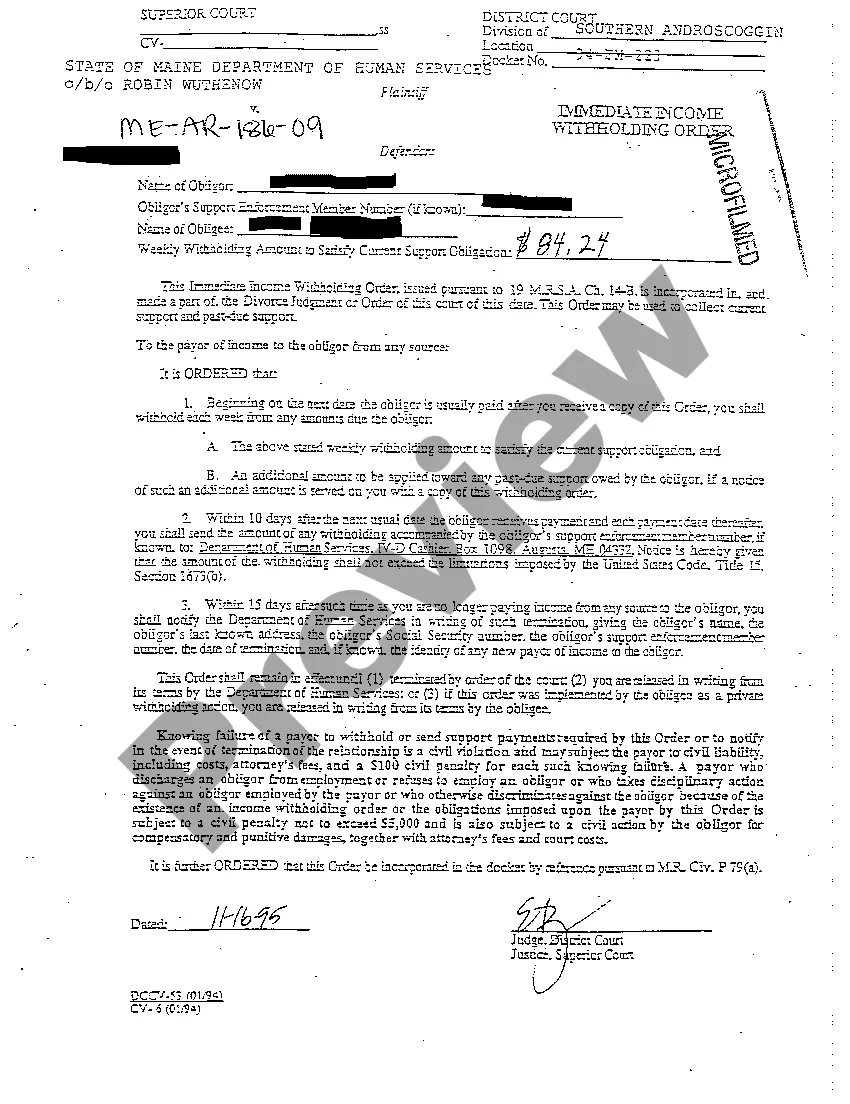

Maine Immediate Income Withholding Order

Description

How to fill out Maine Immediate Income Withholding Order?

Among countless paid and free instances that you can find online, you can't be sure about their trustworthiness.

For instance, who developed them or if they’re qualified enough to handle what you need them for.

Always stay composed and take advantage of US Legal Forms!

If you are using our site for the first time, follow the instructions below to acquire your Maine Immediate Income Withholding Order quickly: Make sure that the document you find is valid in your area. Review the file by examining the information using the Preview feature. Click Buy Now to start the purchasing process or look for another example using the Search bar located at the top. Choose a pricing plan and create an account. Pay for the subscription using your credit/debit card or Paypal. Download the form in the desired format. Once you have signed up and purchased your subscription, you can utilize your Maine Immediate Income Withholding Order as often as needed or for as long as it remains valid in your state. Edit it using your preferred online or offline editor, complete it, sign it, and print a hard copy of it. Do more for less with US Legal Forms!

- Find Maine Immediate Income Withholding Order templates created by experienced legal professionals.

- and avoid the costly and time-consuming process of searching for a lawyer.

- and then compensating them to draft a document for you that you can find on your own.

- If you have a membership, Log In to your account.

- and locate the Download button near the file you’re looking for.

- You'll also have access to your prior saved templates in the My documents section.

