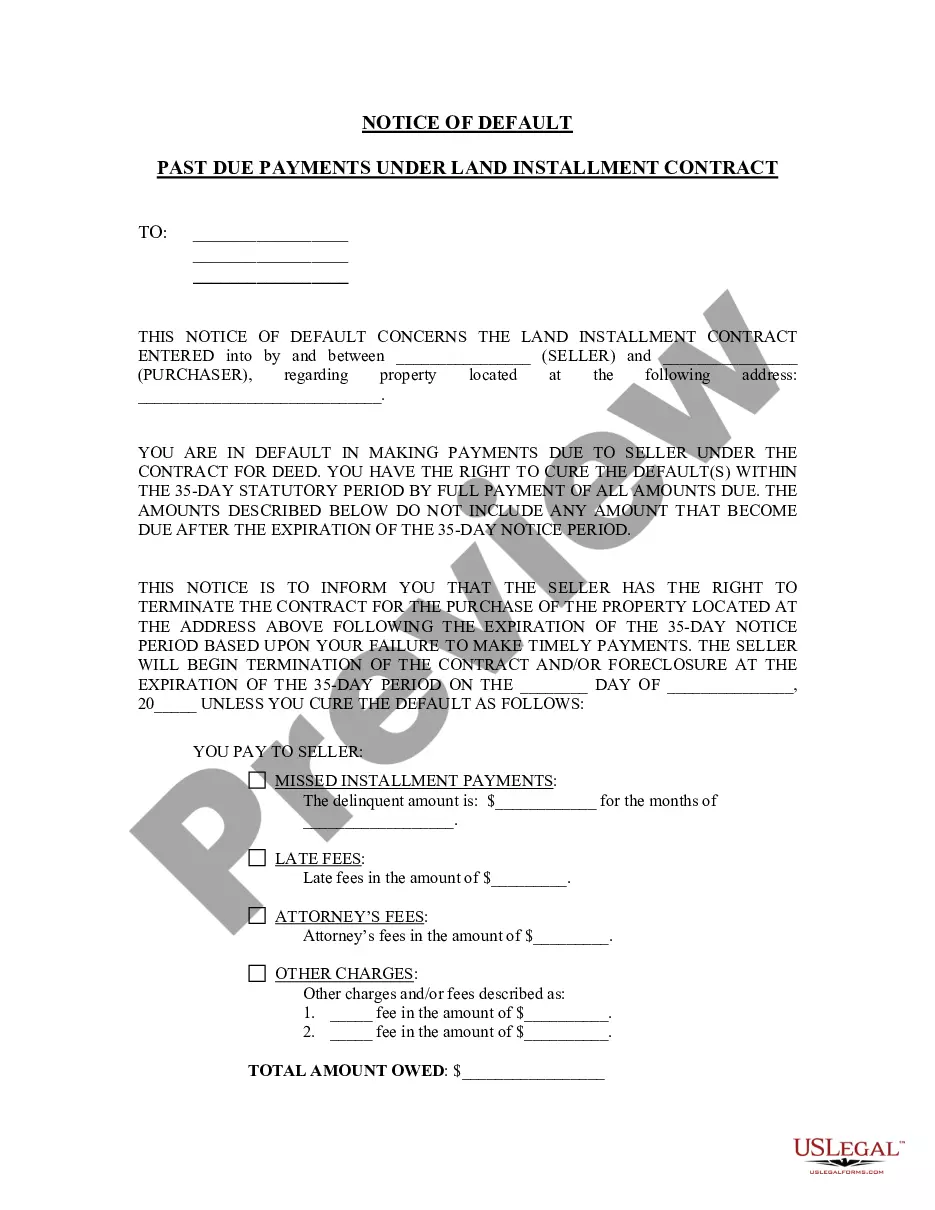

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Maine Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Maine Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Maine Notice of Default for Unpaid Payments related to a Contract for Deed. Our court-acceptable templates are crafted and consistently updated by legal professionals.

Ours is the most comprehensive Forms library available online, providing cost-effective and precise samples for consumers, legal experts, and small to medium-sized businesses (SMBs). The templates are categorized by state, with a selection available for previewing before download.

To retrieve samples, users must possess a subscription and Log Into their account. Click Download next to any form you require and locate it in My documents.

US Legal Forms offers a vast array of legal and tax templates and packages for both business and personal requirements, including the Maine Notice of Default for Unpaid Payments related to a Contract for Deed. Over three million users have successfully utilized our service. Select your subscription plan and access high-quality forms in just a few clicks.

