Maryland I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Are you presently inside a situation in which you will need files for possibly enterprise or individual functions virtually every working day? There are a lot of legal document layouts available online, but locating versions you can trust is not effortless. US Legal Forms provides 1000s of type layouts, much like the Maryland I.R.S. Form SS-4 (to obtain your federal identification number), which are published to satisfy federal and state demands.

If you are currently familiar with US Legal Forms web site and get a free account, merely log in. After that, it is possible to down load the Maryland I.R.S. Form SS-4 (to obtain your federal identification number) template.

If you do not provide an account and need to begin to use US Legal Forms, follow these steps:

- Get the type you will need and make sure it is for that appropriate area/area.

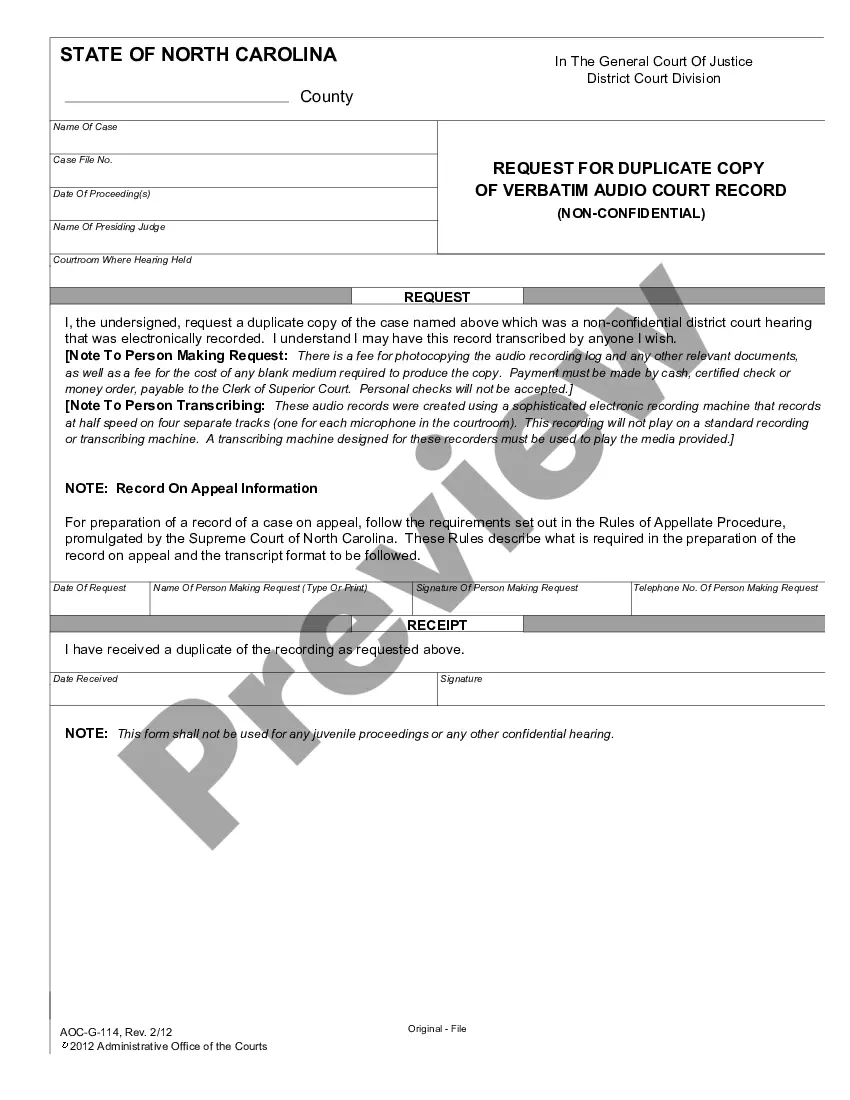

- Make use of the Review button to analyze the form.

- Look at the description to actually have selected the right type.

- In the event the type is not what you`re seeking, utilize the Search industry to obtain the type that fits your needs and demands.

- Once you discover the appropriate type, just click Get now.

- Opt for the costs plan you want, fill out the necessary details to create your money, and pay money for your order with your PayPal or credit card.

- Pick a convenient data file structure and down load your copy.

Discover all the document layouts you might have bought in the My Forms food selection. You may get a more copy of Maryland I.R.S. Form SS-4 (to obtain your federal identification number) at any time, if possible. Just click on the required type to down load or print out the document template.

Use US Legal Forms, the most considerable assortment of legal types, to save time as well as prevent faults. The assistance provides expertly created legal document layouts which can be used for an array of functions. Make a free account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

You can use Form SS-4 to request an Employer Identification Number (EIN) from the IRS. An EIN is assigned to a business for business activities such as tax filing and reporting purposes. The following types of entities can apply for an EIN: Employers (including corporations, partnerships, and sole proprietors)

6 Steps to Complete SS-4 Gather the Information Necessary To Complete Form SS-4. You'll want to gather information on the business. ... Complete the General Information Section. ... Complete the Business Type Information Section. ... Complete the Other Business Information Section. ... Sign the Form. ... Submit Your Form SS-4. SS-4 Instructions: A Simple Guide (2023) - Forbes forbes.com ? advisor ? business ? ss-4-form... forbes.com ? advisor ? business ? ss-4-form...

You can start a business in minutes. COVID-19 has impacted organizations around the world and the IRS is no exception. Due to COVID-19 the IRS has relaxed some ?wet signature? requirements which means you are able to digitally sign Form SS-4 (Application for an EIN)!

SS-4 Confirmation Letter: This letter acts as an official statement from the IRS, confirming your authorized EIN. It outlines your entity's legal name, address, EIN, and the date of issuance.

You can apply for an EIN by filing an Application For Employer Identification Number (Form SS-4) with the Internal Revenue Service (IRS). The form can be submitted online, by mail, telephone, or fax. There is no filing fee.

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration. TIN Description U.S. taxpayer identification numbers i - OECD oecd.org ? tax ? United-States-TIN oecd.org ? tax ? United-States-TIN

You can apply for a FEIN online or download the form through the IRS' website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number. Once approved, your FEIN will be a nine-digit number. Obtain a Federal Tax ID Number from the IRS - Maryland ... Maryland Business Express (.gov) ? start ? obtain-ein Maryland Business Express (.gov) ? start ? obtain-ein

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. Lost or Misplaced Your EIN? | Internal Revenue Service irs.gov ? small-businesses-self-employed ? l... irs.gov ? small-businesses-self-employed ? l...