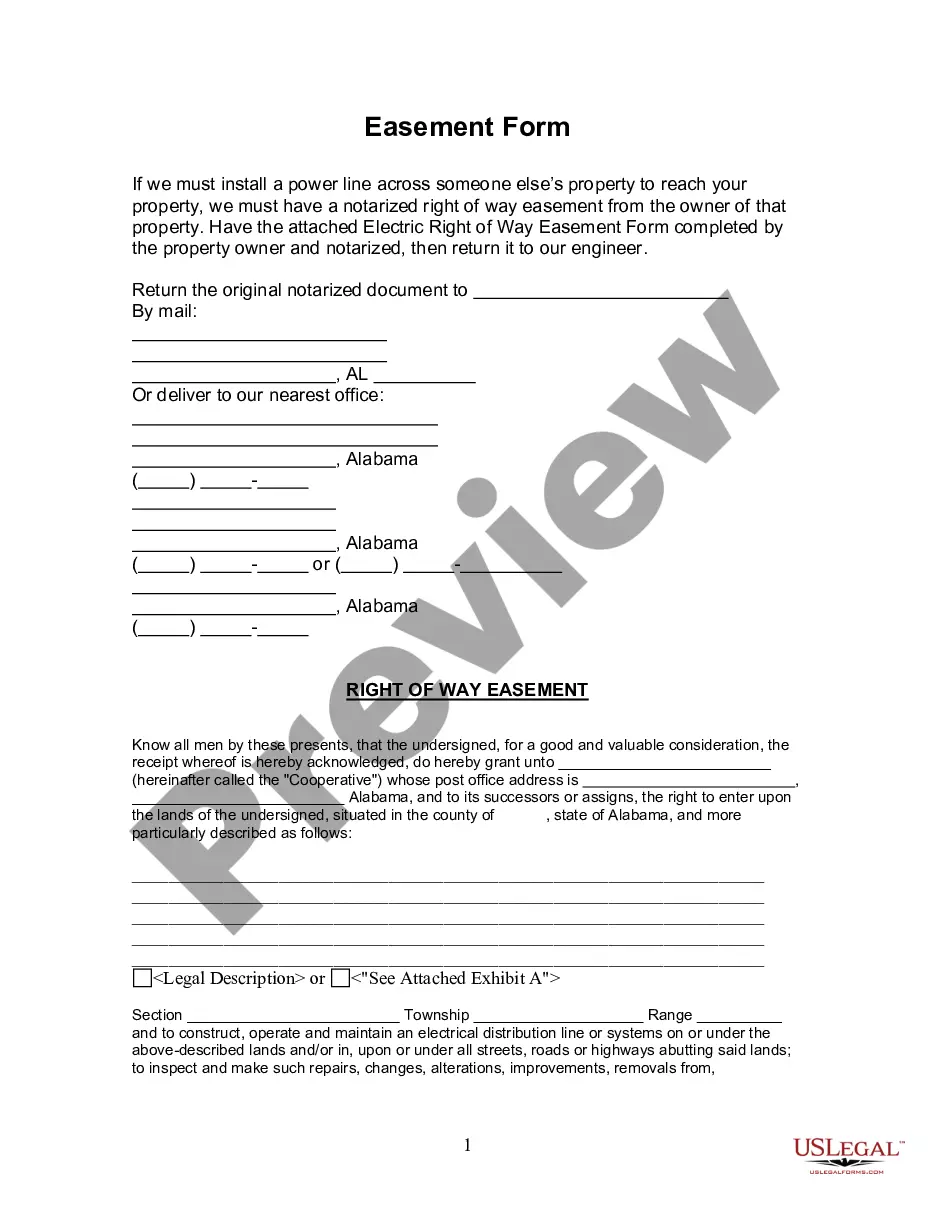

Finding the appropriate legitimate document template can be a challenge. Naturally, there are numerous templates accessible online, but how can you locate the authentic one you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure. Use your account to browse the legal forms you have purchased previously. Proceed to the My documents tab of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and view the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template for your device. Complete, modify, print, and sign the acquired Maine Application for Release of Right to Redeem Property from IRS After Foreclosure. US Legal Forms is the largest repository of legal forms where you can view various document templates. Use the service to obtain properly crafted documents that adhere to state regulations.

Form popularity

FAQ

The IRS right to redeem foreclosure allows the IRS to reclaim property that has been foreclosed on due to unpaid taxes. This right can complicate the foreclosure process but also presents an opportunity for property owners to resolve tax issues. By utilizing the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure, you can better navigate these complexities and work toward a solution.

The IRS right of redemption in a foreclosure refers to the period during which a property owner can reclaim their property by paying the owed amount, including any taxes and fees. This right is crucial as it provides a last chance to retain ownership before the property is sold. If you find yourself in this situation, the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure can guide you through the necessary steps.

The right to redeem property after a foreclosure allows you to reclaim your home by paying off the outstanding debt within a specific timeframe. This right varies by state, but it generally gives homeowners a chance to recover their property before it is permanently lost. Utilizing the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure can be a valuable step in this process.

Form 14135 should be filed with the IRS at the address specified in the instructions for the form. This form is essential for requesting a release of the federal tax lien. By completing the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure, you can ensure you're following the correct procedure and submitting the necessary paperwork.

After a foreclosure, the federal tax lien does not automatically disappear. The lien remains on the property until it is satisfied or released by the IRS. To address this, consider the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure, which can facilitate the release of the tax lien and allow you to regain control of your property.

To obtain a lien payoff from the IRS, you must first contact them directly. You can request the payoff amount by calling the IRS or writing a formal request. Additionally, using the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure can help streamline the process, ensuring you have the necessary documentation to clear the lien.

The Form 14135 is a request for a certificate of discharge of property from a federal tax lien. This application is crucial for individuals seeking to remove the IRS's claim on their property after foreclosure. By submitting the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure, you can initiate the process more smoothly. Using platforms like US Legal Forms can simplify your application and ensure you meet all necessary requirements.

The IRS form used for lien withdrawal is Form 12277. This form is essential for individuals seeking to remove a federal tax lien from their property. By filing this form, you can initiate the process related to the Maine Application for Release of Right to Redeem Property from IRS After Foreclosure. It is important to ensure you complete this form accurately to avoid delays in the withdrawal process.