Maryland Electrologist Agreement - Self-Employed Independent Contractor

Description

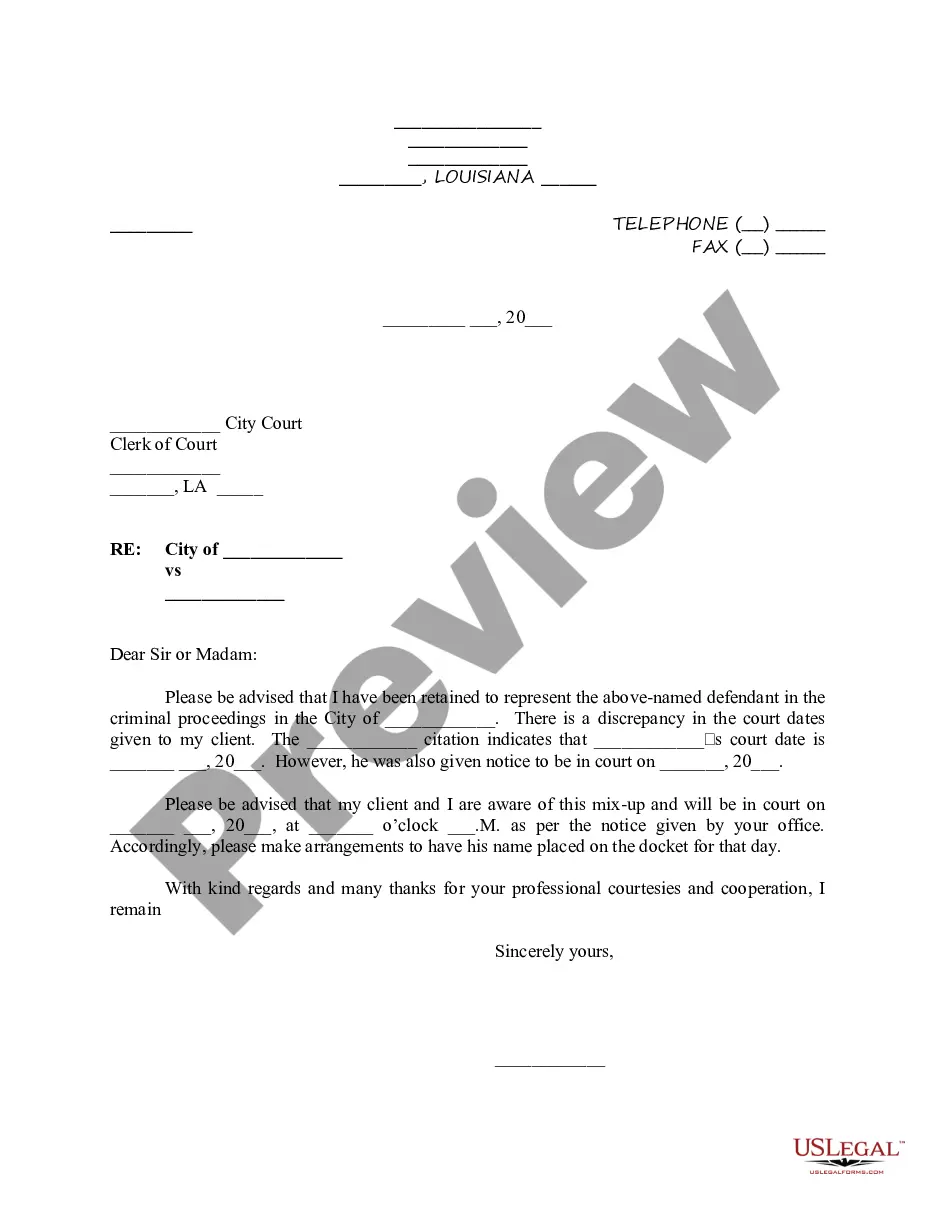

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

If you desire to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest selection of lawful forms, which can be accessed online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require. Various templates for commercial and personal uses are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Maryland Electrologist Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you acquire is yours permanently. You can access every form you obtained in your account. Visit the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Maryland Electrologist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Maryland Electrologist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to browse through the form's details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you want, click the Buy now button. Choose your preferred payment plan and enter your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Maryland Electrologist Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

The primary difference between an independent contractor and an employee in Maryland lies in the degree of control and independence. Independent contractors have more freedom regarding how and when they work, while employees typically follow specific instructions from their employers. Understanding these distinctions is vital for ensuring you are classified correctly under the Maryland Electrologist Agreement - Self-Employed Independent Contractor.

In Maryland, independent contractors are generally not required to carry workers' compensation insurance unless they have employees. However, it could be wise to carry coverage to protect against workplace injuries. If you are operating under a Maryland Electrologist Agreement - Self-Employed Independent Contractor, reviewing your insurance needs with an insurance professional might be a smart choice.

Independent contractors in Maryland must follow specific rules, including adhering to contracts, providing their own tools and equipment, and being responsible for their own taxes. Additionally, independent contractors should maintain clear communication with clients about job expectations and deliverables. The Maryland Electrologist Agreement - Self-Employed Independent Contractor can serve as a vital tool to define these rules and ensure smooth business relationships.

In Maryland, a single member LLC is not legally required to have an operating agreement. However, creating one can be beneficial as it outlines the management structure and operational procedures of your business. This becomes particularly important when working under a Maryland Electrologist Agreement - Self-Employed Independent Contractor, as it adds clarity and legal backing to your business operations.

Legal requirements for independent contractors in Maryland vary, but you must comply with tax regulations, obtain relevant business licenses, and maintain records of your work and payments. It is essential to understand your rights and responsibilities under the Maryland Electrologist Agreement - Self-Employed Independent Contractor to maintain compliance. Additionally, consider consulting with a legal expert to navigate these requirements.

As an independent contractor in Maryland, you need to register your business, which may include obtaining any necessary permits or licenses related to your field. You will also want to draft a Maryland Electrologist Agreement - Self-Employed Independent Contractor to outline your services, terms, and conditions. Having proper documentation will help ensure clarity with your clients.

To be classified as an independent contractor under the Maryland Electrologist Agreement - Self-Employed Independent Contractor, you must demonstrate control over how you complete your work. This means you set your own hours, choose your own methods, and can work for multiple clients. Ensuring this level of independence is crucial for proper classification.

An independent contractor should typically complete several essential forms, including tax forms, business registration documents, and the independent contractor agreement itself. For those in the beauty and wellness industry, utilizing the Maryland Electrologist Agreement - Self-Employed Independent Contractor can help ensure compliance with local regulations. Additionally, it's beneficial to keep track of invoices and receipts for tax purposes.

To fill out an independent contractor agreement, begin by clearly stating the purpose of the agreement. Include both parties' names and addresses, followed by a detailed description of the work to be performed. Be sure to specify the payment terms, deadlines, and any other relevant conditions. The Maryland Electrologist Agreement - Self-Employed Independent Contractor serves as an excellent template to guide you through this process.

Filling out an independent contractor form is a straightforward process. Start by providing your personal information, such as your name and contact details. Next, include information about your business and the services you offer. Finally, make sure to review the Maryland Electrologist Agreement - Self-Employed Independent Contractor carefully to ensure accuracy before submission.