Maryland Visiting Professor Agreement - Self-Employed Independent Contractor

Description

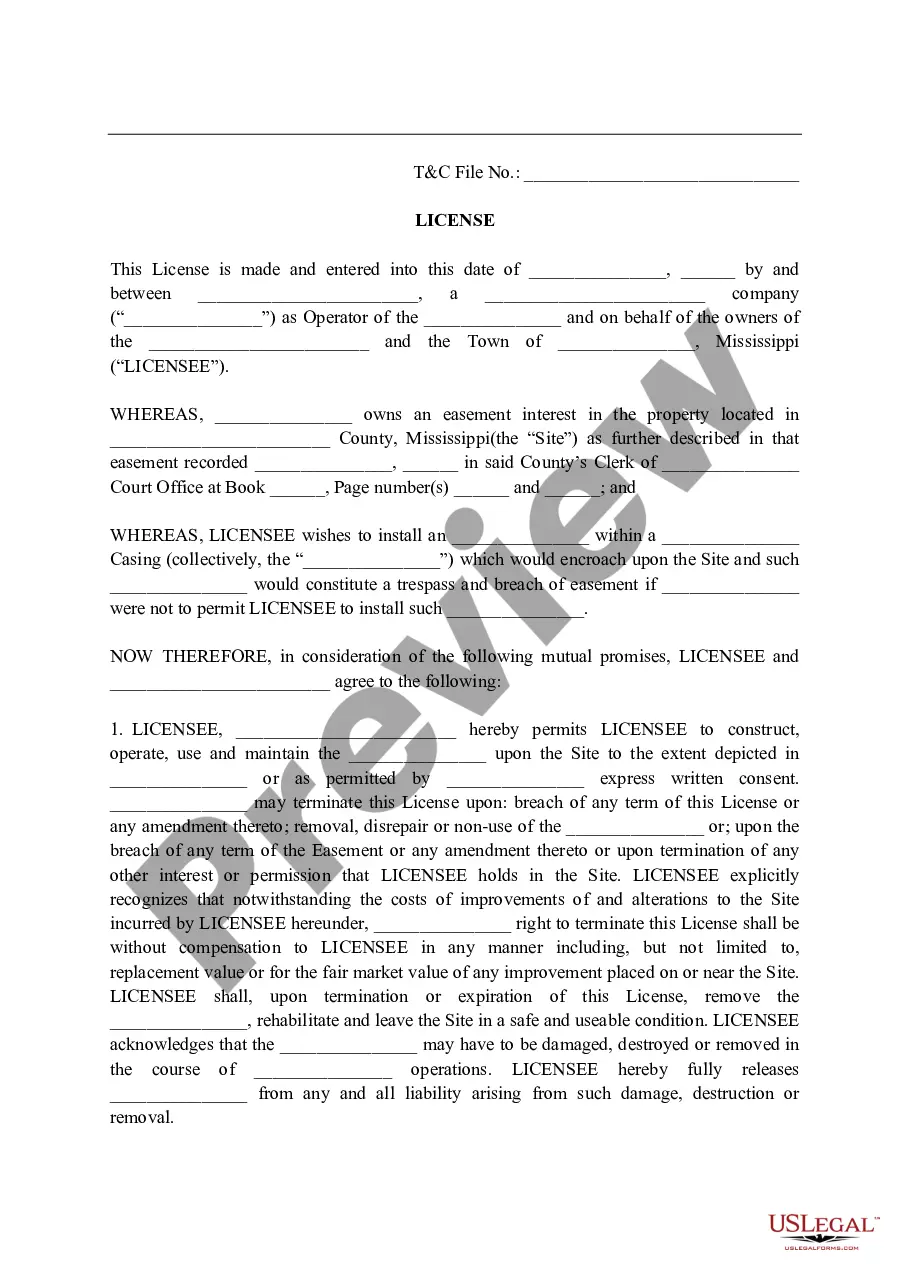

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

In case you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Employ the site's straightforward and user-friendly search function to retrieve the necessary documents.

Numerous templates for businesses and individual purposes are organized by categories and suggestions, or keywords.

Once you have located the form you require, click on the Get Now button. Choose your preferred pricing plan and provide your details to register for the account.

Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or individual needs.

- Utilize US Legal Forms to secure the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Download button to retrieve the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Ensure you have selected the form for the correct jurisdiction/region.

- Use the Review option to examine the form's content. Be sure to read through the description.

- If you are dissatisfied with the form, utilize the Lookup section at the top of the screen to find alternative types of the legal document template.

Form popularity

FAQ

Independent contractors can be required to attend meetings if their Maryland Visiting Professor Agreement - Self-Employed Independent Contractor specifies such a requirement. The agreement should clearly outline the nature of your engagement and any obligations regarding meetings. Clarity in your contract helps set expectations and maintain good professional relationships.

You can often refuse to attend a work meeting if your Maryland Visiting Professor Agreement - Self-Employed Independent Contractor does not require attendance. However, consider the potential impact on your professional relationships. Open communication with your employer about your availability may help align expectations while respecting your independence.

In most cases, if you have a Maryland Visiting Professor Agreement - Self-Employed Independent Contractor, your job cannot force you to attend meetings outside the terms of your agreement. Your agreement should define your obligations and rights. If there are no explicit requirements for meeting attendance, you maintain flexibility in how you manage your work commitments.

Legal requirements for independent contractors vary by state, but generally, they need to comply with tax regulations and business licensing. A Maryland Visiting Professor Agreement - Self-Employed Independent Contractor should clearly outline the contractor's responsibilities, rights, and obligations. Using a reliable template can help ensure that all necessary legal aspects are addressed, offering peace of mind.

Whether contractors need to attend meetings often depends on the terms laid out in the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor. If the agreement specifies participation in meetings for collaboration or updates, attendance may be required. However, contractors generally have more flexibility in their schedules compared to employees.

Creating a Maryland Visiting Professor Agreement - Self-Employed Independent Contractor starts with outlining the scope of work and deliverables. Clearly define roles, responsibilities, and expectations. Additionally, include compensation details, payment terms, and any relevant timelines. It’s often beneficial to use a template from trusted platforms like US Legal Forms to ensure all essential components are covered.

Independent contractors typically do not need workers' compensation insurance in Maryland, as it is primarily meant for employees. However, some circumstances may prompt independent contractors to obtain coverage for their protection and to meet contractual obligations. If you are drafting a Maryland Visiting Professor Agreement - Self-Employed Independent Contractor, it may be beneficial to discuss insurance needs with a professional. UsLegalForms provides resources that can guide you through understanding your insurance needs in relation to your agreement.

A Maryland Visiting Professor Agreement - Self-Employed Independent Contractor typically does not require notarization to be valid. However, notarization can provide an extra layer of credibility and security to the agreement. It's always a good approach to consult a legal expert to ensure that all necessary steps are taken, especially if the agreement involves significant responsibilities or compensation. UsLegalForms offers various templates that can help you create an agreement tailored to your needs.

To fill out an independent contractor form, start by gathering all necessary information about the services you offer and your payment details. If you are working under the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor, ensure you include specific information about your contract terms. Follow the provided instructions on the form, and double-check for accuracy before submission. Platforms like uslegalforms can provide valuable resources for completing these forms correctly.

Writing an independent contractor agreement involves outlining essential details such as the project scope and payment terms. In the context of the Maryland Visiting Professor Agreement - Self-Employed Independent Contractor, it's crucial to define the relationship clearly. Use straightforward language to cover all expectations, from deliverables to timelines. Consider using templates from platforms like uslegalforms for convenience and legal accuracy.