Maryland Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

Locating the appropriate official document template can be challenging. Clearly, there are numerous designs available online, but how can you find the official form you require? Use the US Legal Forms website. The service provides a vast array of templates, including the Maryland Chef Services Contract - Self-Employed, suitable for both business and personal needs. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Maryland Chef Services Contract - Self-Employed. Use your account to browse through the legal forms you may have acquired earlier. Visit the My documents section of your account to retrieve another copy of the document you need.

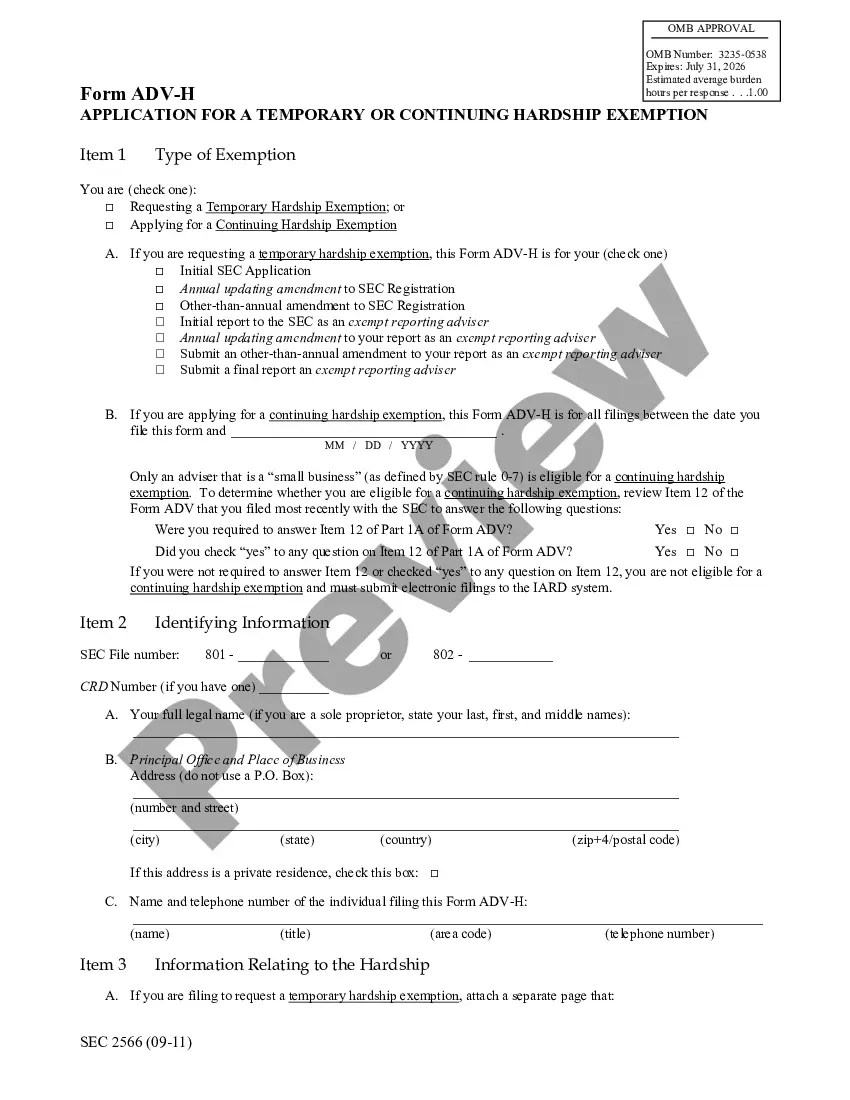

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the right form for your city/state. You can view the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to locate the appropriate form. Once you are certain that the form is correct, click the Get now button to obtain the form. Choose the pricing plan you desire and enter the required details. Create your account and complete your purchase using your PayPal account or credit card. Select the document format and download the legal document template onto your device. Complete, modify, and print out and sign the acquired Maryland Chef Services Contract - Self-Employed.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to acquire properly crafted documents that meet state requirements.

- The templates are designed to cater to both enterprise and personal use.

