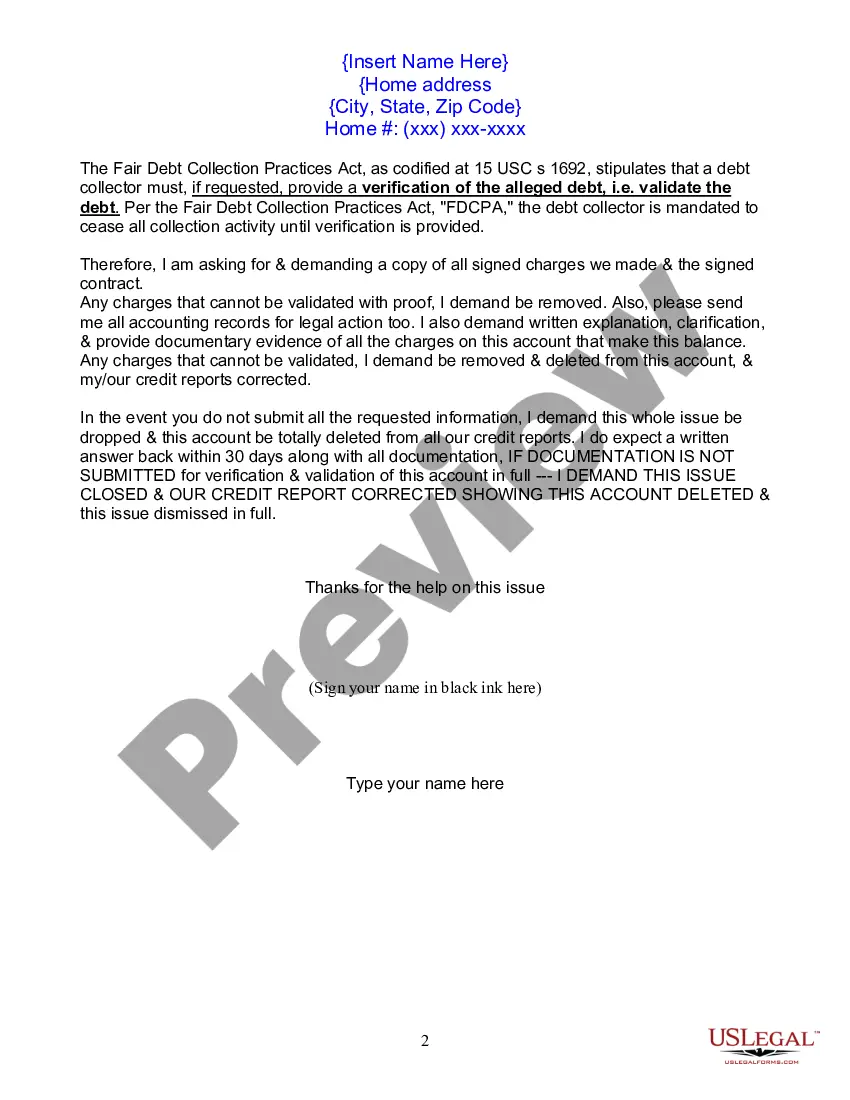

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Maryland Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

Have you ever been in a location where you consistently require documentation for various company or individual activities? There are numerous legal document templates accessible online, but finding those you can rely on is challenging.

US Legal Forms provides thousands of document templates, including the Maryland Letter of Dispute - Complete Balance, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterward, you can download the Maryland Letter of Dispute - Complete Balance template.

Choose a convenient file format and download your copy.

You can view all the document templates you have acquired in the My documents section. You can obtain another copy of the Maryland Letter of Dispute - Complete Balance at any time, if required. Click the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service offers professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct city/region.

- Utilize the Preview button to review the document.

- Examine the details to confirm that you have chosen the correct form.

- If the form does not meet your requirements, use the Search field to find the form that fits your needs.

- Once you find the correct form, click on Buy now.

- Select the payment plan you prefer, complete the necessary information to process your payment, and finalize the order using your PayPal or credit card.

Form popularity

FAQ

To dispute Maryland taxes, you can start by gathering all relevant documentation related to your tax assessment. Next, you should file a Maryland Letter of Dispute - Complete Balance with the appropriate tax authority, outlining your reasons for contesting the assessment. This formal letter serves as your official appeal and can lead to a reassessment of your tax obligations. For assistance, consider using the USLegalForms platform, which provides resources and templates to simplify the process.

Rule 535 in Maryland governs the procedures for disputing tax assessments. This rule allows taxpayers to formally contest their tax obligations by filing a Maryland Letter of Dispute - Complete Balance. Engaging in this process can help you clarify discrepancies and potentially reduce your tax burden. Understanding this rule is essential for anyone looking to navigate the tax dispute landscape effectively.

A letter from the Comptroller of Maryland may arrive for various reasons, including tax assessments, payment reminders, or notices of compliance issues. It is essential to understand the content of this letter, as it can impact your financial obligations. Utilizing a Maryland Letter of Dispute - Complete Balance can help clarify your position and provide a pathway to resolution.

