Maryland Reprint Sales License Agreement

Description

How to fill out Reprint Sales License Agreement?

It is possible to spend several hours on the Internet searching for the legal papers design that fits the federal and state specifications you need. US Legal Forms gives 1000s of legal kinds which can be examined by experts. You can actually obtain or produce the Maryland Reprint Sales License Agreement from our service.

If you have a US Legal Forms profile, you are able to log in and then click the Obtain key. Following that, you are able to full, edit, produce, or signal the Maryland Reprint Sales License Agreement. Every legal papers design you purchase is your own property permanently. To get an additional copy of any obtained kind, go to the My Forms tab and then click the related key.

If you use the US Legal Forms site the very first time, stick to the straightforward guidelines below:

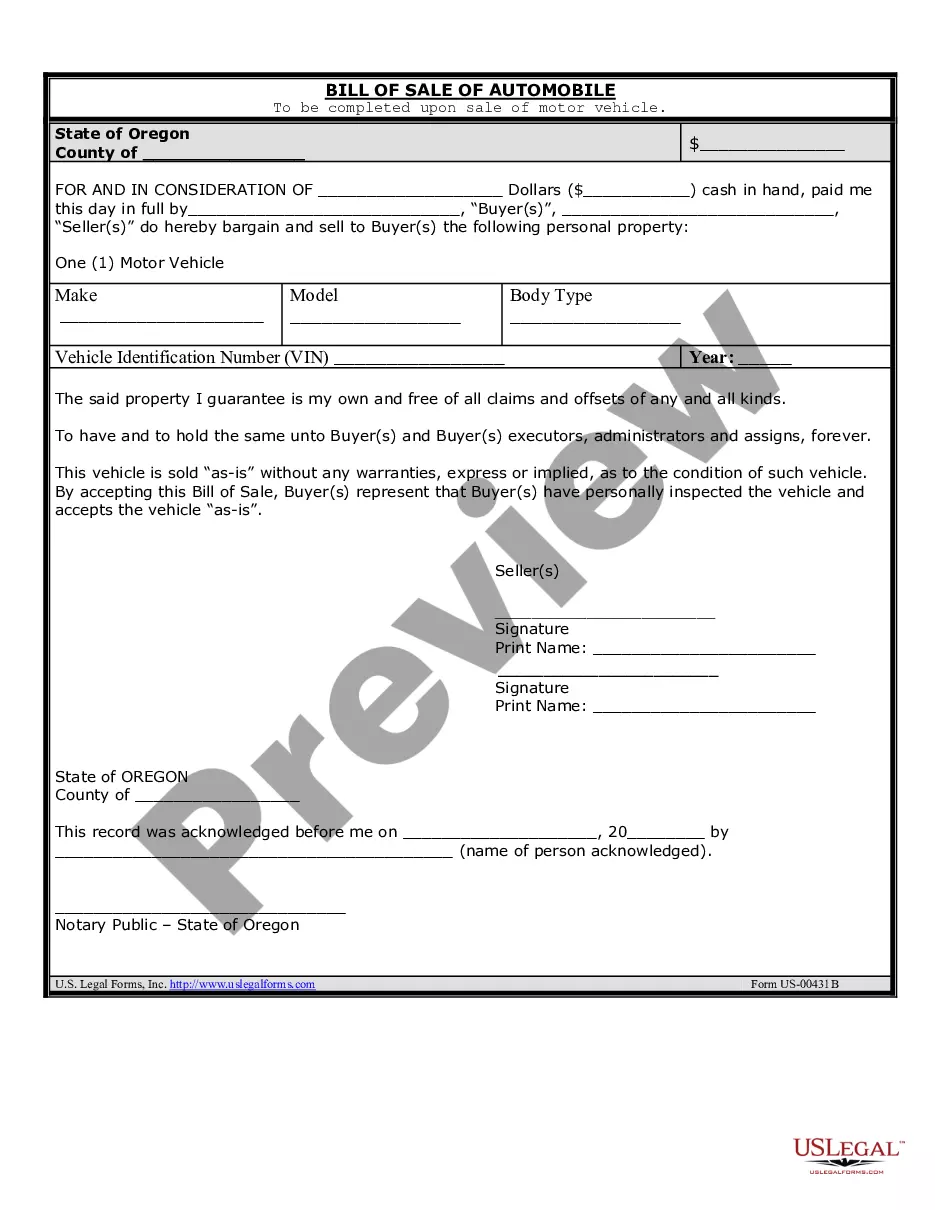

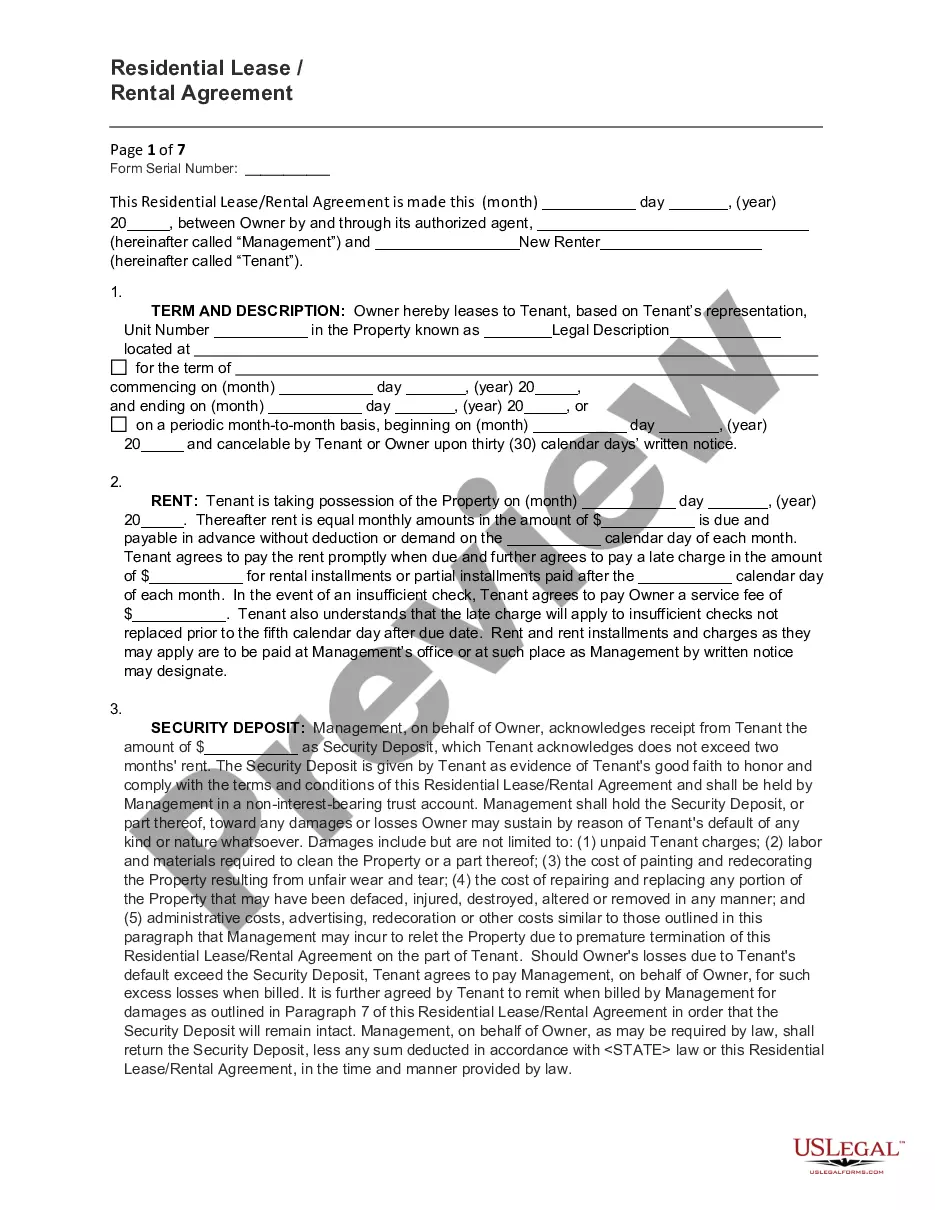

- Initial, make sure that you have selected the correct papers design for that region/town of your liking. Read the kind information to make sure you have chosen the right kind. If accessible, utilize the Review key to look from the papers design at the same time.

- If you wish to get an additional version of the kind, utilize the Look for area to get the design that meets your requirements and specifications.

- Once you have identified the design you need, just click Get now to proceed.

- Find the pricing program you need, key in your references, and register for your account on US Legal Forms.

- Full the purchase. You should use your bank card or PayPal profile to fund the legal kind.

- Find the format of the papers and obtain it in your system.

- Make changes in your papers if needed. It is possible to full, edit and signal and produce Maryland Reprint Sales License Agreement.