Form popularity

FAQ

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

The following states have laws or case law that give courts the authority to order a non-custodial parent to pay for some form of college expenses: Alabama, Arizona, Colorado, Connecticut, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Maryland, Massachusetts, Mississippi, Missouri, Montana,

Questions? Call the Case Initiation Unit at 207 624-4100 or submit a question through our online form. This free, confidential service is available 24/7. If you are a parent afraid that the other parent of your child will harm you or your child, there is help available.

Thankfully, at least for the most part, your obligation to pay taxes stops after you die. But, dying won't get you out of support payments.

Regardless of state differences on the age of majority, once the child is officially considered an adult, the custodial parent will not be owed any new child support payments. However, any outstanding payments are still collectable provided the parent files a court order.

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.

Legal guidelines in all states allow child support to end when the child reaches the age of majority.In most states, child support ends when a child turns 18 or graduates from high school, whichever occurs first. In other states, the age may be 21.

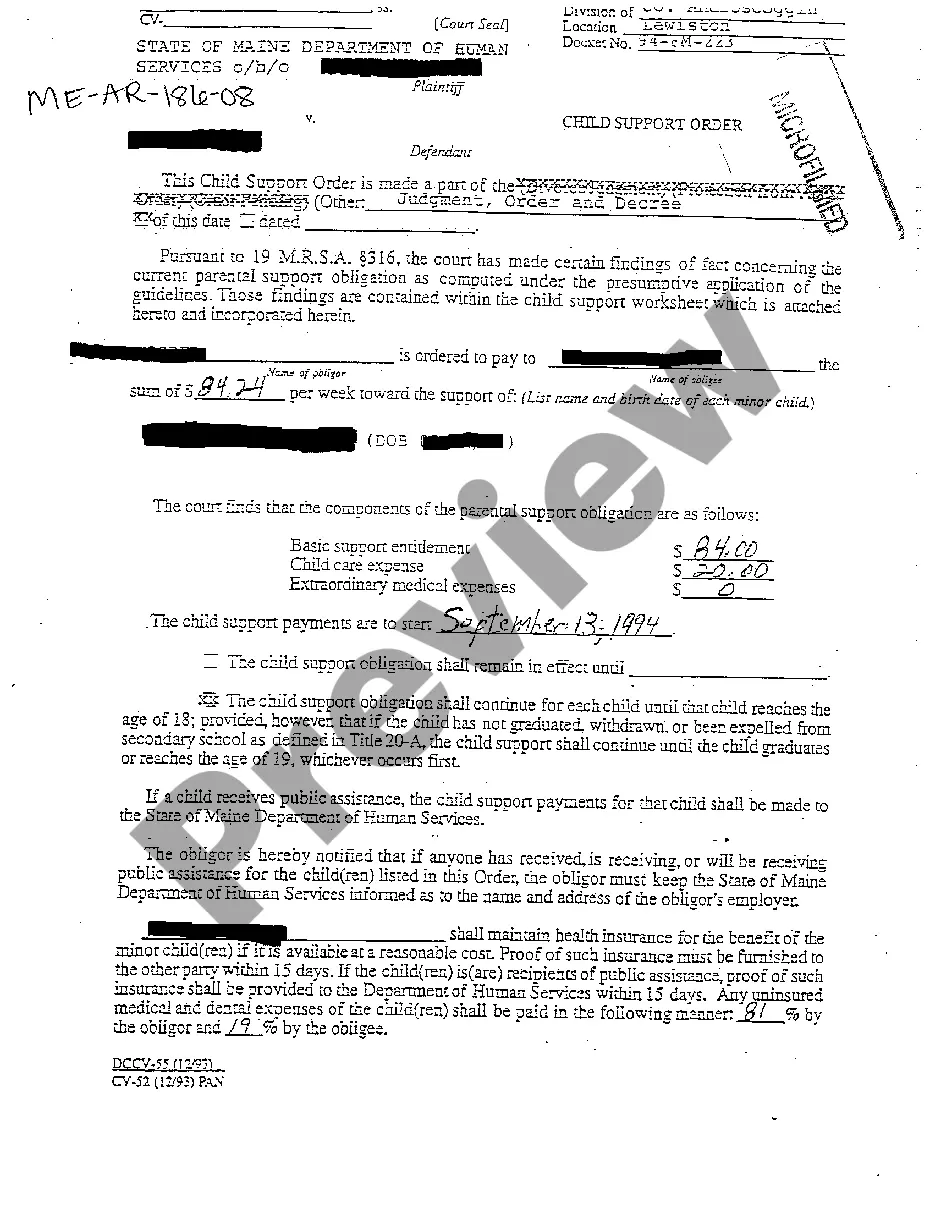

In Maine, the obligation to pay child support ordinarily ends when a child turns 18. A court may extend the obligation until a child's 19th birthday if the child is still in high school, or special circumstances apply.