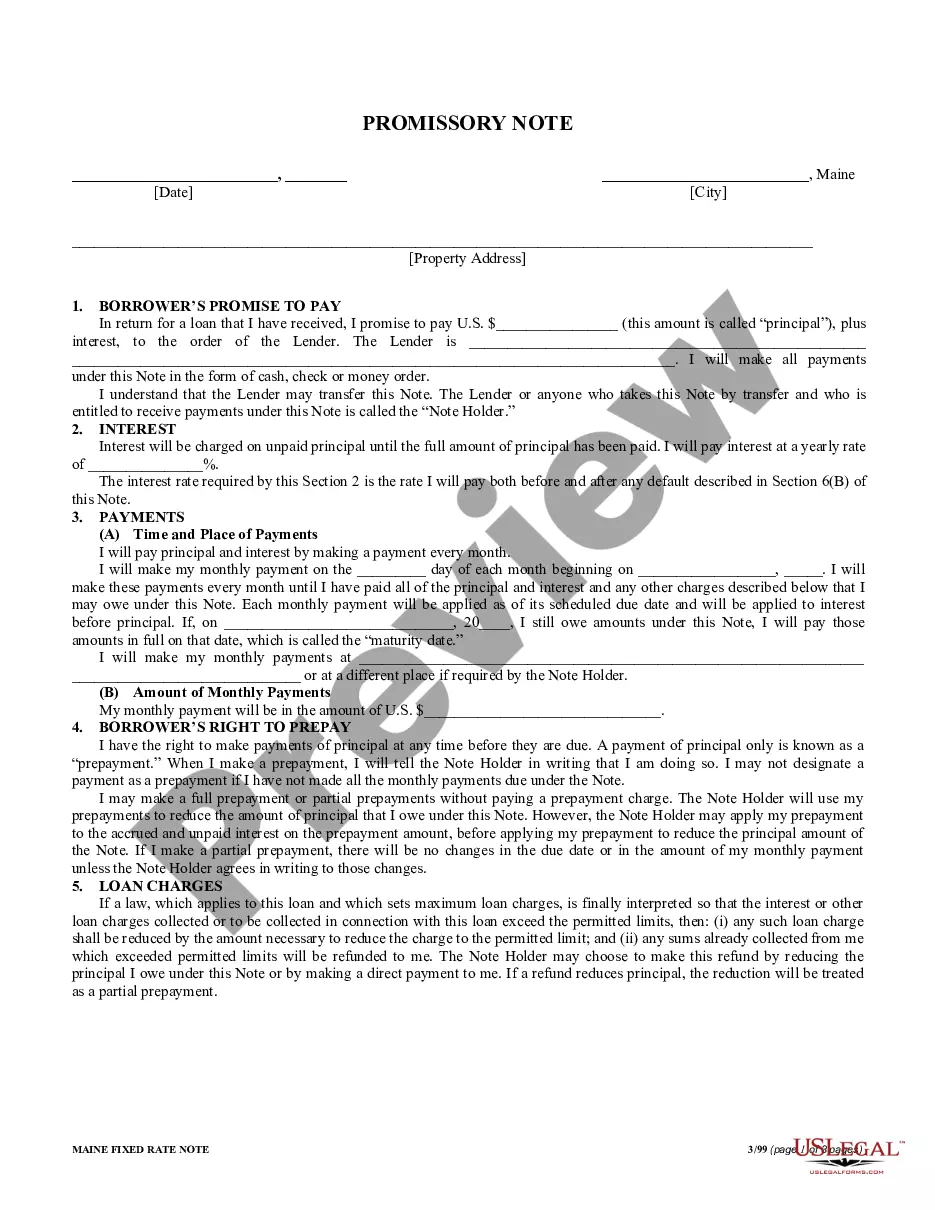

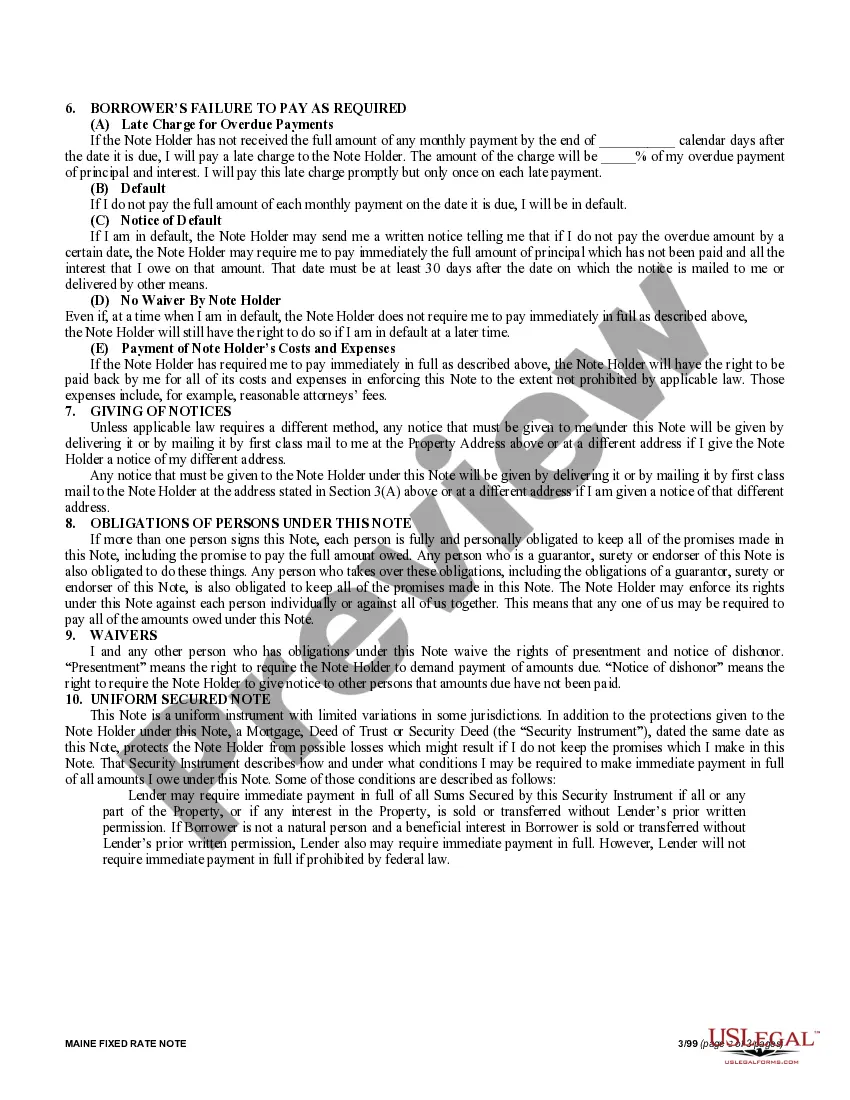

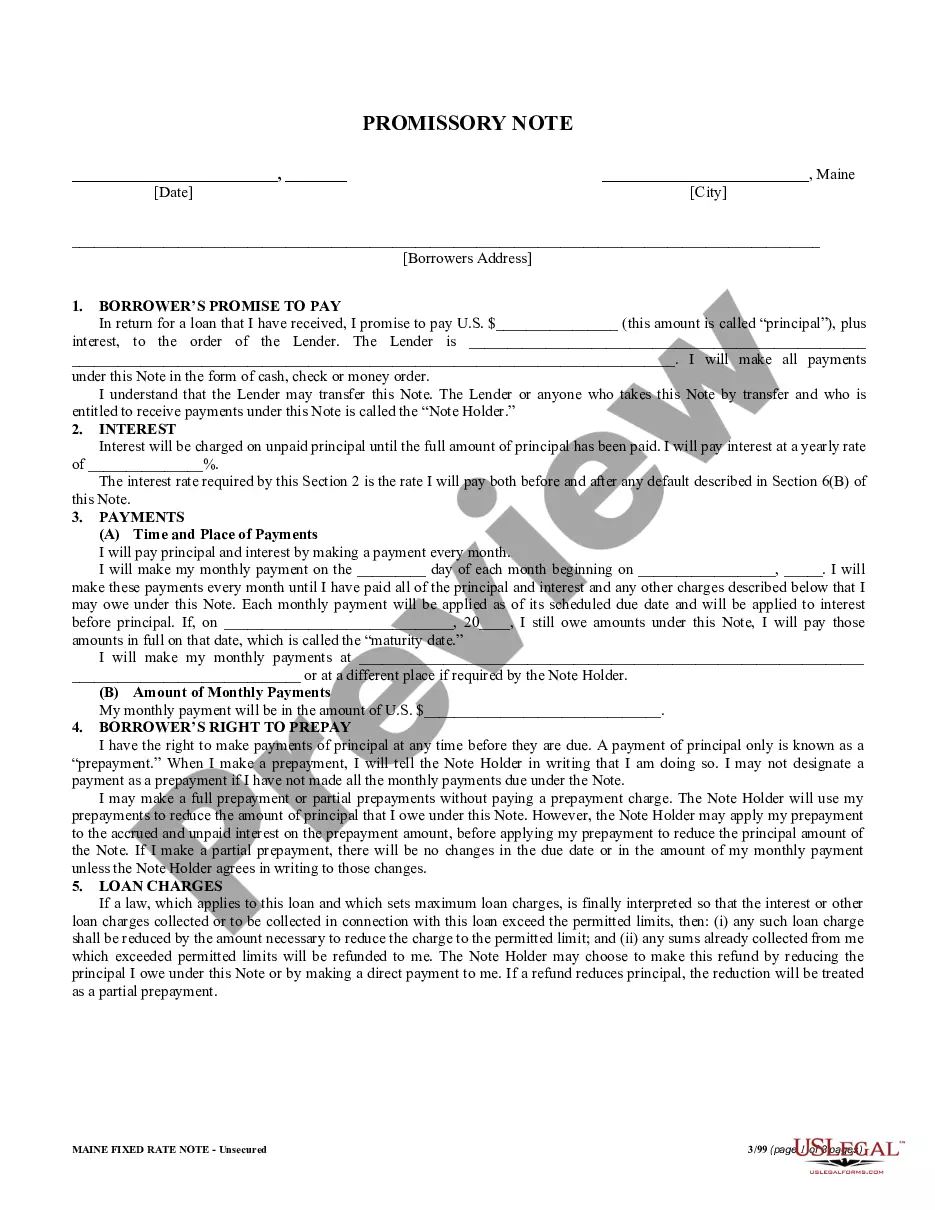

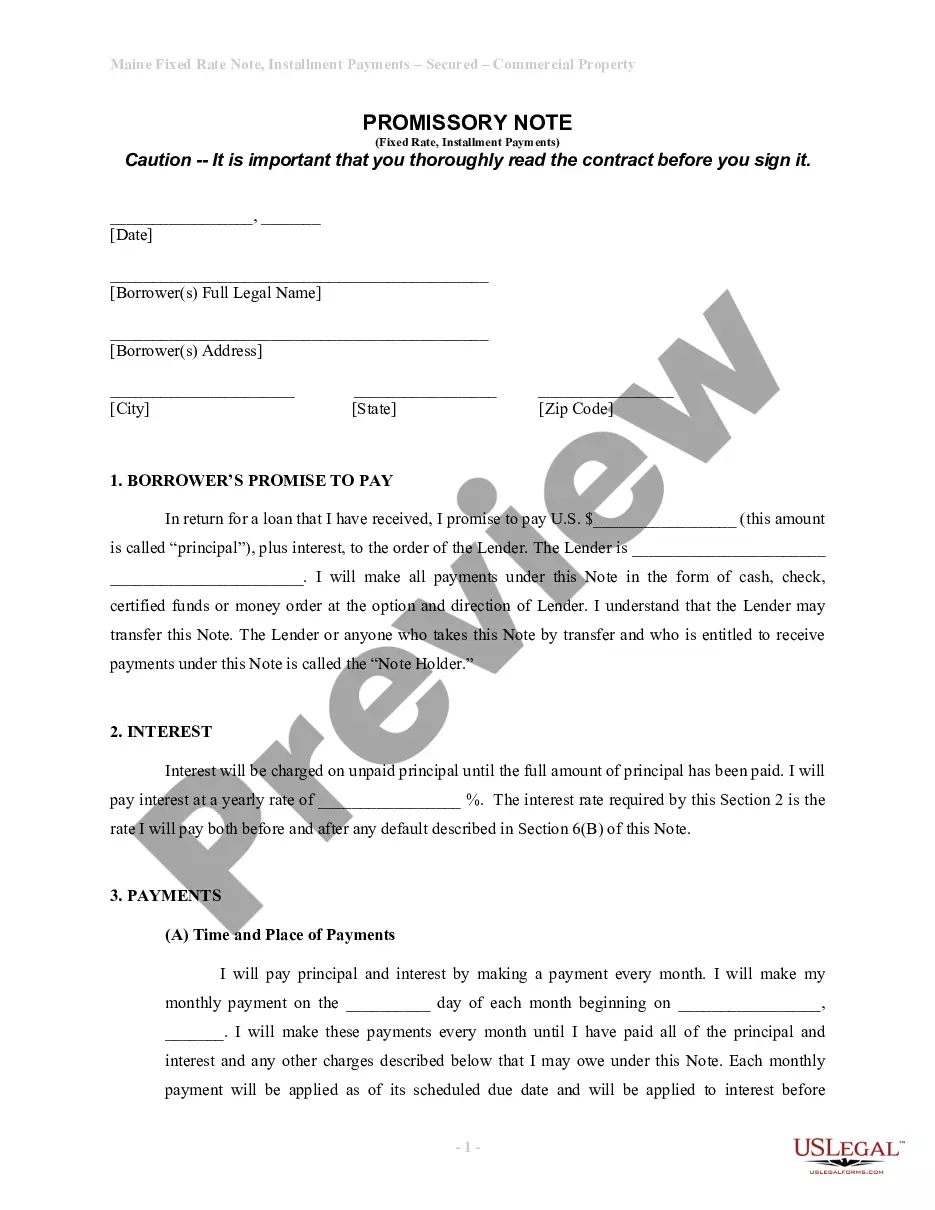

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

Maine Secured Promissory Note

Description

How to fill out Maine Secured Promissory Note?

Access any template from 85,000 legal documents like the Maine Secured Promissory Note available online with US Legal Forms. Each template is crafted and updated by attorneys licensed in the state.

If you possess a subscription, Log In. Once you reach the form’s page, click on the Download button and navigate to My documents to gain access to it.

If you have yet to subscribe, follow the steps outlined below.

With US Legal Forms, you will consistently have instant access to the relevant downloadable template. The service provides access to documents and categorizes them to enhance your searching experience. Use US Legal Forms to obtain your Maine Secured Promissory Note quickly and effortlessly.

- Verify the state-specific criteria for the Maine Secured Promissory Note you wish to utilize.

- Examine the description and view the sample.

- Once you are certain the template meets your needs, simply click Buy Now.

- Select a subscription plan that fits your financial situation.

- Create a personal account.

- Make the payment through one of two convenient methods: using a credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- When your reusable template is ready, print it or save it to your device.

Form popularity

FAQ

If you lose a promissory note, you should inform the involved parties as soon as possible. Depending on state laws, you may be able to obtain a replacement or file a court claim to declare the note void. In the context of a Maine Secured Promissory Note, take immediate steps to secure your rights and ensure legal compliance. Consultation with a legal specialist can offer valuable guidance.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.