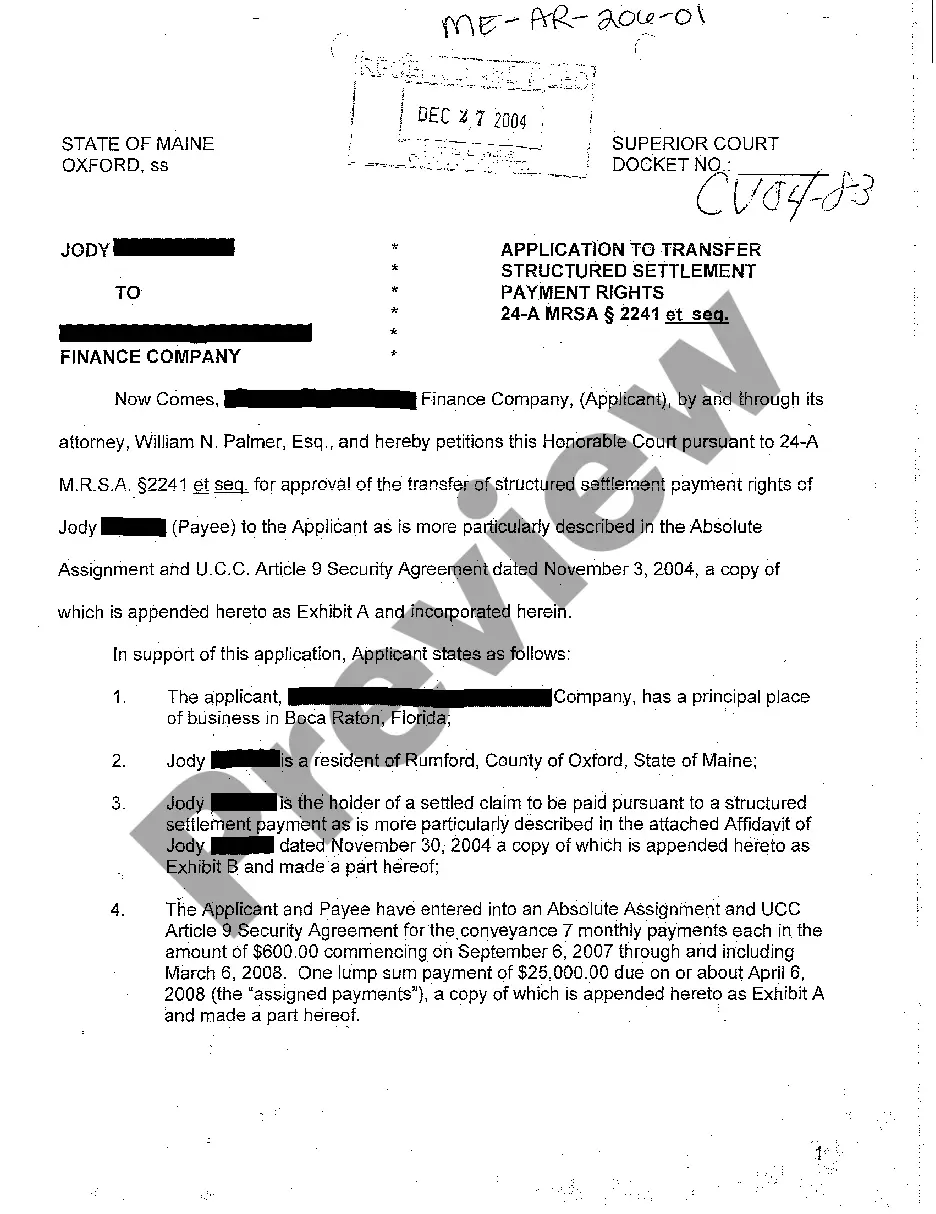

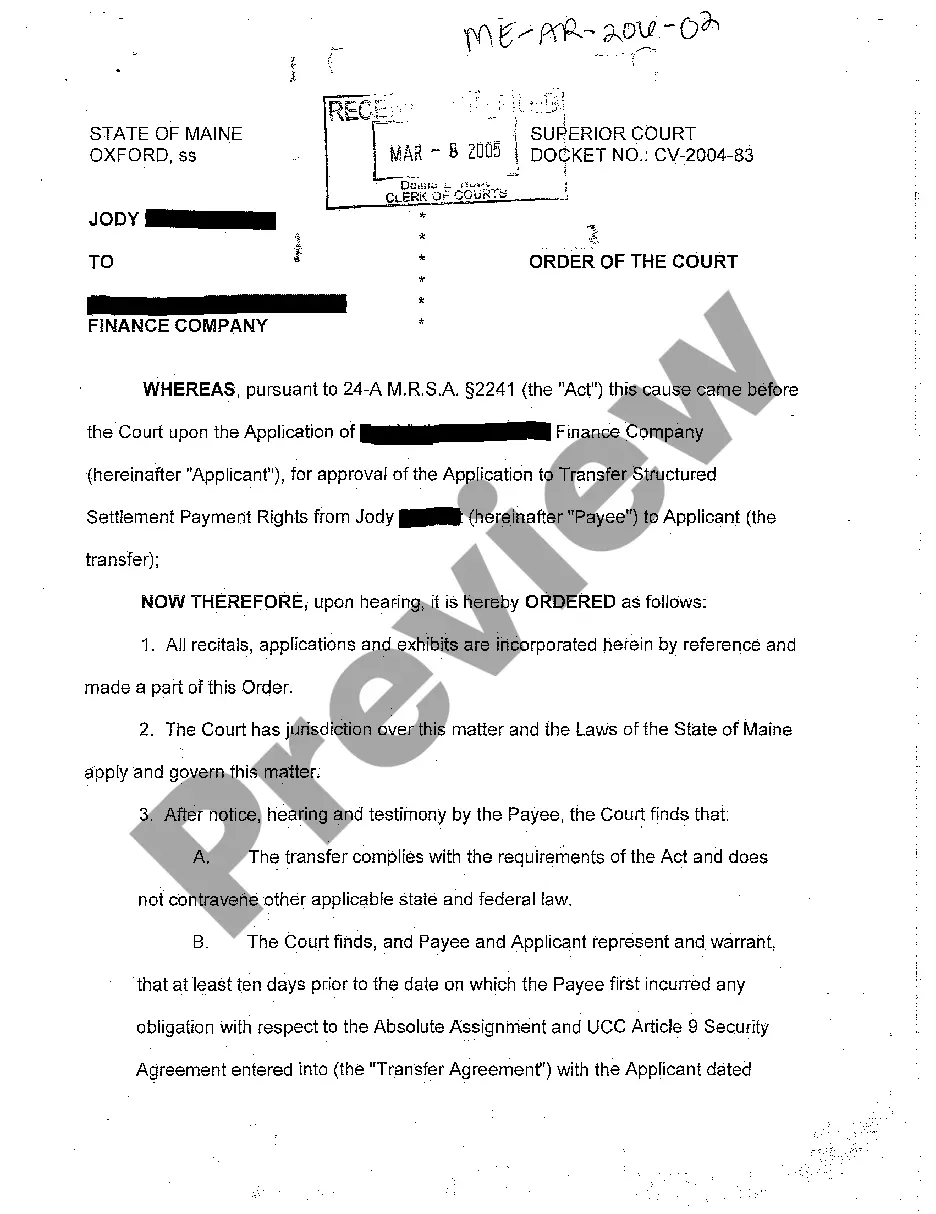

Maine Application to Transfer Structured Settlement Payment Rights

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Application To Transfer Structured Settlement Payment Rights?

Greetings to the finest repository of legal documents, US Legal Forms. Here, you can discover any template, including Maine Application to Transfer Structured Settlement Payment Rights forms, and download them as many as you need.

Create official documents in a few hours instead of days or weeks, without having to spend a fortune on a lawyer or attorney. Obtain your state-specific template in just a few clicks and feel assured knowing that it was prepared by our experienced attorneys.

