Maryland Qualified Investor Certification and Waiver of Claims

Description

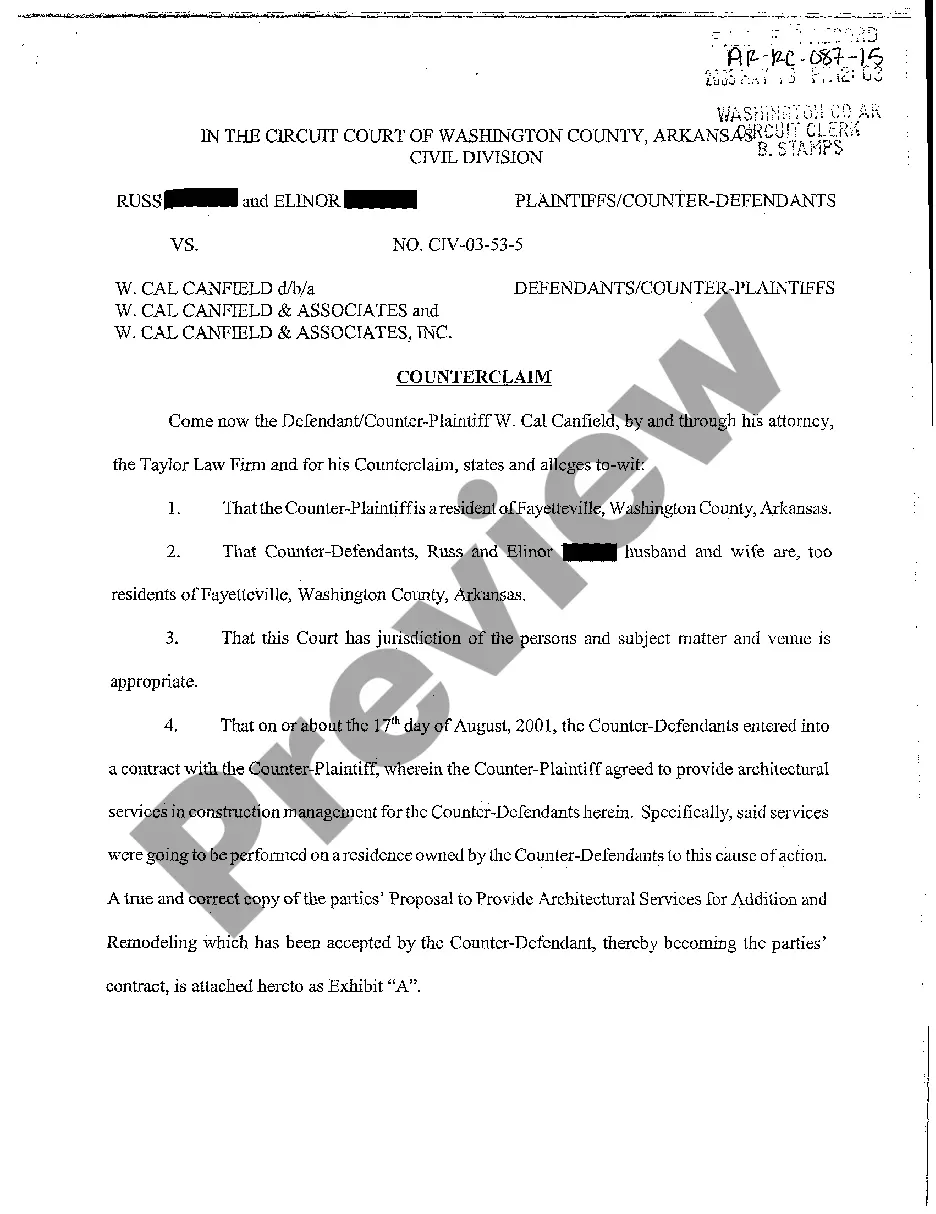

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

How to fill out Qualified Investor Certification And Waiver Of Claims?

You may invest several hours online looking for the authorized file format that suits the federal and state demands you require. US Legal Forms supplies 1000s of authorized kinds which can be examined by experts. You can easily obtain or print out the Maryland Qualified Investor Certification and Waiver of Claims from my services.

If you have a US Legal Forms accounts, you are able to log in and then click the Download option. Next, you are able to full, edit, print out, or sign the Maryland Qualified Investor Certification and Waiver of Claims. Each and every authorized file format you purchase is your own property permanently. To have yet another copy for any bought kind, visit the My Forms tab and then click the related option.

If you use the US Legal Forms website the first time, keep to the basic guidelines under:

- Initially, make sure that you have chosen the best file format to the region/area of your choosing. See the kind description to ensure you have picked out the right kind. If available, take advantage of the Review option to check throughout the file format at the same time.

- If you want to locate yet another version from the kind, take advantage of the Look for discipline to get the format that meets your needs and demands.

- After you have found the format you would like, click Acquire now to proceed.

- Select the costs prepare you would like, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal accounts to cover the authorized kind.

- Select the file format from the file and obtain it in your gadget.

- Make adjustments in your file if required. You may full, edit and sign and print out Maryland Qualified Investor Certification and Waiver of Claims.

Download and print out 1000s of file web templates using the US Legal Forms site, that provides the biggest assortment of authorized kinds. Use skilled and status-specific web templates to deal with your company or personal demands.

Form popularity

FAQ

The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

Generally, you are required to file a Maryland income tax return if: You are or were a Maryland resident; You are required to file a federal income tax return; and. Your Maryland gross income equals or exceeds the level listed below for your filing status.

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

The Maryland earned income tax credit (EITC) will either reduce or eliminate the amount of the state and local income tax that you owe. Detailed EITC guidance for Tax Year 2022, including annual income thresholds can be found here.

The Earned Income Tax Credit (EITC) is a benefit for working people with low to moderate income. If you qualify for the federal earned income tax credit and claim it on your federal return, you may be entitled to a Maryland earned income tax credit on the state return equal to 50% of the federal tax credit.

You can still qualify for the Earned Income Credit (EIC) as long as you have earned income and meet all the other EIC qualifications. Being unemployed, not working, and/or not meeting the filing threshold doesn't automatically disqualify you from the EIC.

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows