Maryland Term Royalty Deed for Term of Existing Lease

Description

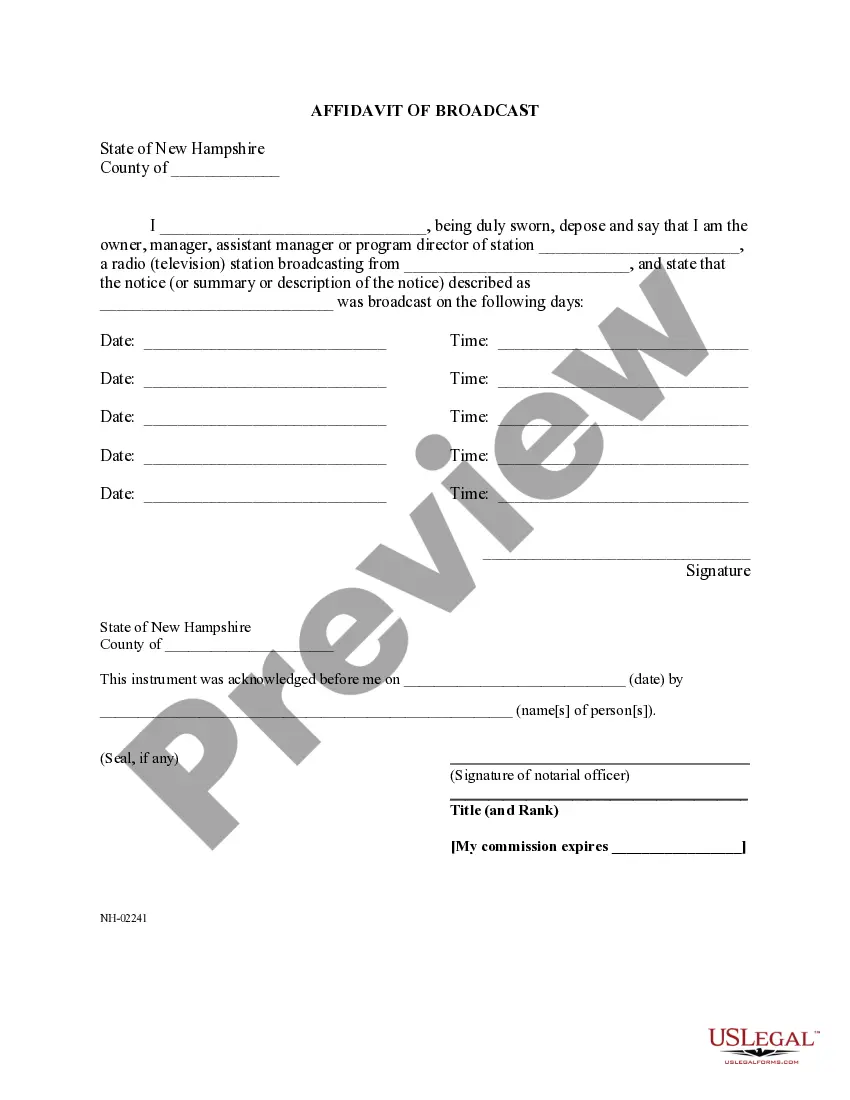

How to fill out Term Royalty Deed For Term Of Existing Lease?

If you need to total, down load, or print out legal record themes, use US Legal Forms, the most important selection of legal varieties, which can be found on the web. Make use of the site`s basic and convenient lookup to get the papers you need. Numerous themes for organization and personal purposes are categorized by types and says, or keywords. Use US Legal Forms to get the Maryland Term Royalty Deed for Term of Existing Lease in just a number of click throughs.

If you are already a US Legal Forms customer, log in for your account and then click the Acquire button to have the Maryland Term Royalty Deed for Term of Existing Lease. You can also accessibility varieties you in the past saved in the My Forms tab of your own account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for the appropriate city/region.

- Step 2. Take advantage of the Preview option to look over the form`s articles. Do not forget to read through the description.

- Step 3. If you are not satisfied with all the type, utilize the Look for field towards the top of the screen to locate other versions in the legal type format.

- Step 4. After you have found the shape you need, click the Get now button. Opt for the pricing prepare you choose and add your references to sign up on an account.

- Step 5. Method the transaction. You may use your charge card or PayPal account to accomplish the transaction.

- Step 6. Select the formatting in the legal type and down load it on the device.

- Step 7. Complete, revise and print out or indicator the Maryland Term Royalty Deed for Term of Existing Lease.

Every single legal record format you buy is your own property forever. You may have acces to every single type you saved within your acccount. Click on the My Forms segment and decide on a type to print out or down load once again.

Contend and down load, and print out the Maryland Term Royalty Deed for Term of Existing Lease with US Legal Forms. There are thousands of professional and condition-particular varieties you may use for the organization or personal demands.

Form popularity

FAQ

Royalties. Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.

The owner is called the Lessor and the person who takes the right to the asset is called the lessee. In the royalty account notes, there is often a mention of the lease which is made between two people. The amount which is to be paid to the lessor on behalf of the lessee is known as Royalties.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

The Royalty is a percentage of the proceeds from the sale of production paid monthly to the Mineral Owner. Historically, royalties retained by the Mineral Owner in lease agreements have ranged between 12.5% to 25%. The lower royalty you retain in the lease, the higher net revenue retained by the operator.

Royalties are a form of real property ownership as defined by the IRS. As property owners, royalty investments could provide a complement to existing real estate portfolios offering similar benefits to REIT's ? including passive-cash flow and upside participation from any recovery in energy prices.

The Internal Revenue Service (IRS) defines a royalty as something paid to obtain intellectual property, or to use intellectual property or rights to such property.