Maryland MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms like the Maryland MHA Request for Short Sale in just minutes.

If you are already a registered user, Log In to download the Maryland MHA Request for Short Sale from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make edits. Fill out, modify, and print and sign the downloaded Maryland MHA Request for Short Sale.

Each design you add to your account has no expiration date and belongs to you forever. Therefore, to download or print another copy, simply visit the My documents section and click on the form you need.

Gain access to the Maryland MHA Request for Short Sale using US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, here are some simple steps to get started.

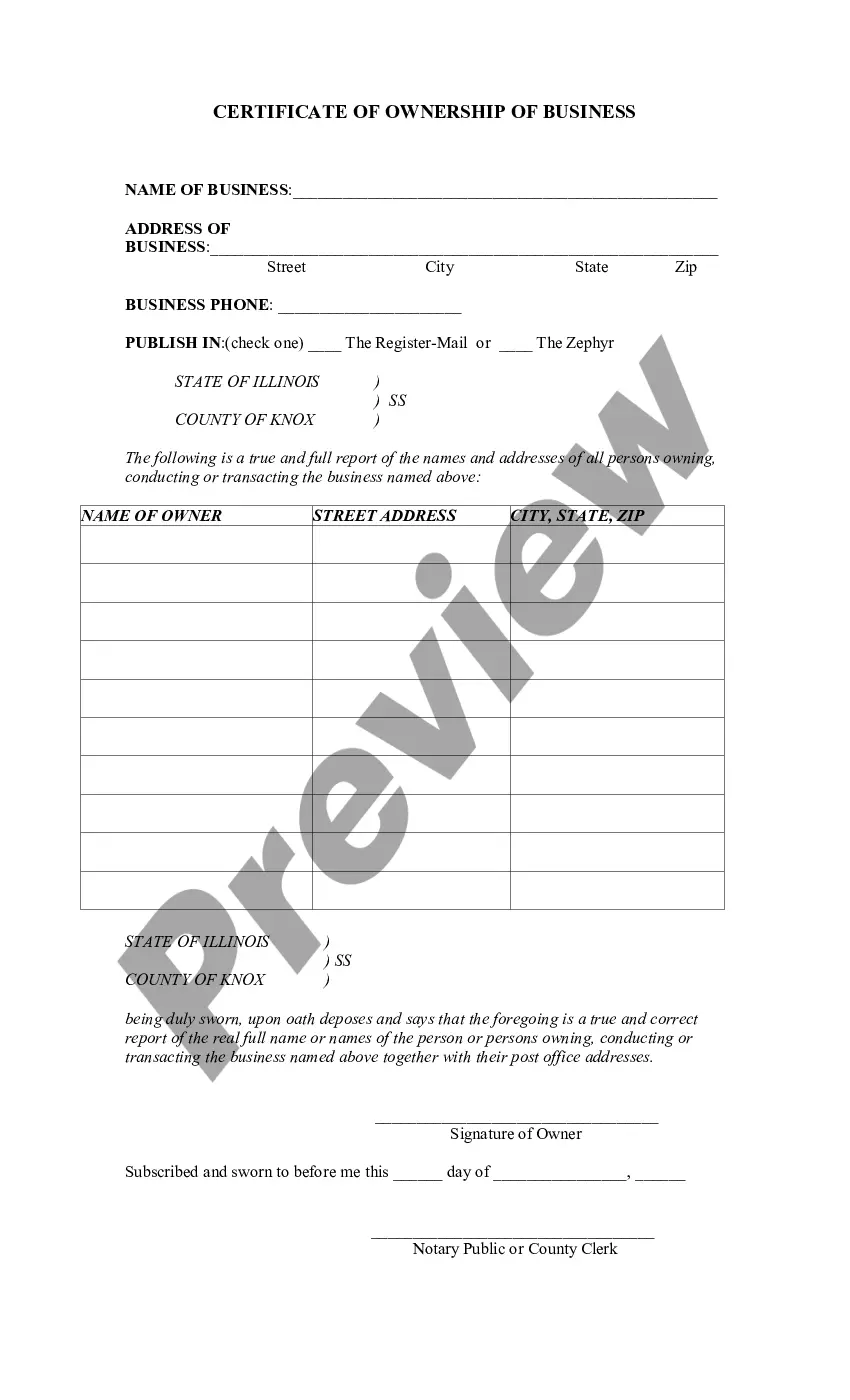

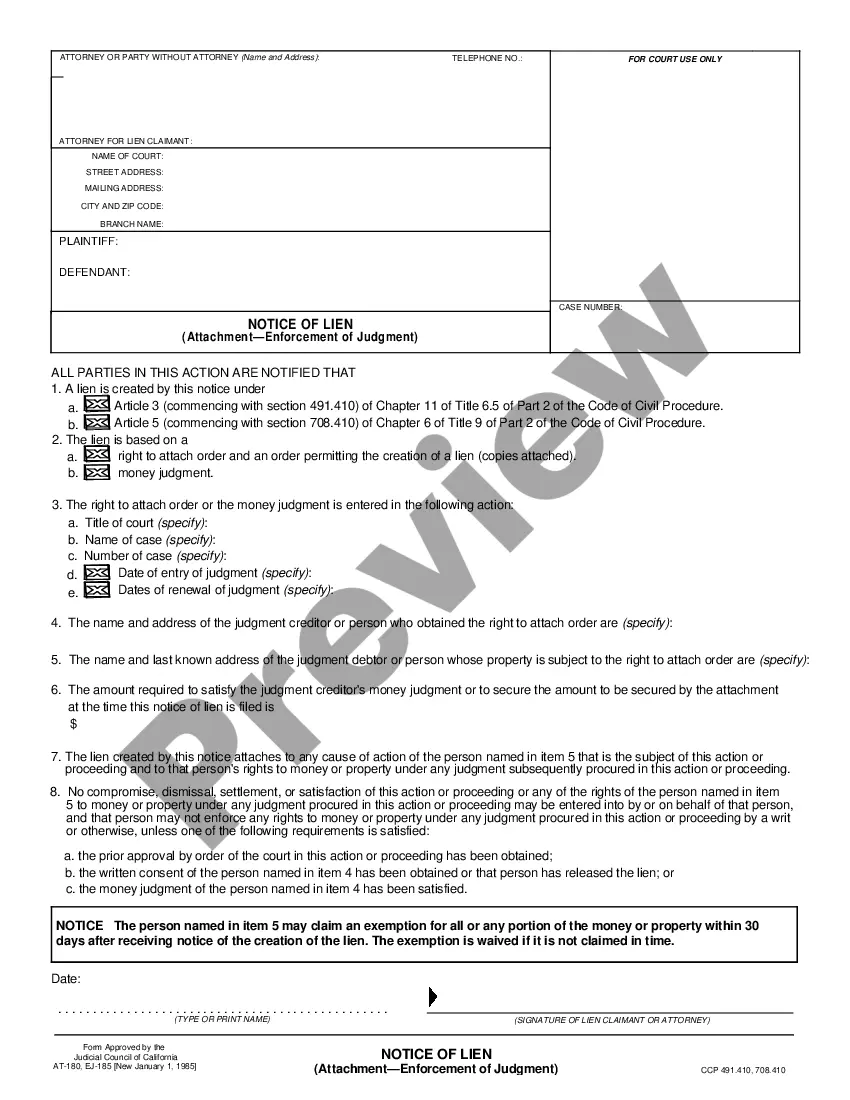

- Make sure you have selected the correct form for your city/state. Click the Preview option to review the form's details. Read the form description to ensure you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, select the pricing plan you wish and provide your information to register for an account.

- Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

To get approved for a Maryland MHA Request for Short Sale, start by reaching out to your lender and expressing your intent to pursue a short sale. You will need to provide detailed financial information, including income statements and any hardship documentation. It is crucial to follow the lender's guidelines, which may involve submitting a formal request. Utilizing the resources available on US Legal Forms can simplify this process by providing necessary documents and guidance, increasing your chances of a successful short sale approval.

To ask for a short sale, initiate the conversation with your lender by explaining your financial difficulties. Make sure to express your desire to submit a Maryland MHA Request for Short Sale, along with any supporting documents that highlight your situation. Clear communication and a thorough understanding of your finances go a long way in this process. Consider seeking assistance from real estate professionals who specialize in short sales to help streamline your request.

To qualify for a short sale, homeowners must demonstrate financial hardship, such as job loss, medical expenses, or a financial crisis. A thorough look at your situation is necessary, as your lender will require evidence of inability to continue mortgage payments when you initiate a Maryland MHA Request for Short Sale. It's important to communicate openly with your lender and gather the required documentation to establish your case. Additionally, having a supportive real estate agent can guide you through the qualifying process.

