Maine Model Accredited Investor Exemption Uniform Notice of Transaction is a form created for use by issuers in connection with securities offerings in the state of Maine. The form is used to provide information regarding the issuer and offering to prospective accredited investors. The form includes information such as the issuer's name, address, and contact information; the offering's terms and conditions; the issuer's financials; and any other relevant facts. There are two types of Maine Model Accredited Investor Exemption Uniform Notice of Transaction: one for offerings of debt securities, and one for offerings of equity securities. Both forms must be signed by the issuer and the accredited investor before any securities can be issued.

Maine Model Accredited Investor Exemption Uniform Notice of Transaction

Description

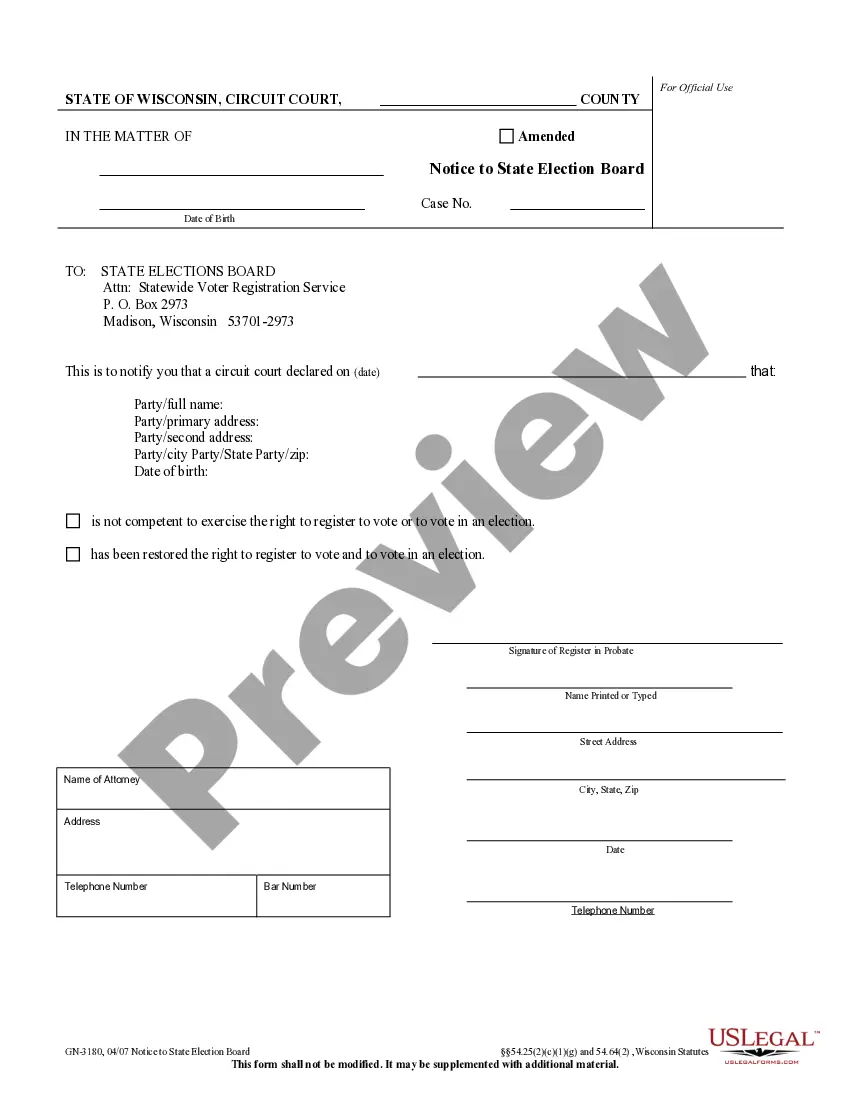

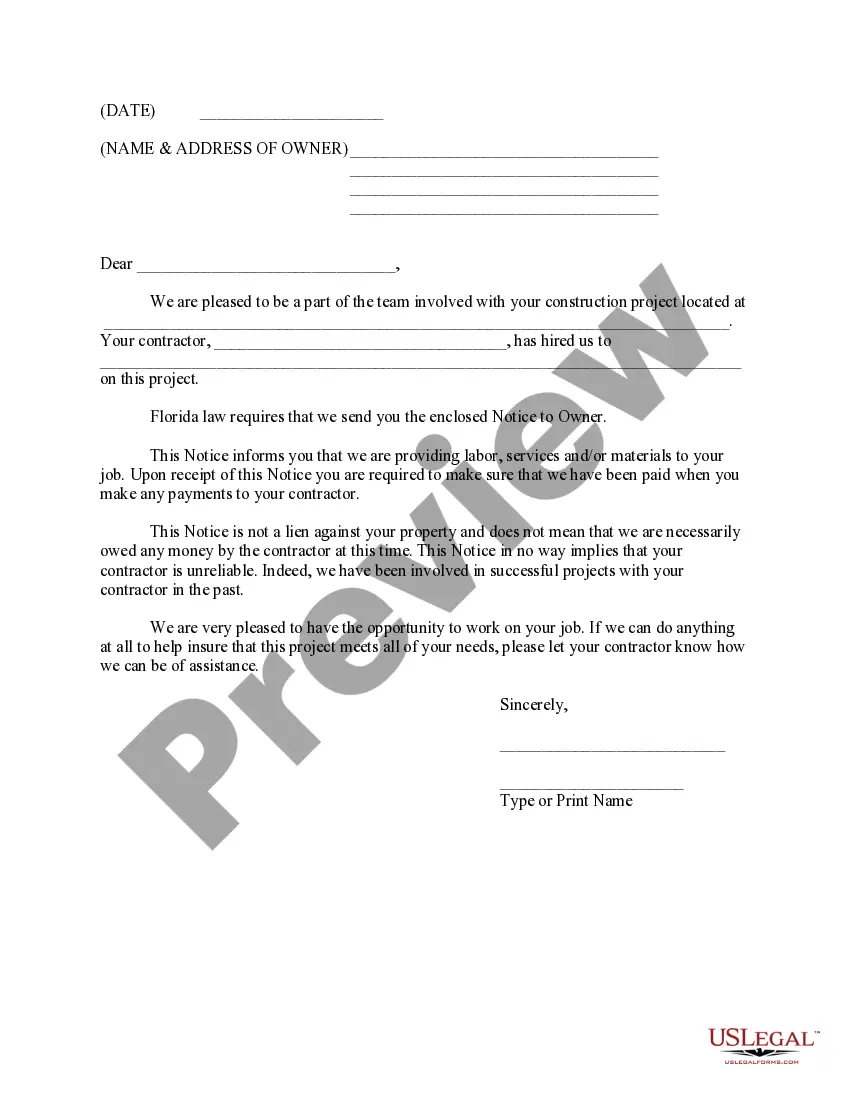

How to fill out Maine Model Accredited Investor Exemption Uniform Notice Of Transaction?

Dealing with official documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Maine Model Accredited Investor Exemption Uniform Notice of Transaction template from our library, you can be sure it complies with federal and state laws.

Dealing with our service is easy and quick. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Maine Model Accredited Investor Exemption Uniform Notice of Transaction within minutes:

- Remember to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Maine Model Accredited Investor Exemption Uniform Notice of Transaction in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Maine Model Accredited Investor Exemption Uniform Notice of Transaction you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

This means that any information a company provides to investors must be free from false or misleading statements. Similarly, a company should not exclude any information if the omission makes what is provided to investors false or misleading.

It prohibits fraudulent or deceitful sales of securities and requires organizations that are issuing securities?such as bonds and stocks?to disclose helpful information about the investment when they register the security.

Rule 506c allows you to market and advertise your offering and allows you to solicit investors. However, under Rule 506c, all investors in the fund must be Accredited Investors.

What has come to be known as a Section 4(1½) or Section 4(a)(1½) transaction is a private resale of restricted securities that technically relies on the Section 4(a)(1) registration exemption. The Section 4(1½) private resale exemption is not formally established by any written SEC rule or regulation.

Requirements of Rule 506 Securities may not be sold to more than 35 non-accredited investors.

Companies conducting an offering under Rule 506(b) can raise an unlimited amount of money and can sell securities to an unlimited number of accredited investors. An offering under Rule 506(b), however, is subject to the following requirements: no general solicitation or advertising to market the securities.

In the U.S, the definition of an accredited investor is put forth by SEC in Rule 501 of Regulation D. 2. To be an accredited investor, a person must have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years with the expectation of earning the same or a higher income in the current year

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.