Maryland Affidavit of Name Change (Of Corporation)

Description

How to fill out Affidavit Of Name Change (Of Corporation)?

You may spend hrs online trying to find the legitimate file template that fits the state and federal specifications you require. US Legal Forms offers a large number of legitimate types that happen to be reviewed by specialists. You can actually download or print the Maryland Affidavit of Name Change (Of Corporation) from our assistance.

If you currently have a US Legal Forms account, it is possible to log in and click on the Acquire key. Afterward, it is possible to comprehensive, edit, print, or indicator the Maryland Affidavit of Name Change (Of Corporation). Each and every legitimate file template you buy is your own forever. To acquire one more copy for any bought kind, visit the My Forms tab and click on the related key.

If you work with the US Legal Forms web site the first time, keep to the straightforward recommendations below:

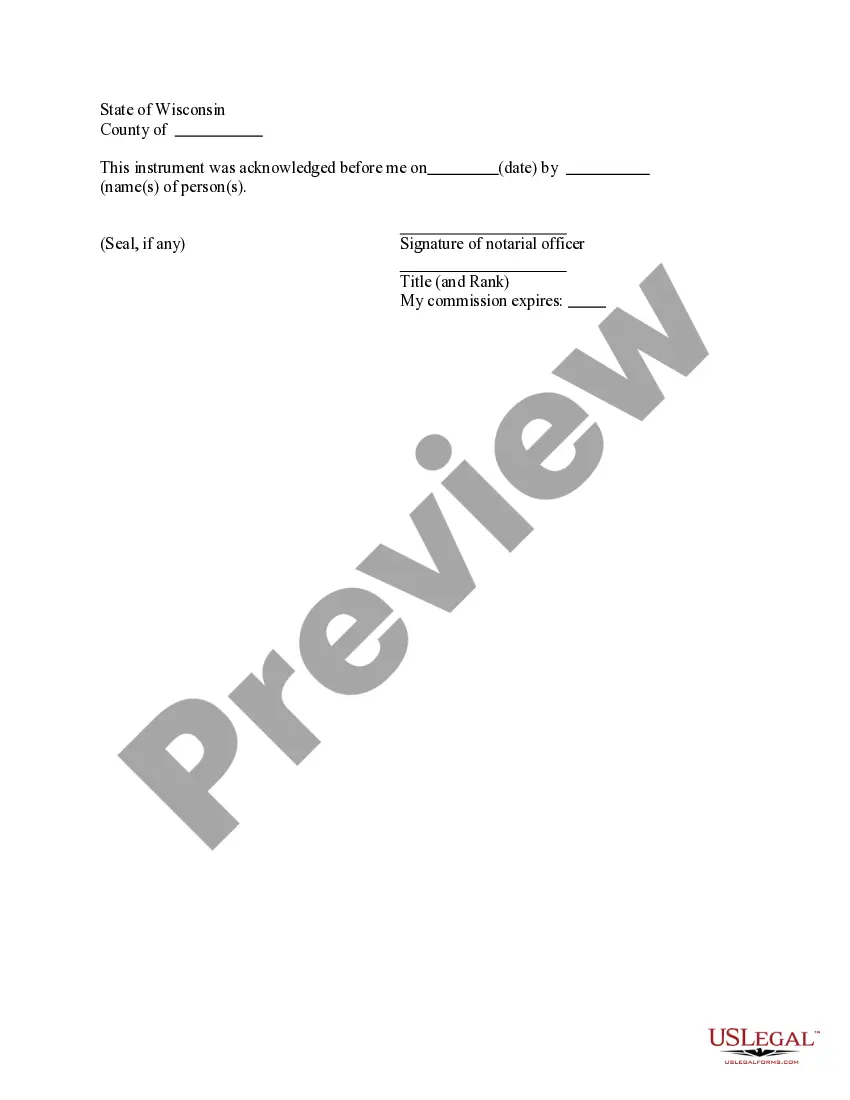

- Very first, be sure that you have chosen the best file template for your state/metropolis that you pick. See the kind explanation to ensure you have selected the right kind. If available, use the Preview key to appear with the file template at the same time.

- If you would like discover one more version of the kind, use the Search area to find the template that meets your needs and specifications.

- Upon having discovered the template you desire, just click Purchase now to carry on.

- Find the prices program you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal account to purchase the legitimate kind.

- Find the format of the file and download it in your device.

- Make alterations in your file if possible. You may comprehensive, edit and indicator and print Maryland Affidavit of Name Change (Of Corporation).

Acquire and print a large number of file web templates using the US Legal Forms website, which provides the most important assortment of legitimate types. Use expert and state-particular web templates to take on your organization or individual requires.

Form popularity

FAQ

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

How Do I File Maryland Articles of Incorporation? Create a Maryland Business Express Account. In the portal, select ?Register Your Business? and ?Create Account.? Enter your name, phone number and email, and choose a username and password. ... Answer Questions About Your Company. ... Pay the Fee.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

You must first make sure the name you want is available. Then, you need to amend your business's formation documents by filing an Amendment to your Articles of Formation for your LLC or an Amendment to your Articles of Incorporation for your Corporation with the Maryland Secretary of State.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

An LLC name change in Maryland costs $100. This is the filing fee for the Articles of Amendment, the official form used to change your Maryland LLC name. If you file your name change online (for next-day approval time), it costs $150 for the expedited filing.

The state of Maryland requires all corporations, nonprofits, LLCs, LPs, and LLPs to submit a Maryland Annual Report each year. In addition, your business may have to file a Personal Property Tax Return if your business owns, leases, or uses personal property located in the state or maintains a trader's license.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

Generally, you are required to file a Maryland income tax return if: You are or were a Maryland resident; You are required to file a federal income tax return; and.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st. Failure to file the Annual Report may result in forfeiture of the entity's right to conduct business in the State of Maryland. The deadline to file is April 15th.