A short sale in Maryland occurs when a homeowner sells their property for less than the amount owed on their mortgage, with the lender's approval. This process often involves completing a Maryland MHA Request for Short Sale to facilitate communication with the bank. Short sales can offer a more favorable outcome compared to foreclosure, allowing the borrower to avoid the severity of credit damage. It’s a viable option when facing financial hardship.

To request a short sale, start by contacting your lender and expressing your interest in pursuing a Maryland MHA Request for Short Sale. You will need to gather your financial documents, including income statements and expenses, to demonstrate your need. It's also helpful to work with a real estate agent who has experience in short sales to guide you through the process smoothly. This ensures you meet all requirements set by the bank.

Yes, short sales can impact your credit score, but typically less than a foreclosure. When you complete a Maryland MHA Request for Short Sale, the bank may report the transaction, which can lead to a decrease in your credit rating. However, the long-term effects are often milder compared to the consequences of a foreclosure. Being proactive can help you limit damage to your credit.

The primary purpose of a short sale, especially in the context of a Maryland MHA Request for Short Sale, is to avoid foreclosure while relieving financial stress. It allows homeowners to sell their property for less than what they owe on the mortgage with the lender's consent. This solution benefits the homeowner by reducing their liability and often helps the lender minimize loss. Ultimately, it can create a smoother transition to financial recovery for affected families.

When pursuing a Maryland MHA Request for Short Sale, start by gathering necessary documents, such as bank statements and tax returns. Next, inform your mortgage lender of your intent to pursue a short sale, which may require submitting a hardship letter alongside your request. After obtaining lender approval, you will list the property with an experienced real estate agent who understands short sales. Finally, once you receive an offer, submit it to your lender for their consideration.

The steps in a short sale include assessing your financial situation, contacting your lender to discuss options, and preparing a Maryland MHA Request for Short Sale. Next, list your property with an agent who understands the short sale process. Once you receive offers, negotiate with potential buyers and submit these offers to your lender for approval before finalizing the sale.

A reasonable offer on a short sale typically reflects the property's current market value and the financial condition of the seller. Lenders generally expect offers that account for the property's depreciation and repair needs. Therefore, as you prepare your Maryland MHA Request for Short Sale, consider working with a real estate professional to determine a competitive offer that accommodates both the buyer and lender interests.