Maryland Statement to Add to Credit Report

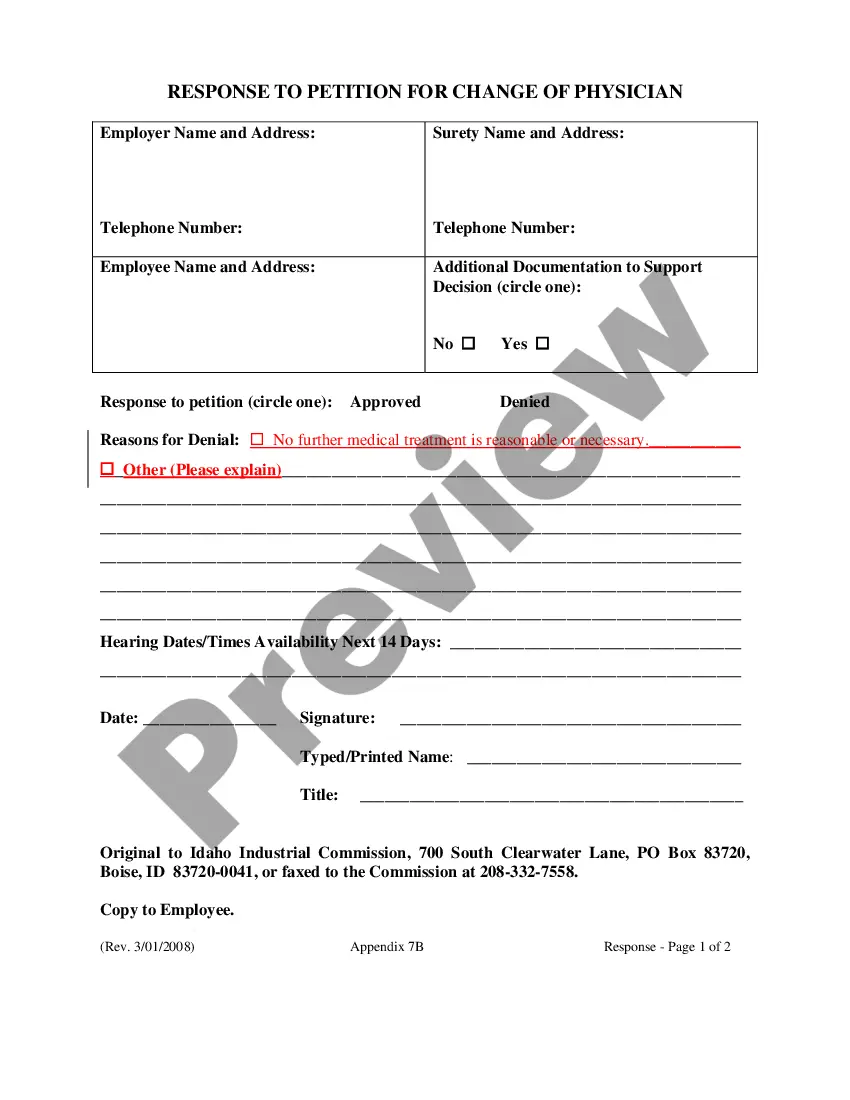

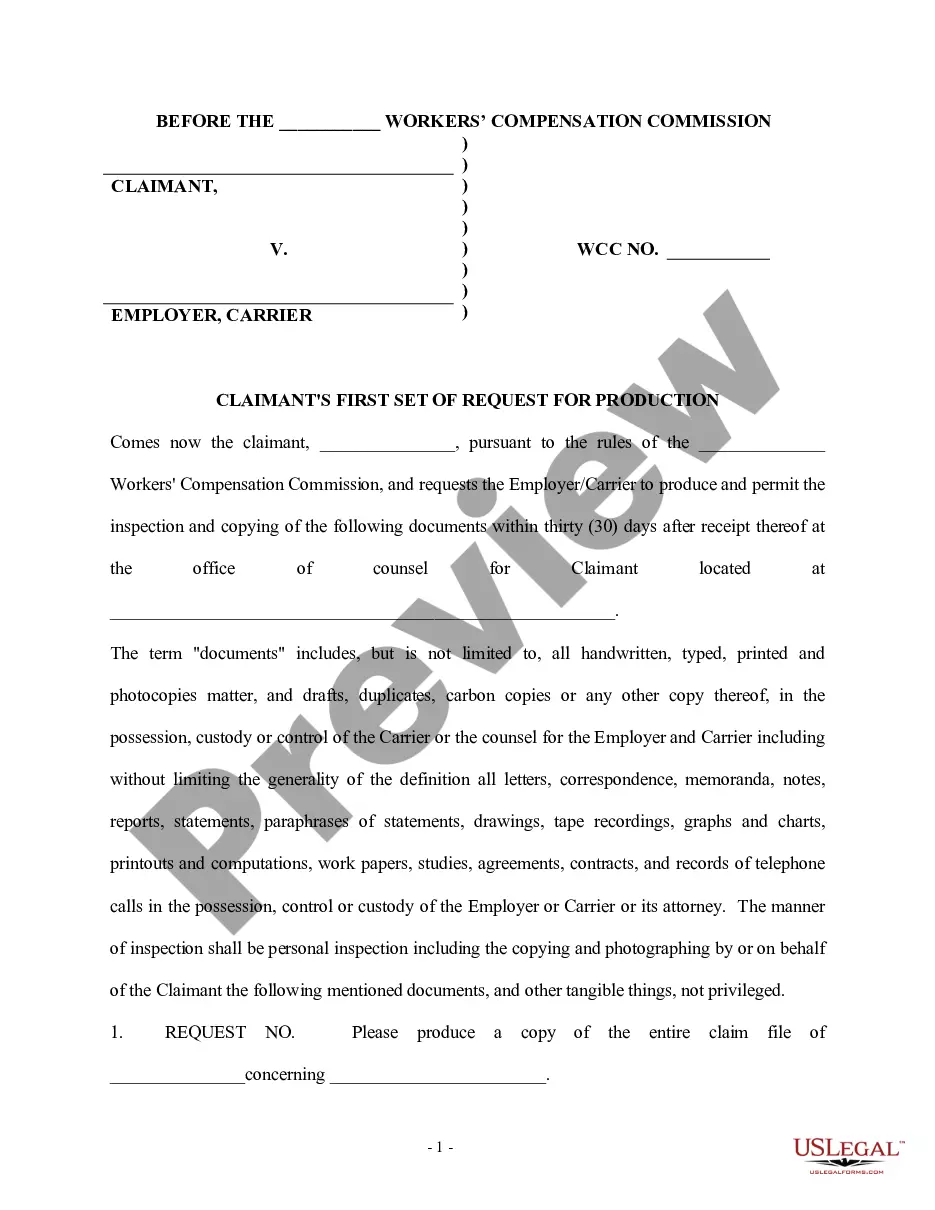

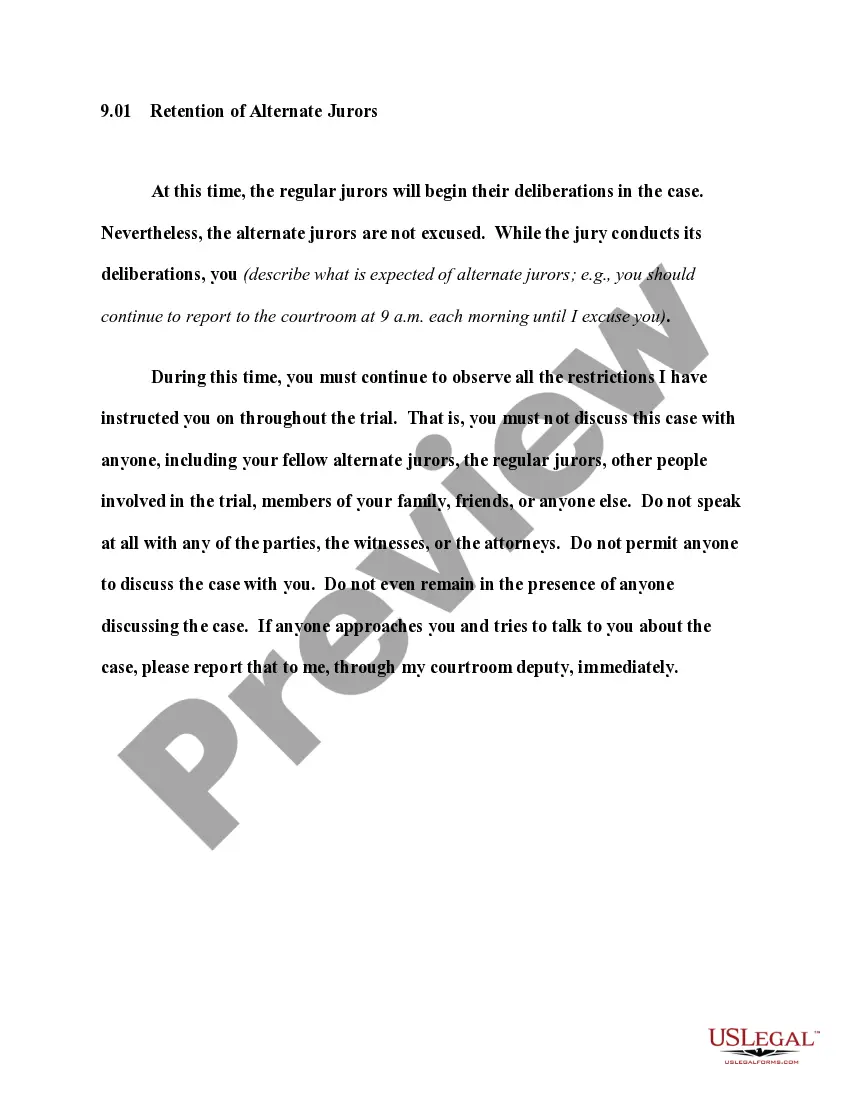

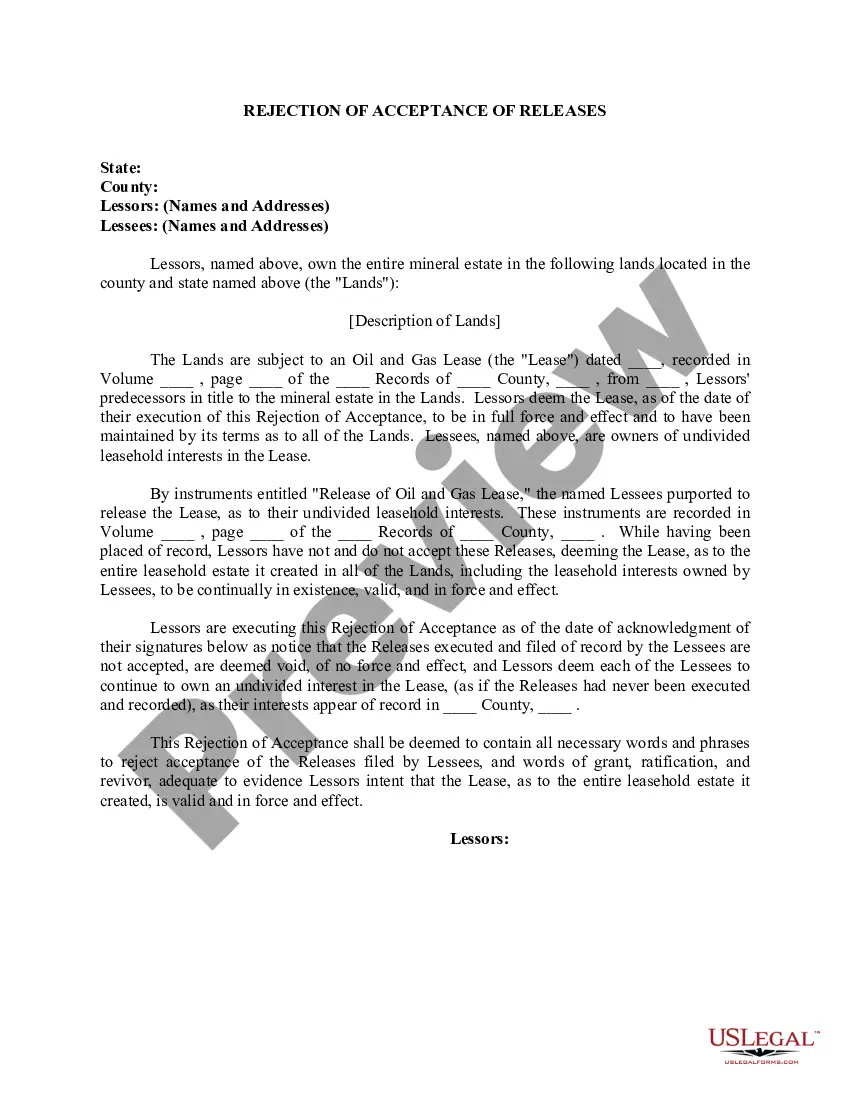

Description

How to fill out Statement To Add To Credit Report?

Are you presently in a situation where you require documents for either business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a wide array of form templates, such as the Maryland Statement to Add to Credit Report, which can be generated to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Maryland Statement to Add to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

- Use the Review button to evaluate the form.

- Read the information to make sure you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Buy now.

- Choose the pricing plan you want, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Maryland Statement to Add to Credit Report anytime, if needed.

- Simply access the required form to download or print the document template.

Form popularity

FAQ

Placing a freeze on your credit can be a wise decision, especially if you suspect identity theft or fraud. A credit freeze prevents new creditors from accessing your credit report, making it difficult for fraudsters to open accounts in your name. However, this