- Ensure you select the correct form pertaining to the state required.

- Examine the document by reviewing the description and utilizing the Preview option.

- Click Buy Now if it’s the document you seek.

- Create your account and complete payment via PayPal or by debit/credit card.

- Download the template to your device and feel free to reuse it as needed.

- Use the Search field to find another document template.

Form popularity

FAQ

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

What happens when you get a default notice? Your creditor will ask you to pay the full amount of the debt instead of paying the instalments you first agreed.Your creditor can also take further action after the account has defaulted, including: Passing the debt to a collection agency.

Breach: Everything You Need to Know. In contract law, a breach means the failure of a contracting party to perform their obligations according to the terms of the agreement.Default, according to the law of obligations and banking law, means to refuse to pay a debt when due.

In law, a default is the failure to do something required by law.

Once a default is recorded on your credit profile, you can't have it removed before the six years are up (unless it's an error). However, there are several things that can reduce its negative impact: Repayment. Try and pay off what you owe as soon as possible.

A default notice (sometimes referred to as a default letter or Notice of Default) is a formal letter sent to you by a creditor as a result of payments missed on a credit agreement between yourself and a credit provider.The notice will give you 14 days to pay any amount owed before issuing a default.

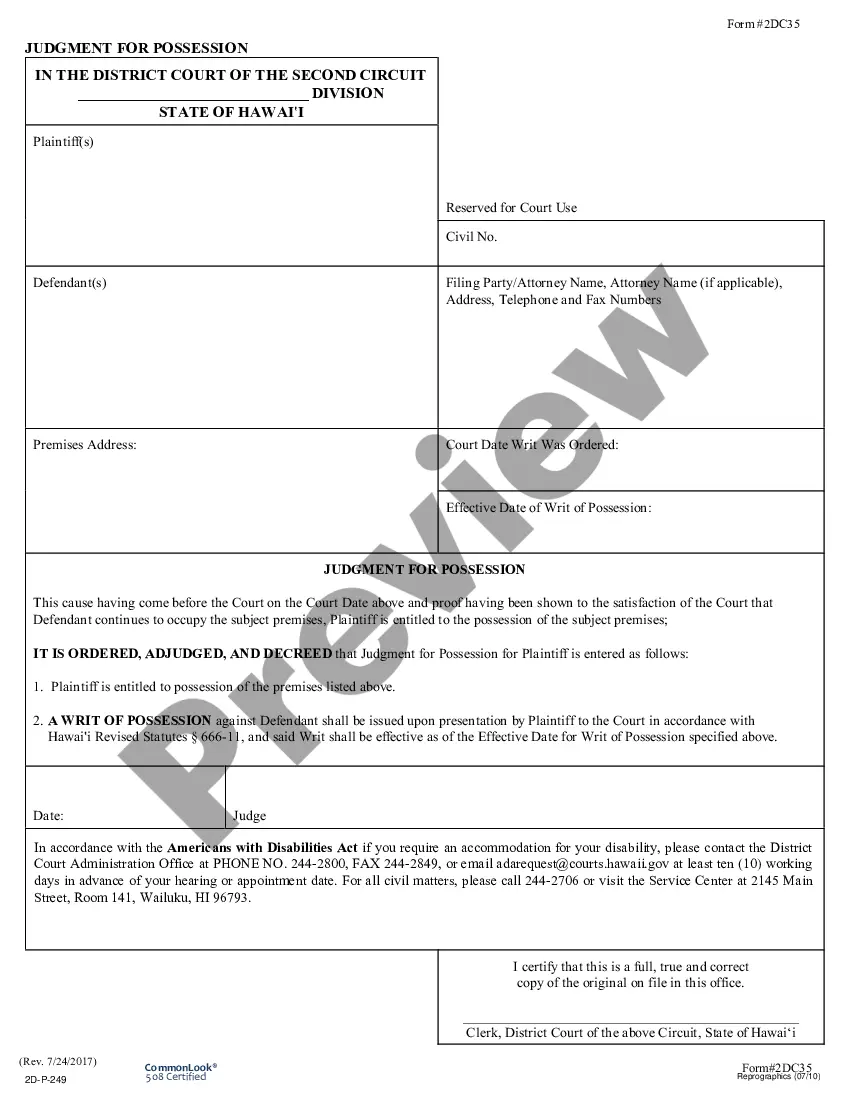

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

A default is a non-material breach of contract, whereby one party fails to perform a contractual obligation. What specifically constitutes a default will be set out in the contract terms, but generally, it can be defined as an omission or a failure to do what is expected or required.