Maryland Moving Services Contract - Self-Employed

Description

How to fill out Moving Services Contract - Self-Employed?

If you want to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms that can be accessed online.

Take advantage of the site’s user-friendly and convenient search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Maryland Moving Services Contract - Self-Employed with just a few clicks.

Each legal document template you purchase is yours forever. You can access each form you saved in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and obtain, and print the Maryland Moving Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Maryland Moving Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

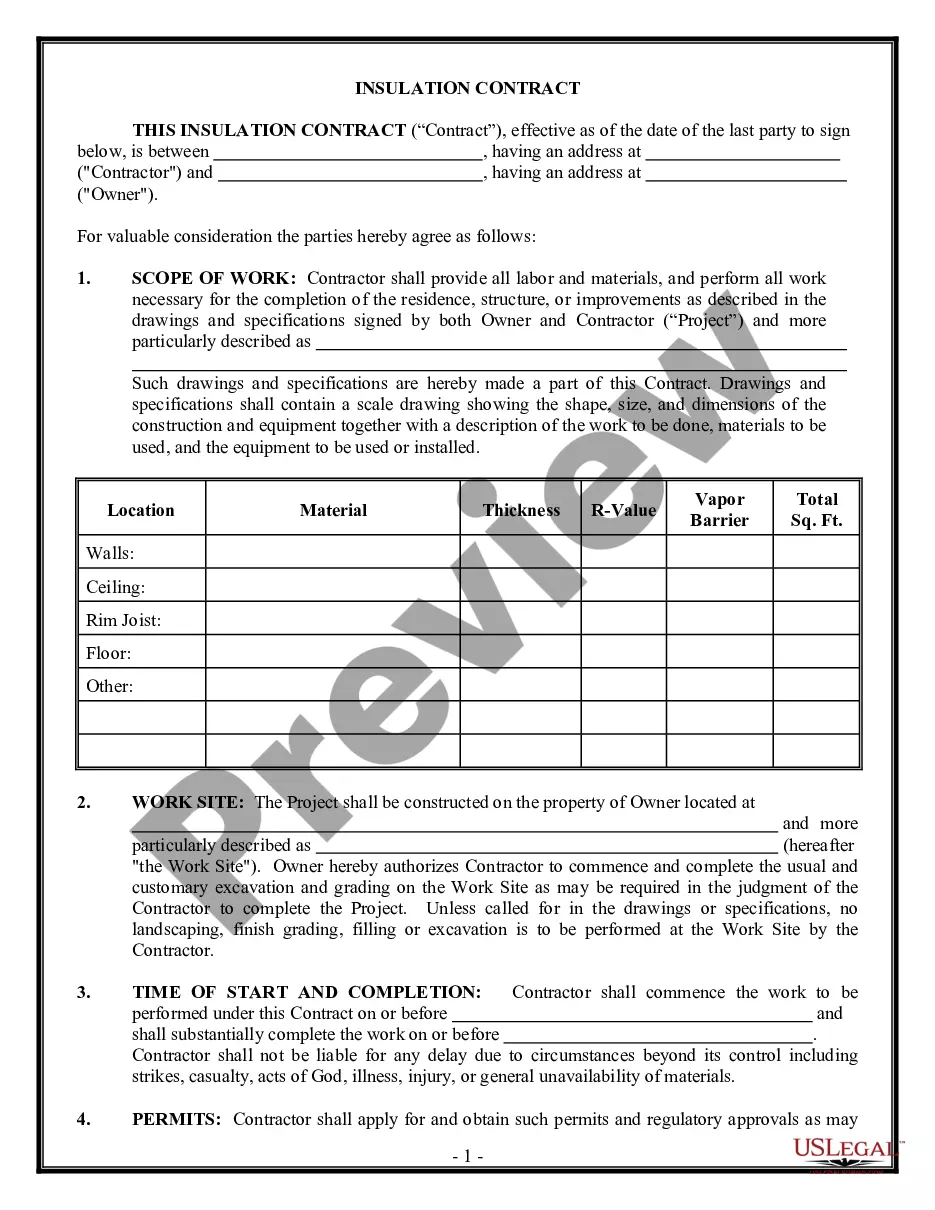

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Maryland Moving Services Contract - Self-Employed.

Form popularity

FAQ

To register your business with the state of Maryland, you must first choose a business structure, such as a limited liability company or sole proprietorship. Next, visit the Maryland Secretary of State's website to file your business formation documents and obtain any necessary licenses. Additionally, consider completing a Maryland Moving Services Contract - Self-Employed to ensure your moving services comply with state regulations.

While you do not necessarily need an LLC to start a moving company, forming one can protect your personal assets and lend credibility to your business. An LLC structure helps manage liability while you navigate the logistics of your operations. Incorporating a Maryland Moving Services Contract - Self-Employed also aids in setting clear expectations with clients.

Starting a moving company can be a great business opportunity, especially if you understand your target market and are passionate about helping people. The demand for moving services is typically consistent, creating potential for steady income. By offering a Maryland Moving Services Contract - Self-Employed, you can establish credibility and professionalism in your operations.

Starting a moving company from scratch involves several steps, including market research and developing a comprehensive business plan. You will need to secure funding for equipment and marketing, and ensure compliance with local regulations. Don't forget to explore a Maryland Moving Services Contract - Self-Employed to help formalize your customer agreements.

When starting a moving company, it is important to have liability insurance and cargo insurance to protect your business and customers. Additionally, consider workers' compensation insurance if you plan to hire employees. A well-structured Maryland Moving Services Contract - Self-Employed can also mitigate risks and foster trust with clients.

To start your own moving company, begin with a solid business plan that defines your services and target market. Next, register your business and obtain the necessary permits and a Maryland Moving Services Contract - Self-Employed. Finally, market your services through various channels to attract clients and build a reputation in your area.

Starting a moving company can require various initial costs depending on your business model. Generally, you will need to invest in a reliable truck, moving supplies, and marketing efforts. Also, consider the expenses for obtaining a Maryland Moving Services Contract - Self-Employed, and any necessary licensing or insurance. Planning your budget carefully helps ensure you have enough resources to get your business off the ground.

To write a contract for a 1099 employee, start by stating the individual's name and the nature of their work. Clearly outline compensation, the scope of work, and any important deadlines. It's crucial to specify the independent nature of the work relationship to maintain compliance with tax laws associated with a Maryland Moving Services Contract - Self-Employed. Consulting platforms like USLegalForms can provide valuable guidance and comprehensive templates.

employed contract should clearly define the business relationship and services rendered. Begin with the names of both parties, followed by the description of work, payment terms, and deadlines. Additionally, include clauses for any necessary liabilities and insurance, which are critical for protecting both parties in a Maryland Moving Services Contract SelfEmployed.

Writing an independent contractor agreement involves specifying the nature of the services provided and the payment arrangements. Include details on project timelines and any specific materials or resources required for completion. It's also wise to outline confidentiality expectations and dispute resolution processes, making it easier to navigate any potential issues that arise in a Maryland Moving Services Contract - Self-Employed.