- All forms are validated by experts to ensure compliance with legal standards.

- Users can easily access previously purchased forms through their accounts.

- The platform offers a user-friendly interface to assist in finding the right documents.

Form popularity

FAQ

To cater in Maryland, you typically need to obtain a catering license, depending on the scope of your services. If you’re planning to operate as a self-employed chef, reviewing the specific licensing requirements is crucial. The Maryland Chef Services Contract - Self-Employed can help you understand these requirements more clearly, ensuring that you comply with local regulations. Consider using the services of USLegalForms to help you get all necessary documents and licenses in order.

Yes, private chefs typically operate as self-employed individuals. This business model grants them the ability to create personalized experiences for their clients. A Maryland Chef Services Contract - Self-Employed can help outline the specifics of the engagement, ensuring that both the chef and the client are aligned on expectations and services.

Yes, chefs often work as independent contractors, particularly if they provide their services to private clients. This arrangement allows chefs the freedom to operate their business without being tied to a single employer. Utilizing a Maryland Chef Services Contract - Self-Employed can help formalize this arrangement and clarify the terms for both parties.

Cooking meals from home for sale can be a lucrative venture, but it must comply with local laws and regulations. In Maryland, you may need to obtain the appropriate licenses and permits. A Maryland Chef Services Contract - Self-Employed can assist in formalizing your offerings and ensuring that your business operates smoothly and legally.

Yes, becoming a self-employed chef is entirely feasible. It allows you to operate independently, catering to clients' specific needs. Utilizing a Maryland Chef Services Contract - Self-Employed can help you outline service expectations and ensure a professional relationship with your clients.

While you can refer to yourself as a chef, your experience and qualifications can lend credibility to that title. Many clients look for chefs who have a proven track record, so it's beneficial to showcase your skills. Additionally, if you wish to offer your services commercially, it may be wise to draft a Maryland Chef Services Contract - Self-Employed to formalize your business.

Certainly, a chef can be self-employed. Many chefs opt for this path to pursue their passion while gaining greater control over their work environment. A well-structured Maryland Chef Services Contract - Self-Employed helps facilitate this arrangement by ensuring that both the chef and the client understand their rights and responsibilities.

Yes, personal chefs often operate as self-employed individuals. By doing so, they have the flexibility to set their own schedules and choose their clients. A Maryland Chef Services Contract - Self-Employed is essential for clearly outlining the terms of service between chefs and their clients, protecting both parties.

