This form is when the Lessor ratifies the Lease and grants, leases, and lets all of Lessor's undivided mineral interest in the Lands to Lessee on the same terms and conditions as provided for in the Lease, and adopts and confirms the Lease as if Lessor was an original party to and named as a Lessor in the Lease.

Maryland Ratification of Oil, Gas, and Mineral Lease by Mineral Owner

Description

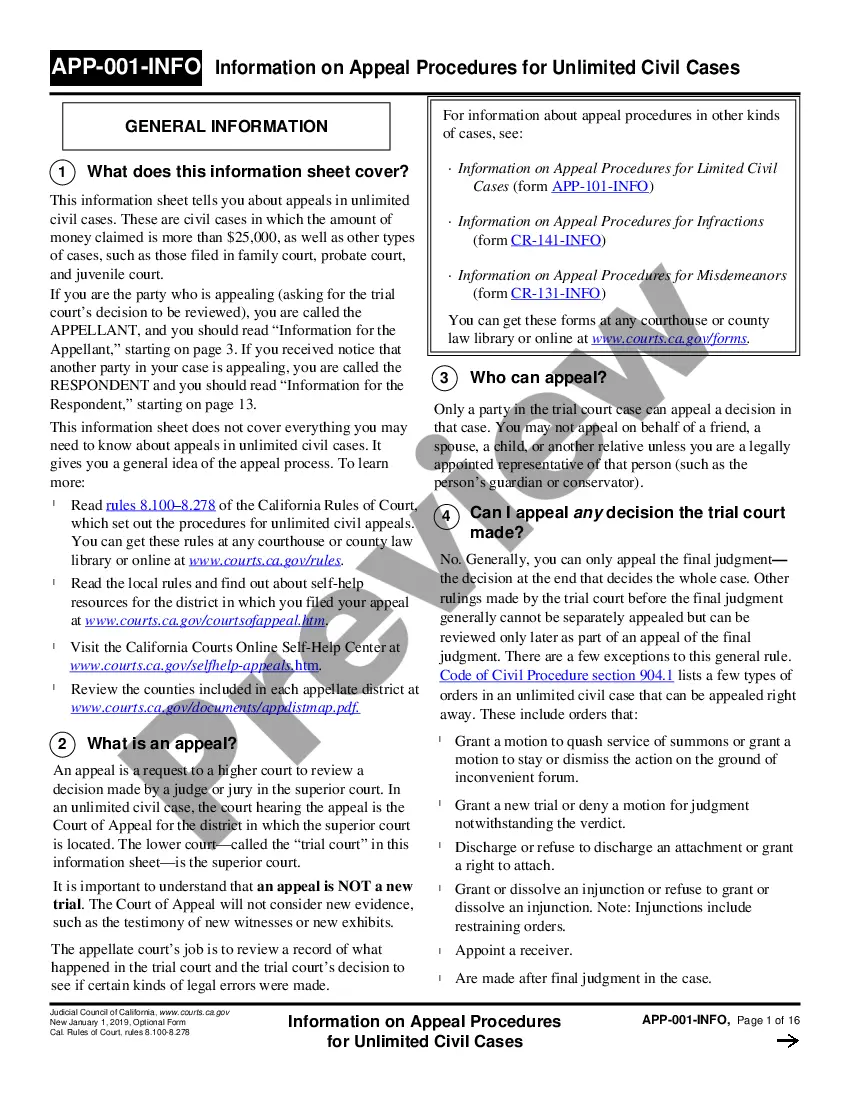

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Mineral Owner?

Finding the right legal document template can be quite a have difficulties. Of course, there are plenty of themes available online, but how would you get the legal form you want? Utilize the US Legal Forms site. The services gives a huge number of themes, like the Maryland Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, that you can use for business and personal needs. Each of the varieties are checked out by specialists and satisfy state and federal requirements.

When you are already authorized, log in to your account and click the Acquire button to get the Maryland Ratification of Oil, Gas, and Mineral Lease by Mineral Owner. Utilize your account to check with the legal varieties you might have purchased formerly. Check out the My Forms tab of your account and acquire an additional backup of your document you want.

When you are a brand new end user of US Legal Forms, listed here are basic directions for you to adhere to:

- Initially, make sure you have chosen the proper form to your city/area. You are able to look through the form while using Review button and read the form information to make sure it is the right one for you.

- In the event the form fails to satisfy your requirements, utilize the Seach area to obtain the right form.

- Once you are positive that the form is proper, select the Acquire now button to get the form.

- Pick the rates strategy you desire and enter in the necessary details. Create your account and pay money for an order making use of your PayPal account or bank card.

- Pick the submit format and acquire the legal document template to your product.

- Total, change and produce and signal the obtained Maryland Ratification of Oil, Gas, and Mineral Lease by Mineral Owner.

US Legal Forms may be the biggest local library of legal varieties where you will find different document themes. Utilize the service to acquire professionally-manufactured papers that adhere to state requirements.

Form popularity

FAQ

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights.

A mineral lease is a contract between a mineral owner (the lessor) and a company or working interest owner (the lessee) in which the lessor grants the lessee the right to explore, drill, and produce oil, gas, and other minerals for a specified period of time.

A royalty is a fee that is imposed by local, state or federal governments on either the amount of minerals produced at a mine or the revenue or profit generated by the minerals sold from a mine. A royalty can be imposed as either a ?net? or ?gross? royalty.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

- Lessor -The owner of the minerals that grants the lease. - Lessee -The oil and gas developer that takes the lease. - Primary Term-Length of time the Lessee has to establish production by drilling a well on the lands subject to the lease. Generally, primary terms run from one to ten years.

Receive Payment Royalties are a form of payment made to the owner of the mineral rights, in exchange for the right to extract and sell the resource. In the context of mineral rights, royalties are typically a percentage of the revenue generated from the sale of minerals extracted from the property.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Mineral rights give ownership of the mineral assets (metals and fossil fuels) below the surface of an area of land. Mineral rights owners are given the right to explore, develop, and extract the minerals. Mineral owners may choose to drill oil and gas wells or excavate hard rock materials like gold.