If you’re already a registered customer, simply sign in to your account and then click Download next to the Maine Application to Transfer Structured Settlement Payment Rights you need. Since US Legal Forms is online-based, you’ll consistently have access to your downloaded documents, regardless of the device you're using. Locate them in the My documents section.

Print the document and complete it with your or your business’s details. Once you’ve filled out the Maine Application to Transfer Structured Settlement Payment Rights, submit it to your attorney for confirmation. It’s an additional step, but a crucial one to ensure you're completely protected. Join US Legal Forms today and access thousands of reusable templates.

- If you don't have an account yet, what are you waiting for.

- Verify the document’s validity in your residing state if it’s state-specific.

- Examine the description (if provided) to ensure it's the correct template.

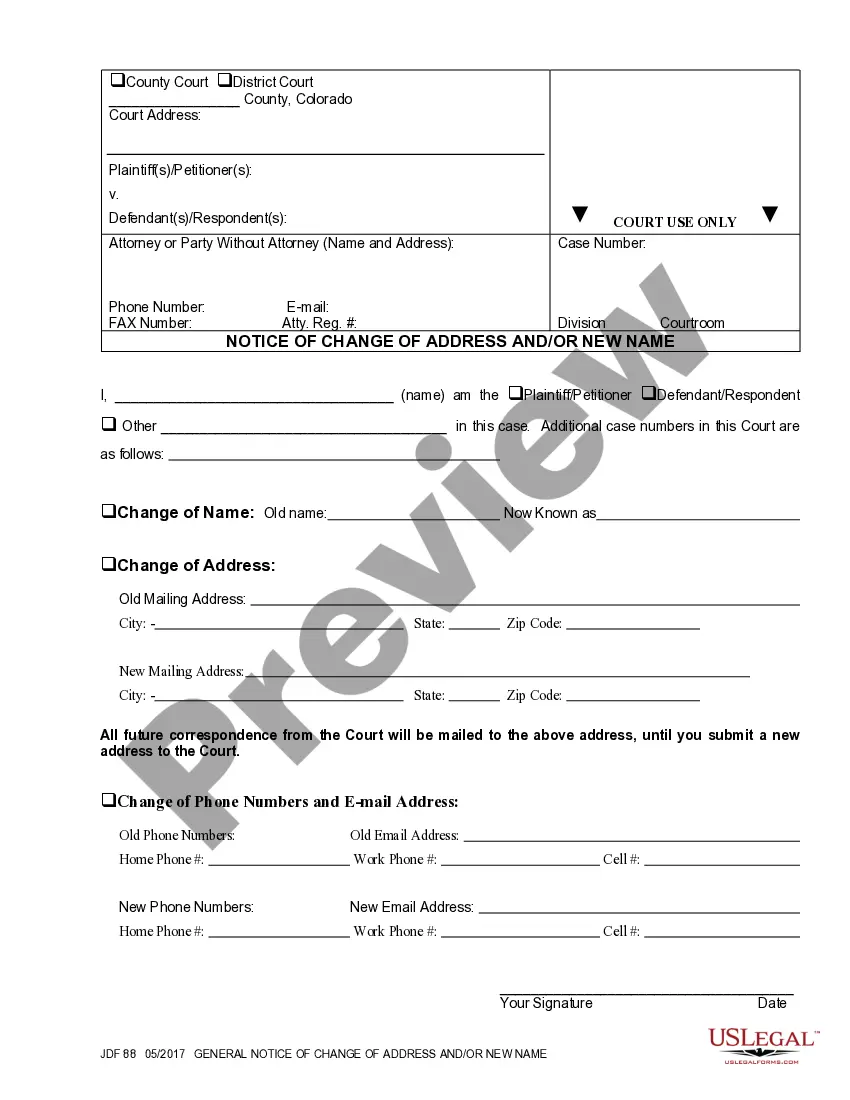

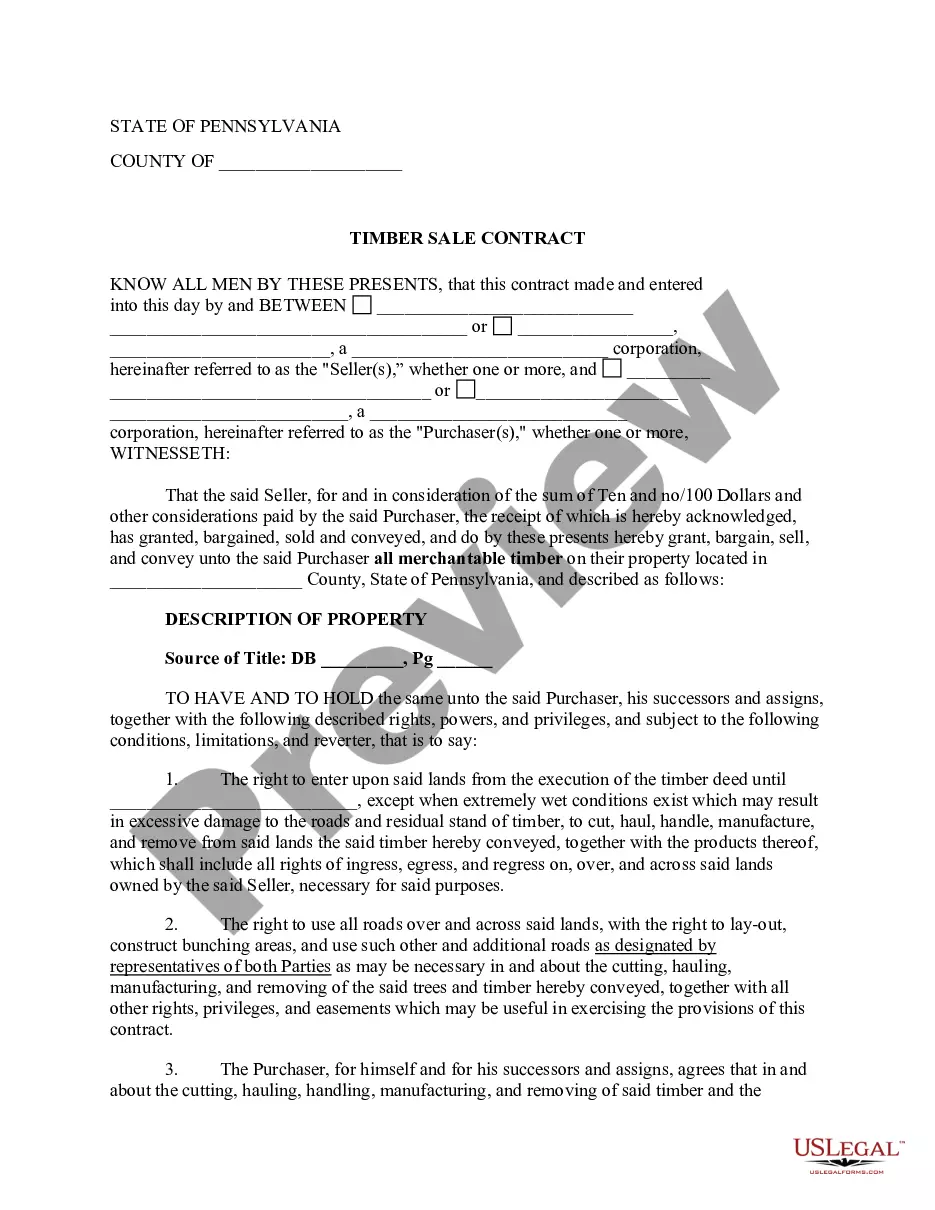

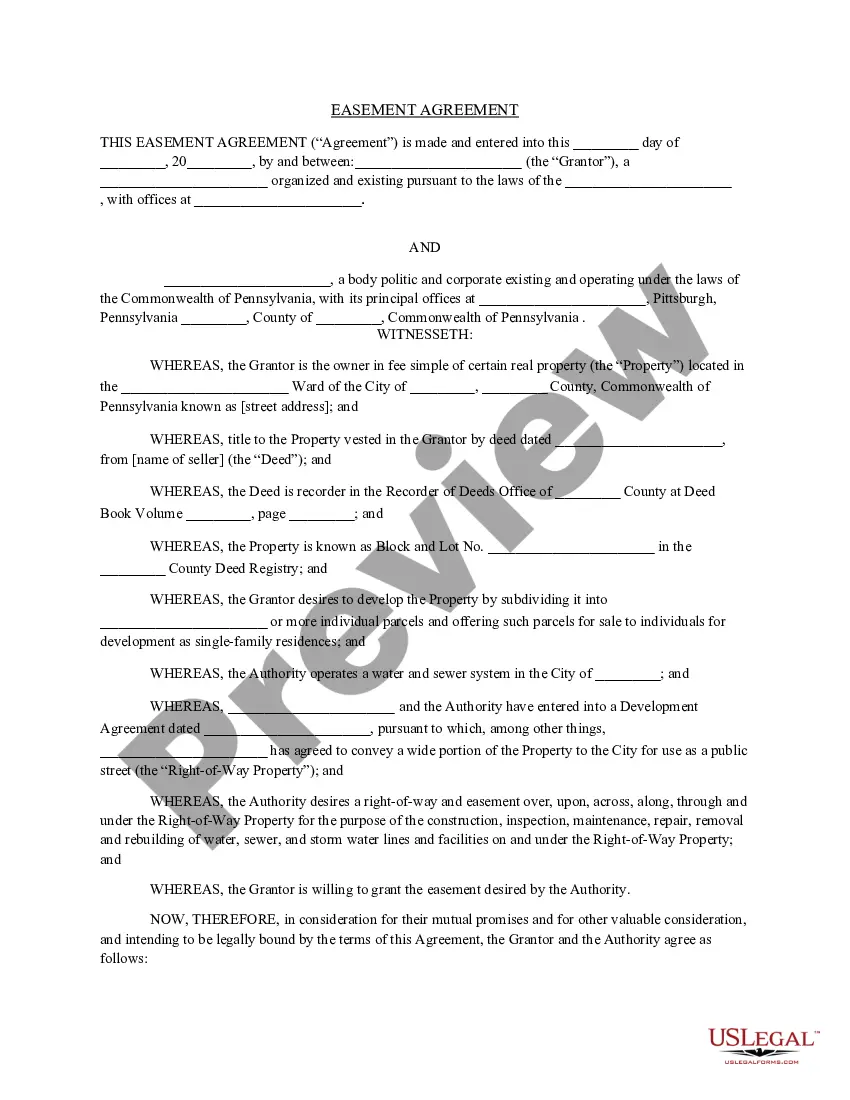

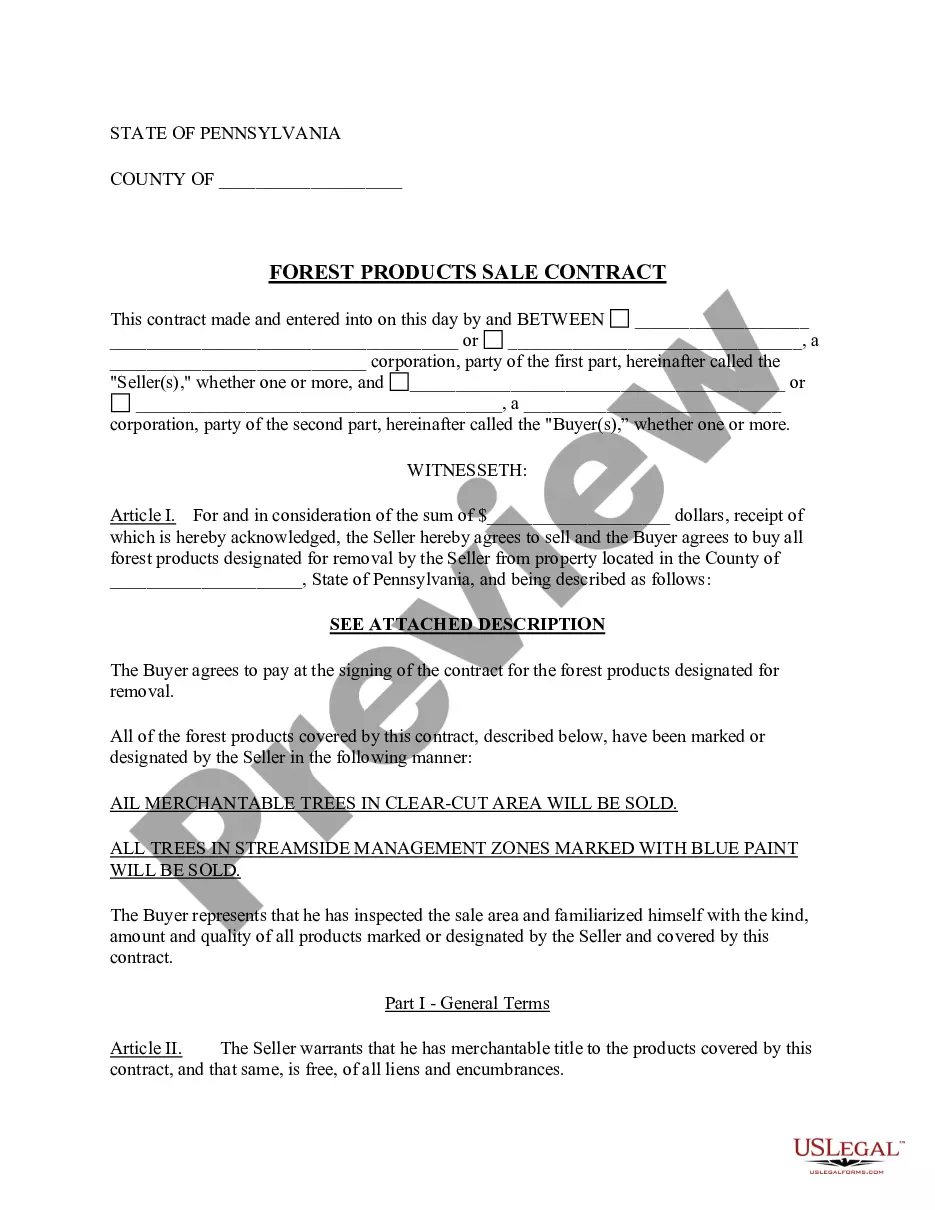

- View additional content using the Preview feature.

- If the template satisfies all your needs, click Purchase Now.

- Choose a pricing plan to create your account.

- Utilize a credit card or PayPal account to register.

- Download the file in your preferred format (Word or PDF).

Form popularity

FAQ

On average, it takes 30 45 days to sell structured settlement payments. Selling your structured settlement payments requires court approval which is usually the main cause for any unexpected delays in the transfer.

How Is a Settlement Paid Out? Compensation for a personal injury can be paid out as a single lump sum or as a series of periodic payments in the form of a structured settlement. Structured settlement annuities can be tailored to meet individual needs, but once agreed upon, the terms cannot be changed.

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

The bulk of the cost of selling your settlement will be the discount rate, which will vary greatly by company. Quotes can range from 7% to as high as 29%. Expect many companies to offer a high discount rate in their initial quotes. Do not accept the initial quote from any company.

Unlike stocks, bonds and mutual funds, structured settlements do not fluctuate with market changes. Payments are guaranteed by the insurance company that issued the annuity. A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

You can sell your structured settlement to a factoring company for immediate cash. Although you must first obtain court approval, you have the legal right to sell your payments, either in part or in full, to a structured settlement buyer.

The qualified assignment fee (ranging from $0 to $750) is commissionable with some companies. In other cases it is not. Insurance laws in effect in most states expressly prohibit reduction of commissions or rebating. There are different market based structured settlement options for both plaintiffs and attorney.

The industry is now providing $5 billion annually in Structured Settlement annuities. A Structured Settlement is an annuity that pays the injured plaintiff a series of periodic payments over time, rather than in a single lump sum. The annuity is purchased by the defendant from a highly rated life insurance company.