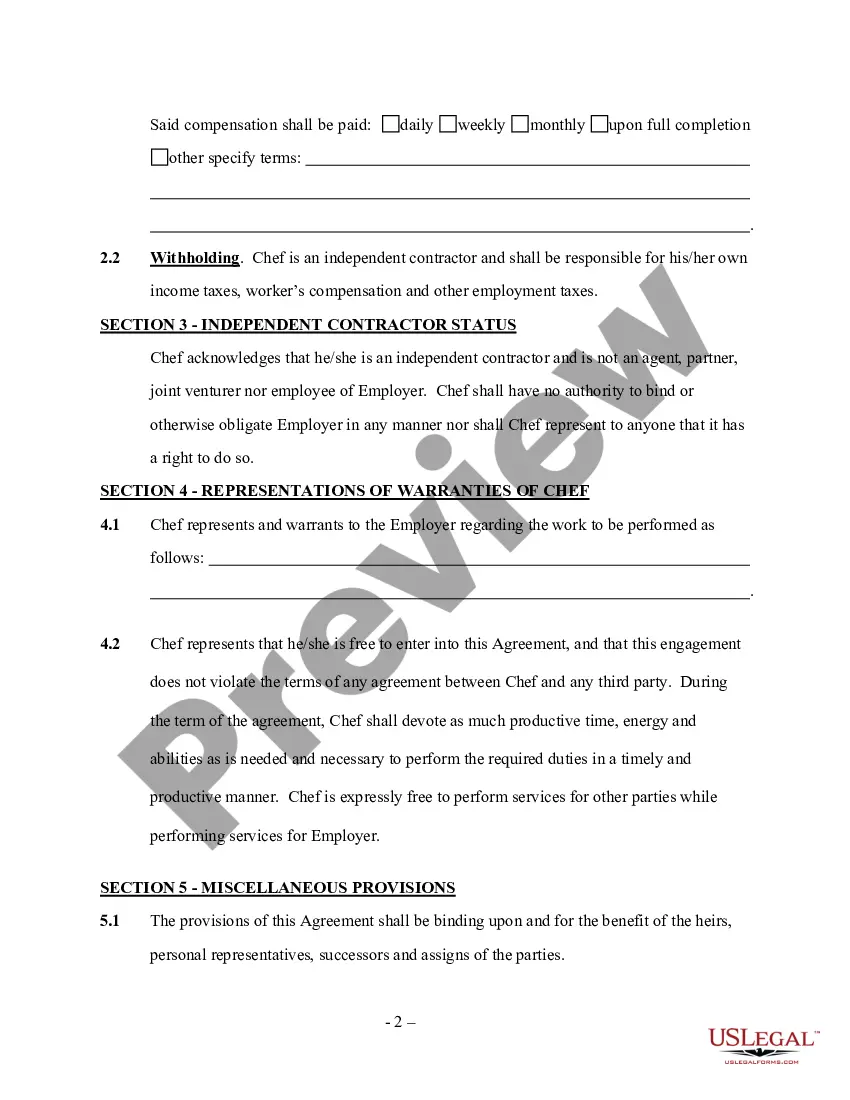

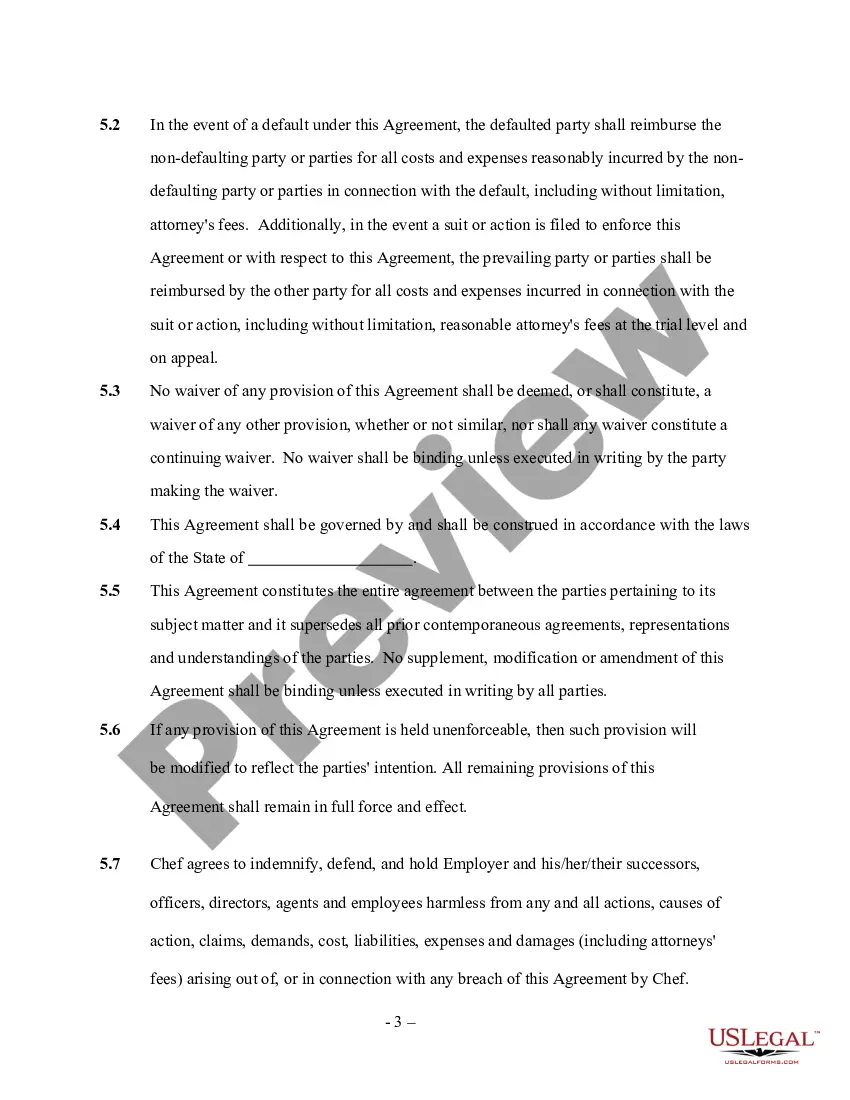

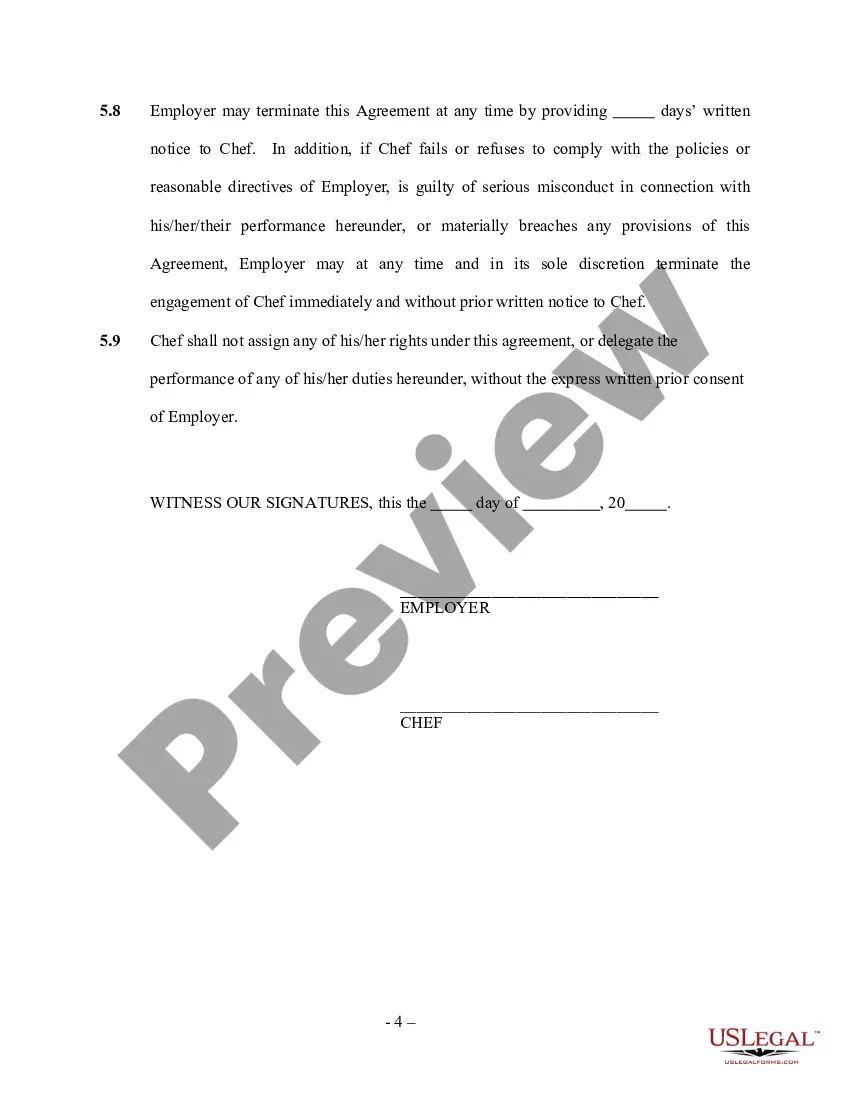

To write a simple Maryland Chef Services Contract - Self-Employed, start by clearly stating the parties involved, including their names and contact details. Next, outline the specific services you will provide, along with the payment terms and deadlines. It’s also important to include a section detailing the contract duration and conditions for termination. By using a reliable platform like US Legal Forms, you can access templates and guidance to ensure your contract meets legal standards.