action won’t affect your credit score. If you're looking to manage your credit proactively, consider using a Maryland Statement to Add to Credit Report to explain any potential inquiries while your credit is frozen.

You should consider adding a consumer statement if there are negative items on your credit report that require explanation. This statement can clarify your situation, such as a job loss or medical issues, that may have contributed to missed payments. By using a Maryland Statement to Add to Credit Report, you can provide valuable context to potential lenders. This can lead to a more favorable evaluation of your creditworthiness.

Yes, adding a consumer statement to your credit report can be beneficial. It provides you with an opportunity to explain any negative information that may appear on your report. This additional context can help lenders better understand your financial situation. Using a Maryland Statement to Add to Credit Report allows you to present your side of the story, potentially improving your chances for credit approval.

A credit report should not include personal opinions, race, religion, or marital status. It also should not reflect any information about your health or disability status. Having accurate information is crucial for maintaining a good credit score. If you find inaccuracies, you can consider using a Maryland Statement to Add to Credit Report to clarify misunderstandings.

The biggest killer of credit scores is late payments. When you miss a payment, it can negatively impact your credit score for years. Additionally, high credit utilization, which occurs when you use a large portion of your available credit, can also harm your credit standing. To better manage your credit, consider adding a Maryland Statement to Add to Credit Report to explain any circumstances surrounding late payments.

A consumer statement does not directly improve your credit score, but it can provide important context for lenders reviewing your report. When you add a Maryland Statement to Add to Credit Report, it allows you to explain any issues that may have affected your credit history. This transparency can help lenders understand your situation better, potentially influencing their decision positively. Using services like US Legal Forms can simplify this process and ensure your statement is effective.

To add a statement to your credit report, start by writing your Maryland Statement to Add to Credit Report. You can then submit this statement to the credit bureaus along with any supporting documents. Services like US Legal Forms can assist you in formatting and filing your statement correctly. This ensures that your voice is heard and your circumstances are explained.

To put a note on your credit report, you can contact the credit bureaus directly or use a service like US Legal Forms. First, you need to gather the necessary information and draft your Maryland Statement to Add to Credit Report. After that, submit your statement through the appropriate channels. This process allows you to provide context for any negative entries on your credit report.

You can add a statement to your credit report if you feel it is necessary to explain your credit history. This process involves submitting your statement to the credit bureaus, which will then include it in your report. A Maryland Statement to Add to Credit Report serves as a valuable tool for you to clarify your situation. This addition can empower you by providing potential lenders with a better understanding of your creditworthiness.

Yes, you can include a statement on your credit report, typically limited to 100 words. This statement allows you to explain any negative entries that may affect your credit score. Using a Maryland Statement to Add to Credit Report can be an effective way to provide context about your financial situation. Keep your statement concise and focused to ensure it communicates your message clearly.