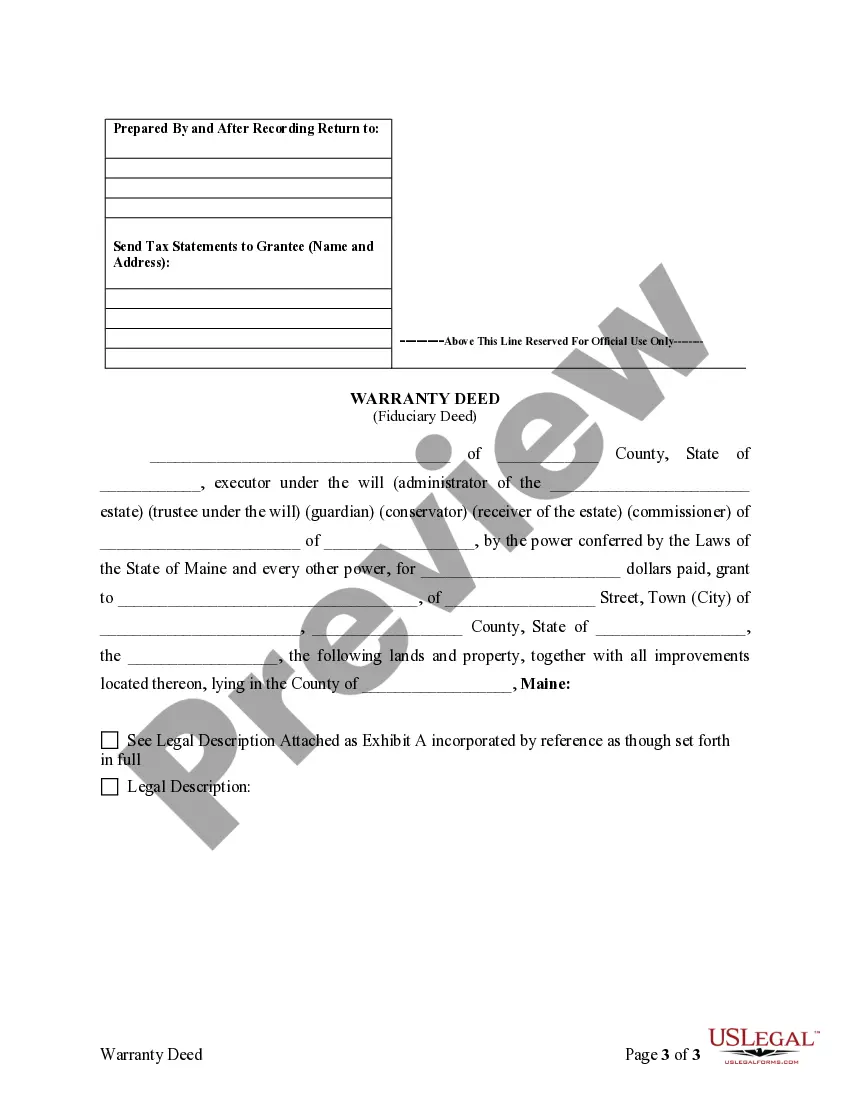

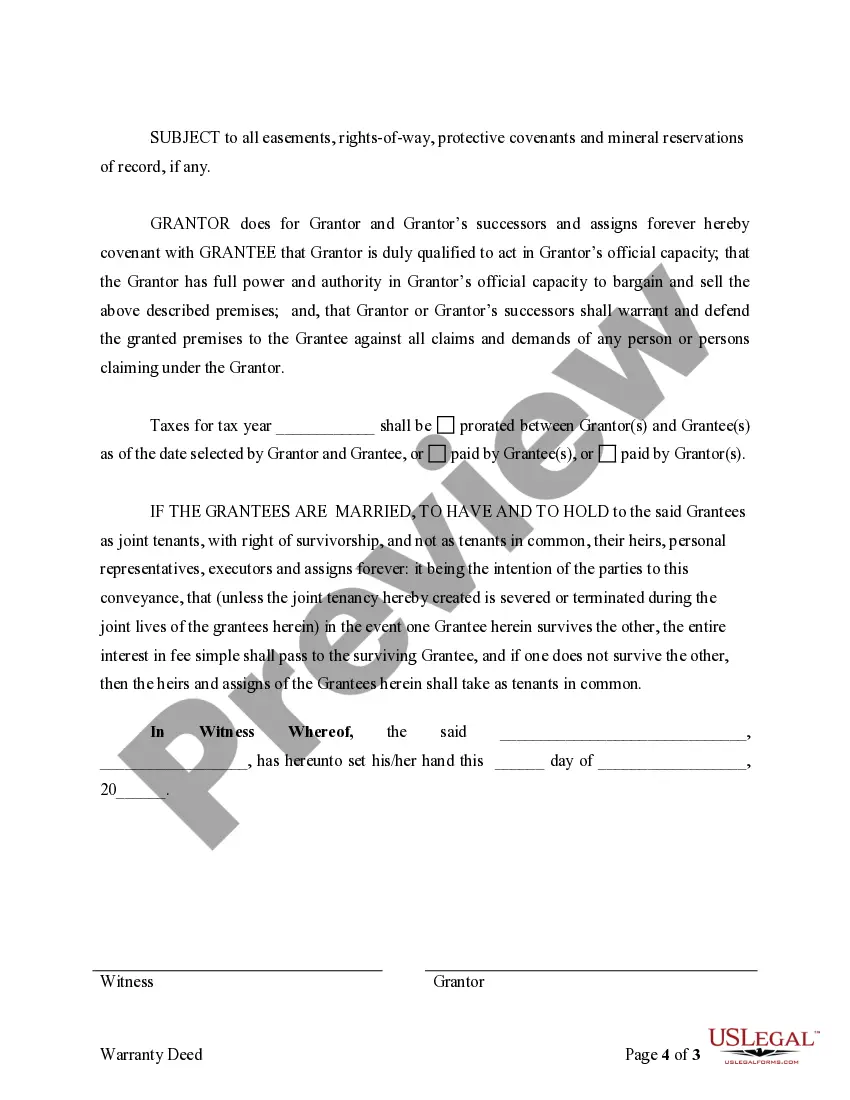

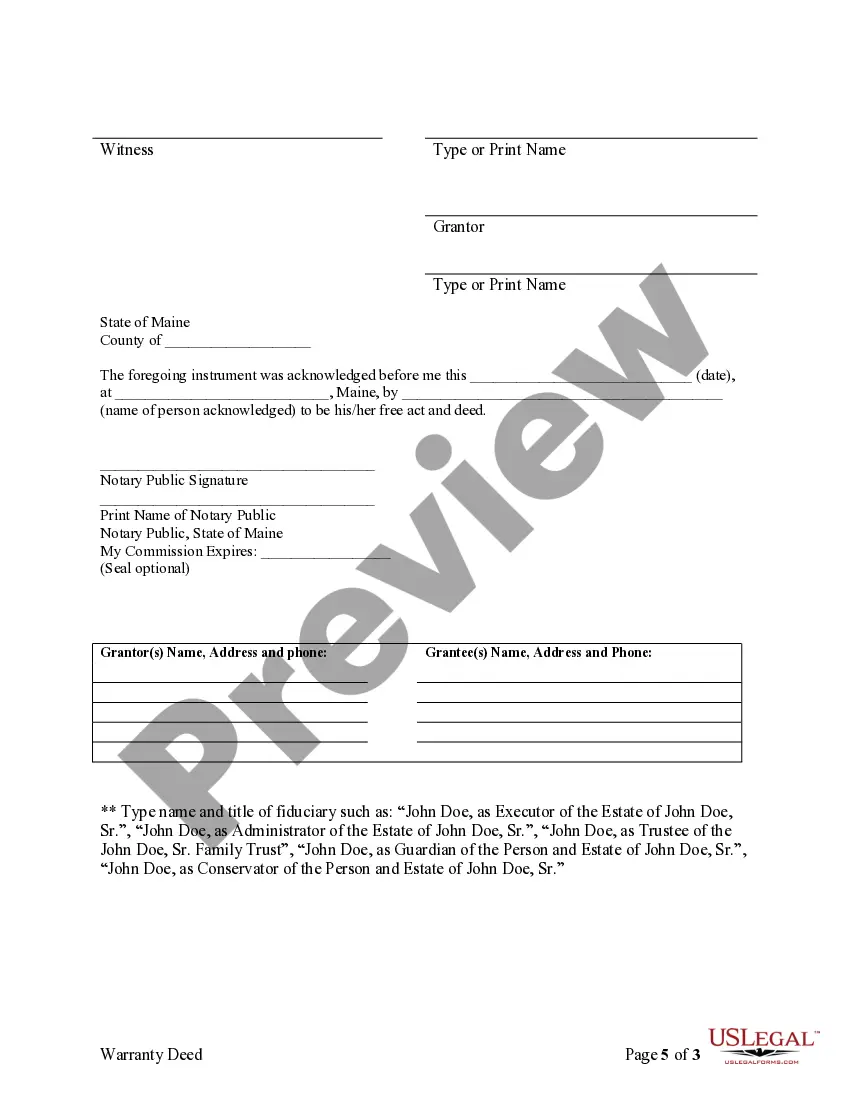

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Maine Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among numerous complimentary and paid templates that you can discover online, you cannot guarantee their dependability.

For instance, who created them or if they possess the necessary qualifications to manage your requirements.

Always remain composed and utilize US Legal Forms!

Review the template by examining the details using the Preview option. Click Buy Now to commence the purchasing process or search for another template using the Search field in the header. Select a subscription plan and establish an account. Process the payment for the subscription using your credit/debit card or PayPal. Download the document in your desired format. Once you have registered and purchased your subscription, you can utilize your Maine Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries as frequently as you wish or for as long as it remains valid in your area. Modify it with your preferred online or offline editor, complete it, sign it, and create a physical copy. Achieve more for less with US Legal Forms!

- Find Maine Fiduciary Deed to be used by Executors, Trustees, Trustors, Administrators, and other Fiduciaries templates crafted by experienced attorneys.

- Avoid the expensive and time-intensive process of seeking an attorney and then compensating them to draft documents for you that you could locate independently.

- If you currently have a subscription, Log In to your account and look for the Download button adjacent to the form you’re looking for.

- You will also be able to access all your previously downloaded documents in the My documents section.

- If you are using our service for the first time, adhere to the guidelines below to obtain your Maine Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries seamlessly.

- Ensure that the file you discover is legitimate in your area.

