This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Maryland Formula System for Distribution of Earnings to Partners

Description

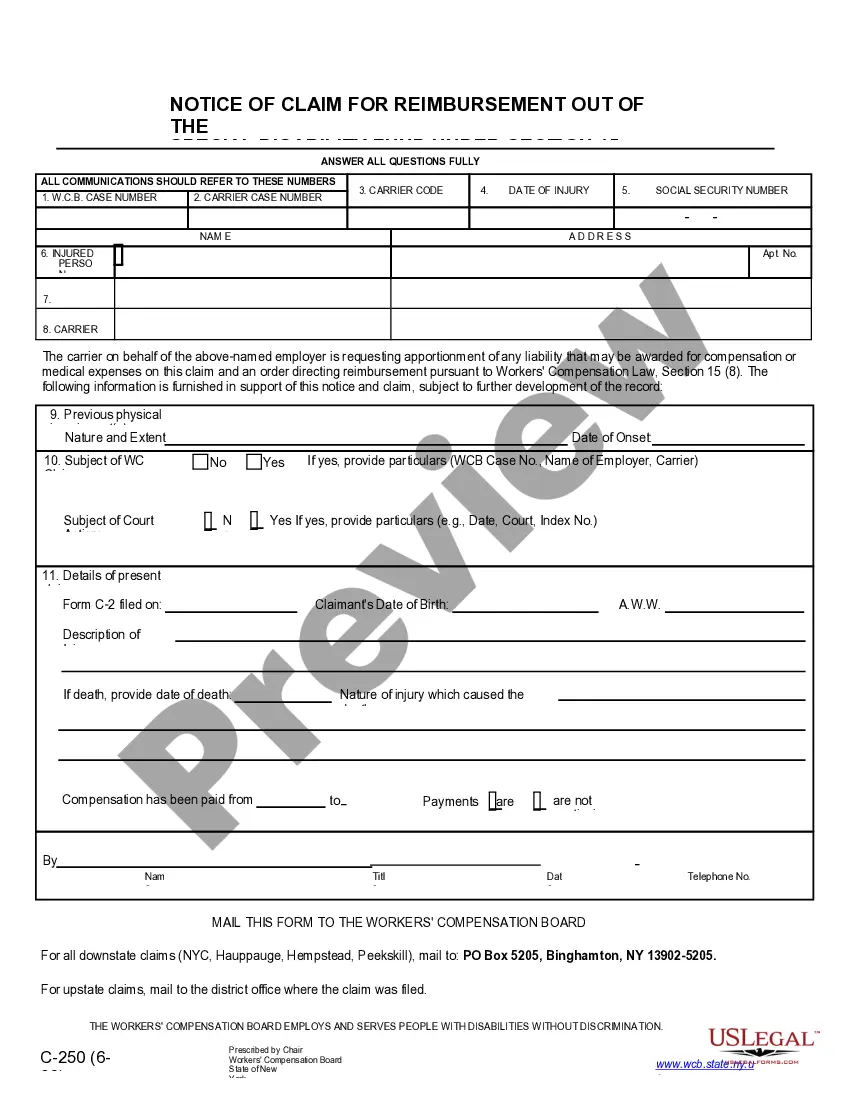

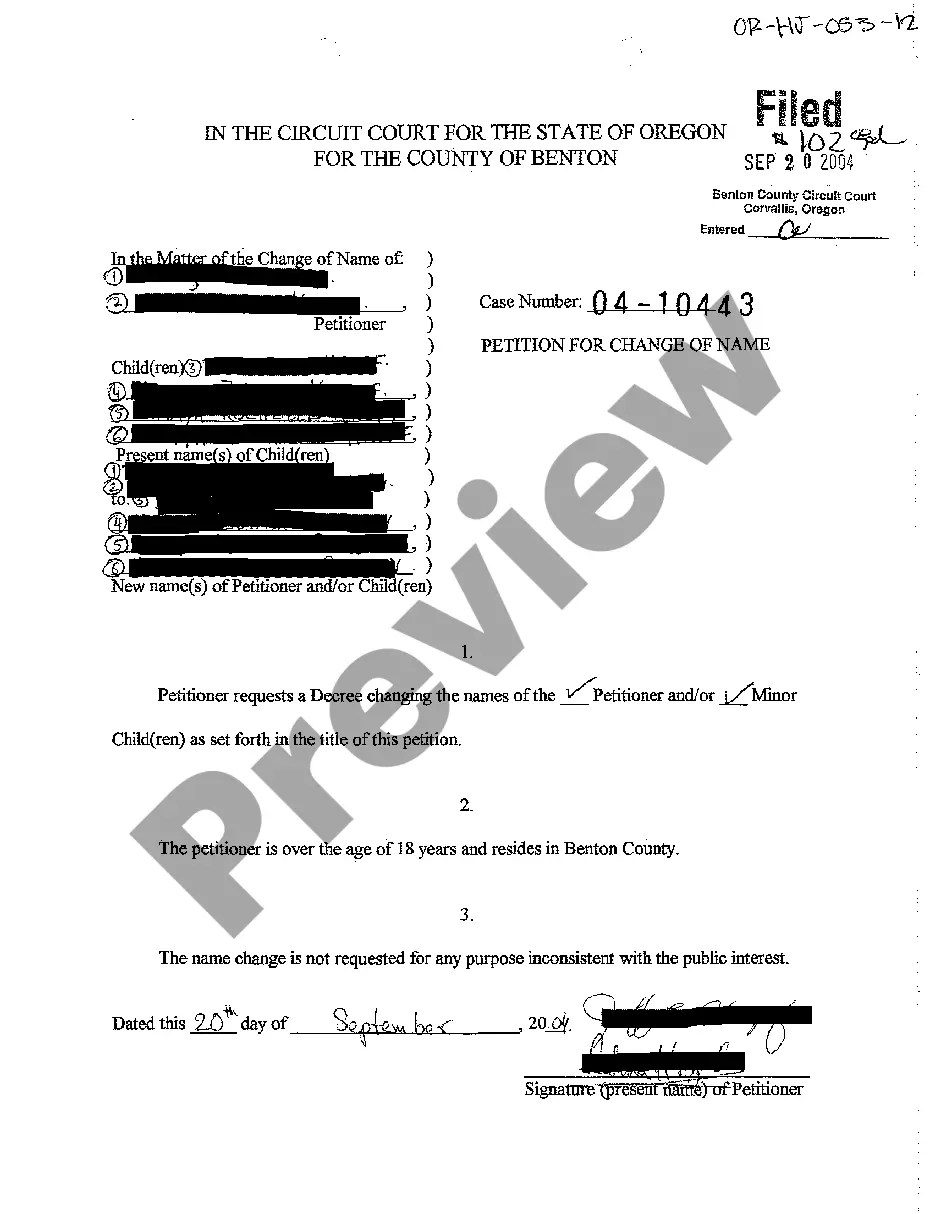

How to fill out Formula System For Distribution Of Earnings To Partners?

You are able to commit hrs online trying to find the legitimate file design that meets the state and federal requirements you will need. US Legal Forms provides 1000s of legitimate kinds which can be evaluated by experts. You can easily acquire or printing the Maryland Formula System for Distribution of Earnings to Partners from my services.

If you currently have a US Legal Forms bank account, you can log in and click the Obtain button. Next, you can total, change, printing, or indication the Maryland Formula System for Distribution of Earnings to Partners. Each and every legitimate file design you get is your own property permanently. To get yet another duplicate for any acquired type, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the basic directions under:

- Initially, make certain you have chosen the proper file design for that state/city of your choosing. See the type description to ensure you have chosen the proper type. If offered, take advantage of the Review button to appear with the file design also.

- If you wish to find yet another model of your type, take advantage of the Research industry to get the design that fits your needs and requirements.

- Upon having identified the design you would like, just click Purchase now to carry on.

- Select the pricing plan you would like, type your references, and register for an account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal bank account to fund the legitimate type.

- Select the formatting of your file and acquire it to your product.

- Make alterations to your file if possible. You are able to total, change and indication and printing Maryland Formula System for Distribution of Earnings to Partners.

