Pennsylvania Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

If you want to aggregate, acquire, or reproduce legal document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Employ the site’s simple and convenient search feature to find the documents you need. Numerous templates for commercial and personal use are categorized by groups and states, or keywords.

Use US Legal Forms to locate the Pennsylvania Option of Remaining Partners to Purchase with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you acquired within your account. Click the My documents section and choose a form to print or download again.

Be proactive and download, and print the Pennsylvania Option of Remaining Partners to Purchase with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Pennsylvania Option of Remaining Partners to Purchase.

- You can also access documents you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

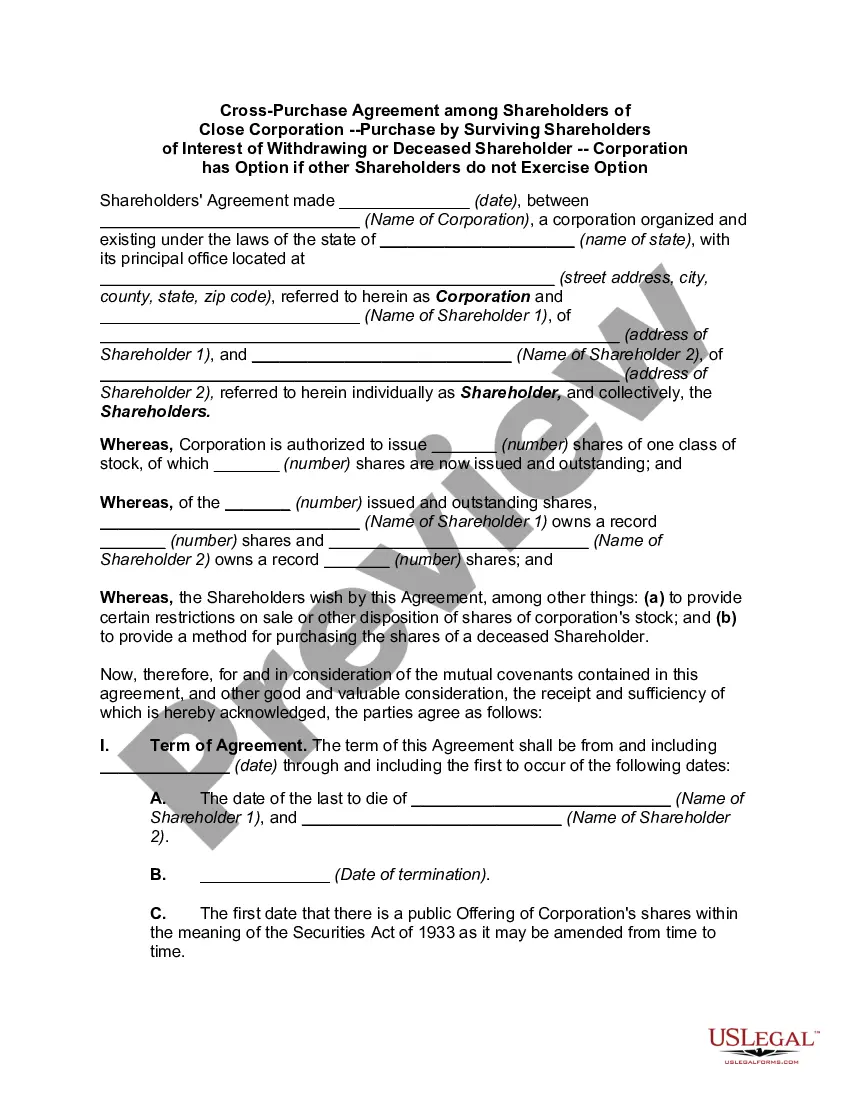

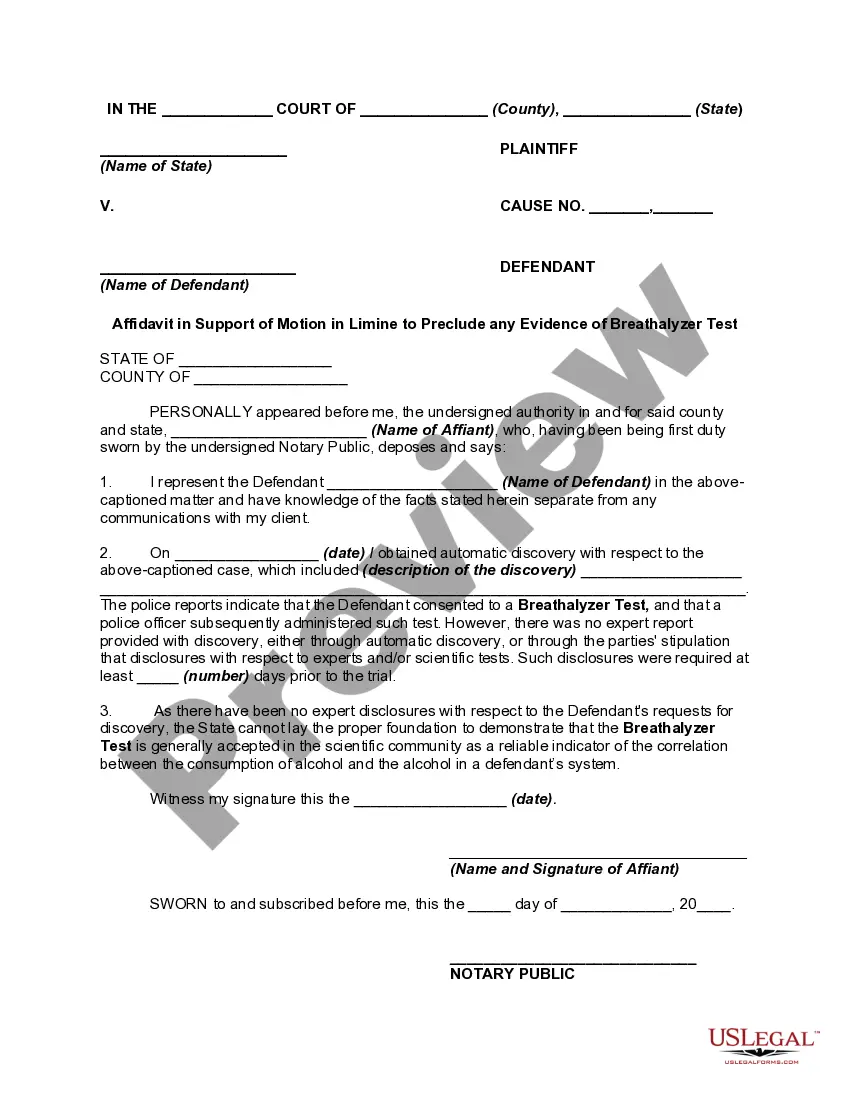

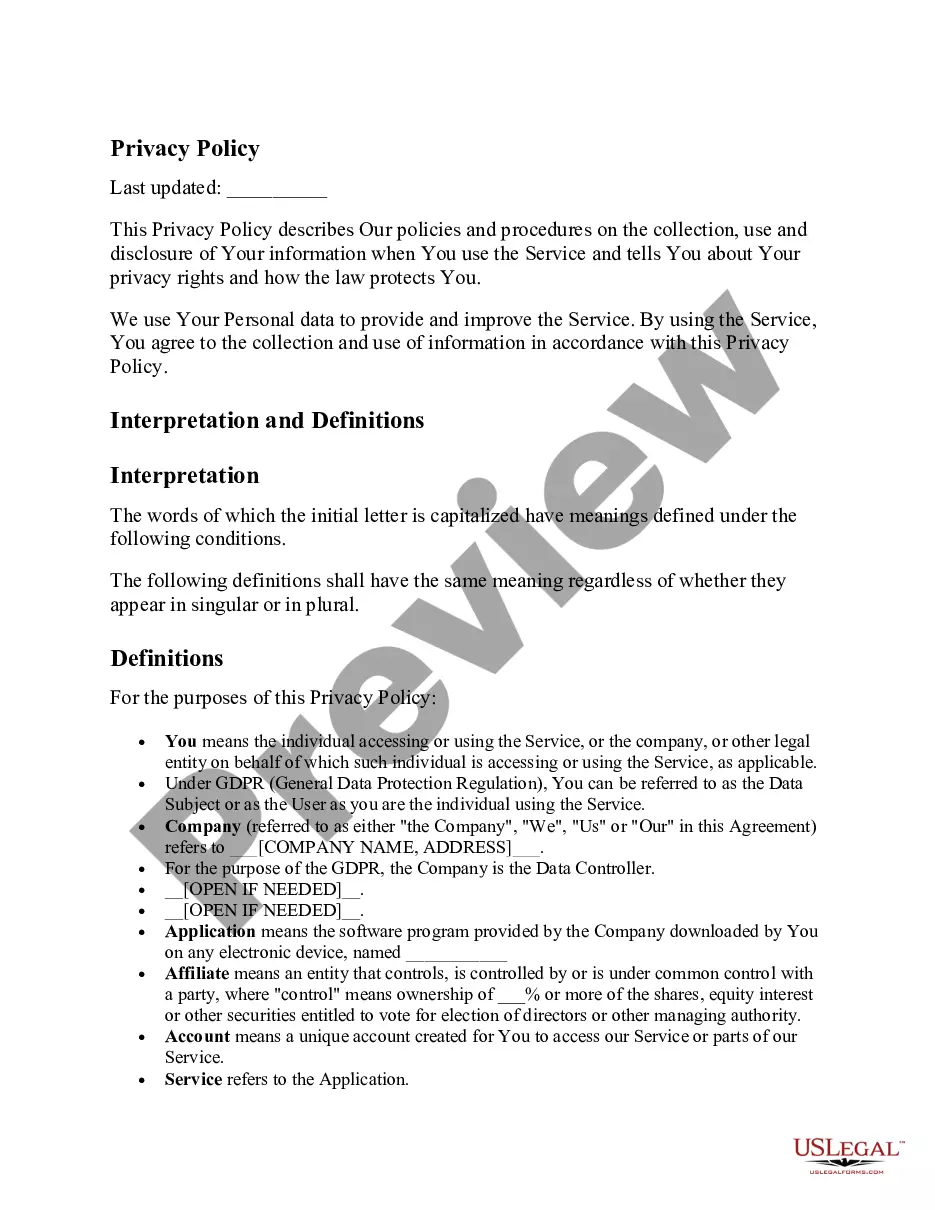

- Step 2. Use the Preview option to view the form’s details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

- Step 4. After you have found the form you need, click the Get now button. Select the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Pennsylvania Option of Remaining Partners to Purchase.

Form popularity

FAQ