Obtain and produce 1000s of papers layouts using the US Legal Forms website, that provides the greatest selection of legal kinds. Use expert and state-specific layouts to deal with your small business or personal requirements.

Form popularity

FAQ

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

How can I file Maryland Form 1? Maryland Form 1 is the Annual Report and Business Personal Property Return that is required to be filed by all Maryland business entities. Form 1 can be filed online through . Form 1, along with the filing fee, is due by April 15th.

Qualifying organizations must complete Maryland Sales and Use Tax Exemption Certificate Application (SUTEC Application) and attach the required documents to the corresponding schedules. The SUTEC Application and applicable schedules must be completed in their entirety for the application to be processed.

Unless you are a grower or manufacturer, you may not offer for sale, sell or otherwise dispose of any goods within Maryland, without first obtaining a trader's license from the Clerk of the Circuit Court and opening a sales tax account.

The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax. All other organizations must issue a resale certificate, with their Maryland sales and use tax license number, to purchase items tax-free for resale.

If you will make sales in Maryland, you will need to obtain a sales and use tax license. To obtain one, complete a Combined Registration Application. The application provides a one-stop method for registering a variety of tax accounts, including the sales and use tax license.

Qualifying organizations must complete Maryland Sales and Use Tax Exemption Certificate Application (SUTEC Application) and attach the required documents to the corresponding schedules. The SUTEC Application and applicable schedules must be completed in their entirety for the application to be processed.