Form popularity

FAQ

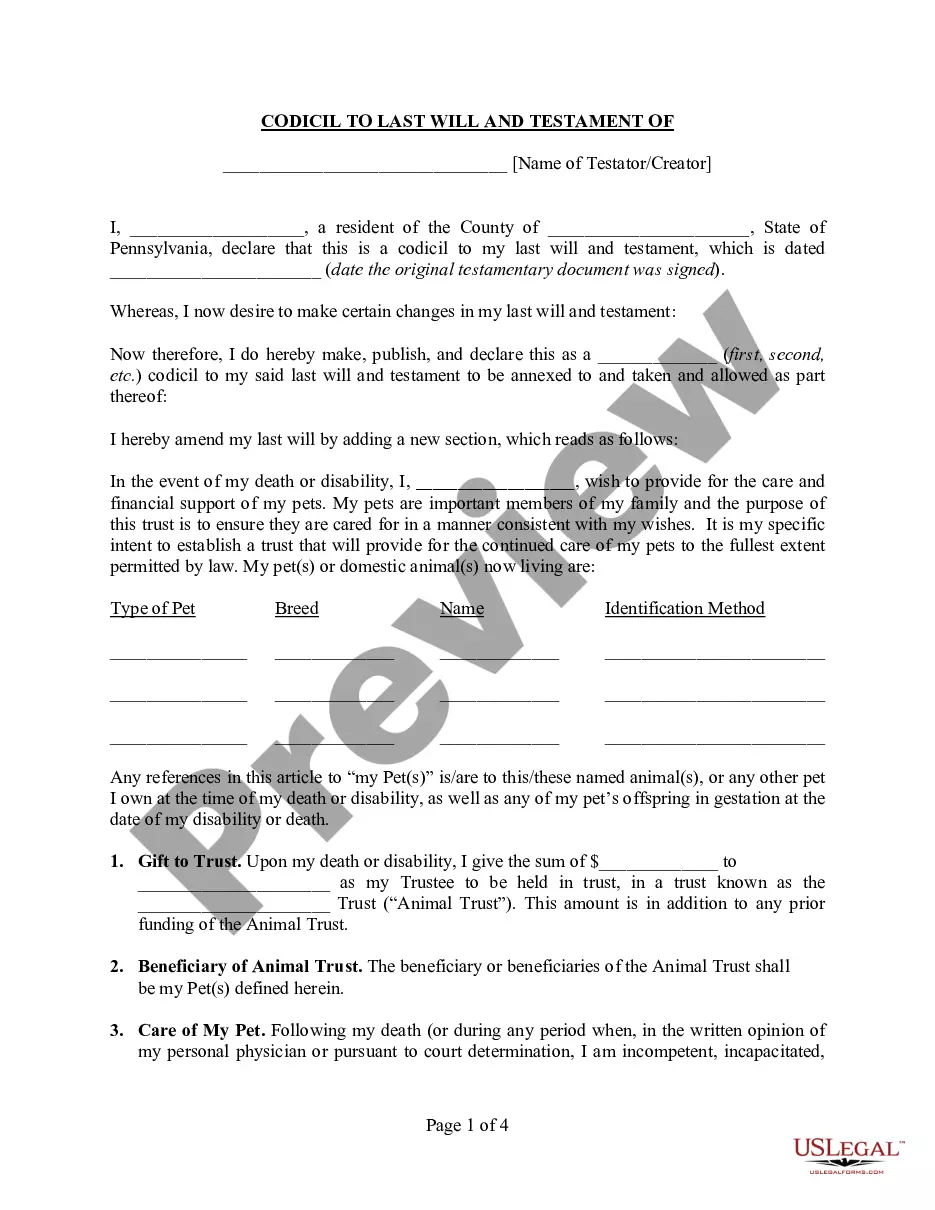

Beneficiaries of a trust or estate receive Schedule K-1 (Form 1041). This document details the income distributed to each beneficiary and helps them report their share on their personal tax returns. Understanding your role with a Maine Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can clarify tax responsibilities. Consulting with a tax professional can enhance your understanding of these requirements.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

The defendant was acting as a fiduciary of the plaintiff; The defendant breached a fiduciary duty to the plaintiff; The plaintiff suffered damages as a result of the breach; and. The defendant's breach of fiduciary duty caused the plaintiff's damages.

The executor of a will has a fiduciary duty to act in the best interest of the estate. This means that the law prevents you from acting in your own interest to the detriment of the estate. As an extension of this duty, executors also have several responsibilities to the beneficiaries of the will.

Fiduciary - An individual or bank or trust company that acts for the benefit of another. Trustees, executors, and personal representatives are all fiduciaries.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A breach of fiduciary duty occurs when a principal fails to act responsibly in the best interests of a client. The consequences of a breach of fiduciary duty are multiple. They can range from reputation damage to loss of a license and monetary penalties.