Pennsylvania does implement standardized testing in various educational contexts, which is important for assessing student performance and educational outcomes. While this may seem unrelated to partnerships, understanding the broader regulatory landscape can be beneficial. For partnerships involving educational enterprises, knowing these aspects may affect your operational decisions. Therefore, it's crucial to be informed about both business and educational regulations to navigate your partnership smoothly.

Partnership income is indeed subject to local tax in Pennsylvania. The rules surrounding partnership taxation are specific, and all partners should understand their responsibilities. You’ll need to accurately report any partnership income when filing your local tax returns. Consider leveraging USLegalForms for assistance in structuring your filings and understanding your obligations.

Yes, interest income is subject to local tax in Pennsylvania. This means that if you earn interest from various sources, it must be reported when calculating your local tax obligations. It's essential for individuals and businesses to consider this when assessing their total tax liability. Utilizing services like USLegalForms can help you navigate these requirements effectively.

Any amount designated as capital gain is fully taxable as dividend income for Pennsylvania purposes. Exempt interest dividends from states other than Pennsylvania or other than exempt federal obligations are taxable income for Pennsylvania personal income tax purposes.

Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

Types of Income Subject to Tax Withholding.

You can sell your primary residence exempt of capital gains taxes on the first $250,000 if you are single and $500,000 if married. This exemption is only allowable once every two years. You can add your cost basis and costs of any improvements you made to the home to the $250,000 if single or $500,000 if married.

The Pennsylvania Business Entity Registration Form (PA-100) must be completed by Business Entities to register for certain taxes and services administered by the PA Department of Revenue and the Department of Labor & Industry.

If you're a single filer and the profit on the sale of your home does not exceed $250,000, or you're a married couple filing jointly with a profit that does not exceed $500,000, you do not have to pay tax on the gain. Anything above those amounts must be reported as a capital gain.

5 ways to avoid paying Capital Gains Tax when you sell your stockStay in a lower tax bracket. If you're a retiree or in a lower tax bracket (less than $75,900 for married couples, in 2017,) you may not have to worry about CGT.Harvest your losses.Gift your stock.Move to a tax-friendly state.Invest in an Opportunity Zone.