Obtain and printing 1000s of file templates utilizing the US Legal Forms website, that provides the largest assortment of legitimate kinds. Use professional and condition-particular templates to take on your small business or person requirements.

Form popularity

FAQ

This means that the partnership itself is not subject to tax: any profits are instead taxable on the partners. Generally, for tax purposes each partner is treated as receiving their share of the income and expenses of the partnership as they arise.

The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts. The respective drawings accounts are closed to the partner capital accounts.

How to Fill MW-507 Form Line 1 ? The line includes the total amount of personal exemptions. Line 2 ? Review additional withholdings. ... Line 3 ? Employees mark line 3 if they did not owe any Maryland income tax in the previous year and earned a full refund.

Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner. For deadlines, see About Form 1065, U.S. Return of Partnership Income.

Partnerships are considered pass-through entities. That means that any income or losses are passed through the partnership to the individual owners, who are then responsible to account for that income or loss on their income tax returns.

Partnership accounting is the same as accounting for a proprietorship except there are separate capital and drawing accounts for each partner. The fundamental accounting equation (Assets = Liabilities + Owner's Equity) remains unchanged except that total owners' equity is the sum of the partners' capital accounts.

If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income. If the partnership realized a loss, credit the income section and debit each partner's capital account based on his or her share of the loss.

Business income from a partnership is generally computed in the same manner as income for an individual. That is, taxable income is determined by subtracting allowable deductions from gross income. This net income is passed through as ordinary income to the partner on Schedule K-1.