Receiving a letter from taxation typically indicates that there are issues regarding your tax filings or outstanding balances. This letter serves as a notification and may require your immediate attention. To resolve any disputes, consider using a Maryland Letter of Dispute - Complete Balance to formally address the matter with the tax authorities.

You may receive various types of mail from the Comptroller of Maryland, including tax forms, payment reminders, and notices about tax audits. If there are discrepancies or concerns, you might also receive a Maryland Letter of Dispute - Complete Balance. It is crucial to review this correspondence carefully to ensure compliance and take appropriate action.

If you owe Maryland taxes, you may face penalties, interest, and possible collection actions. The Comptroller can garnish wages or place liens on property to recover owed amounts. To address your tax issues, consider sending a Maryland Letter of Dispute - Complete Balance, which can help clarify your situation and negotiate a resolution.

In Maryland, a debt typically becomes uncollectible after three years from the date it was due. However, specific circumstances may affect this timeline, especially with tax debts. It is advisable to consult with professionals or use resources like a Maryland Letter of Dispute - Complete Balance to understand your options.

The Comptroller of Maryland sends various documents related to tax responsibilities, including tax bills and notices of tax assessments. If you have an outstanding balance, you may receive a Maryland Letter of Dispute - Complete Balance to address discrepancies. This letter provides essential information on how to respond and resolve any tax issues efficiently.

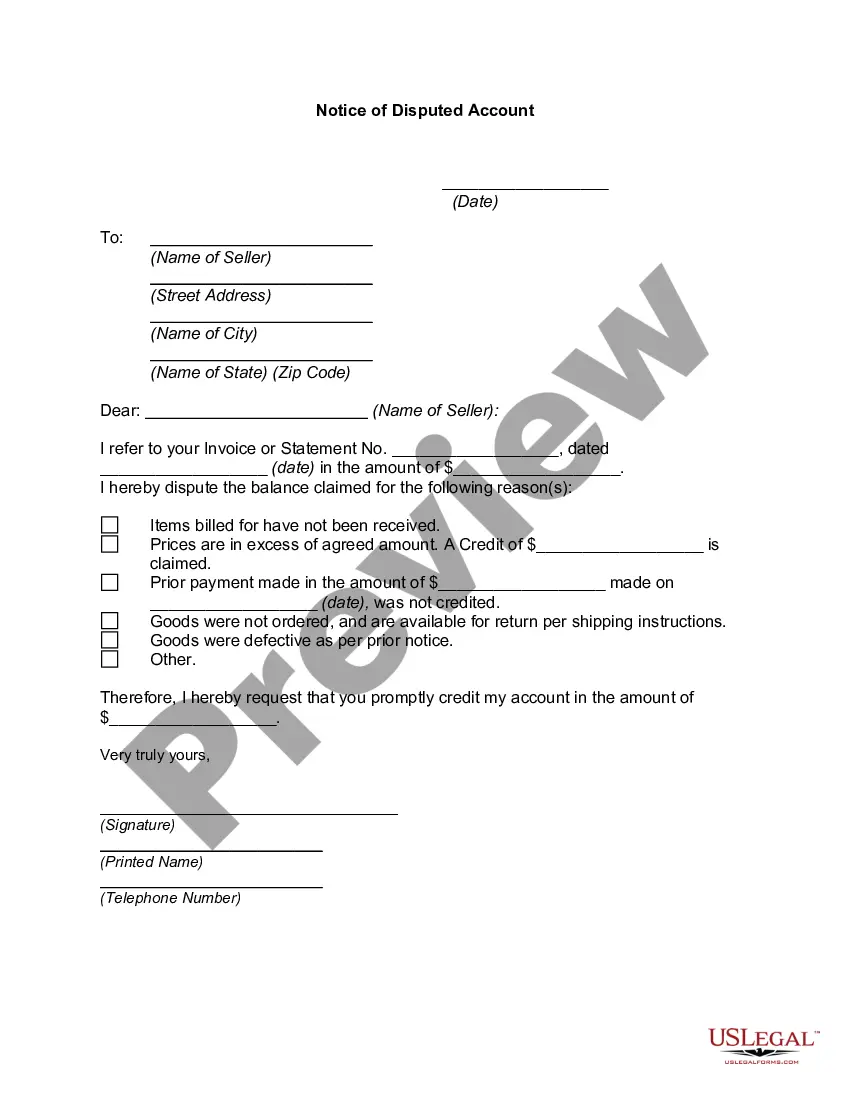

When disputing a collection, it is best to clearly state your position and reference the specific details of the debt. You might say, 'I am disputing this collection due to inaccuracies in the amount owed.' Always mention your Maryland Letter of Dispute - Complete Balance, as it reinforces your claim and establishes a formal record of your communication.

Filling out the DC CV 001 form requires you to provide your personal information, details about the debt, and the nature of your dispute. Carefully follow the instructions on the form, ensuring all sections are completed. If you are referencing a Maryland Letter of Dispute - Complete Balance, include that information where applicable to strengthen your submission.