This due diligence form entails policies and procedures for the identification, retention, storage, protection and disposal of company records. This Records Retention Policy is intended to ensure that the company's records management policies adhere to customer, legal and business requirements and are conducted in a cost-efficient manner.

Maryland Records Retention Policy

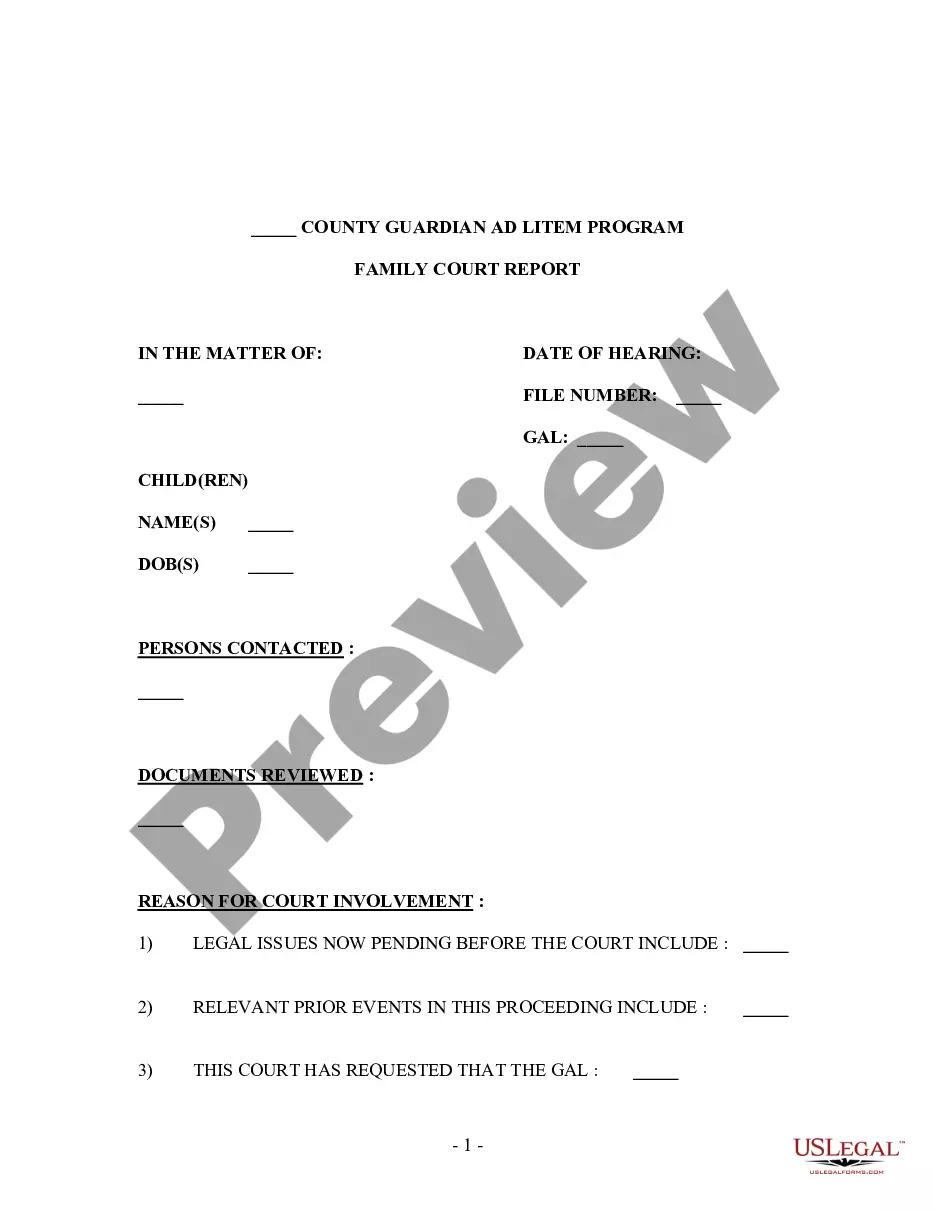

Description

How to fill out Records Retention Policy?

Selecting the optimal authorized document template can be challenging.

Of course, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Maryland Records Retention Policy, suitable for both business and personal use.

You can review the form using the Preview button and read the form description to confirm it meets your requirements. If the form does not fulfill your needs, use the Search area to find the correct form.

- All of the forms are reviewed by experts and comply with both federal and state regulations.

- If you are already a member, Log In to your account and click the Obtain button to access the Maryland Records Retention Policy.

- Utilize your account to navigate through the legal forms you have previously purchased.

- Go to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

To create a record retention policy, begin by researching the Maryland Records Retention Policy and gathering input from relevant stakeholders. Identify the different categories of records your organization holds and outline retention periods based on legal mandates. Establish methods for securely archiving and disposing of records once they are no longer needed, highlighting the importance of compliance. Documenting this process will provide clarity and guidance for everyone involved.

Developing a data retention policy requires careful planning and an understanding of your data landscape. Start by categorizing the types of data your organization collects and processing under the guidance of the Maryland Records Retention Policy. Determine the legal and operational requirements for each category, then decide how long to retain the data. Ensure that the policy aligns with your business goals while safeguarding against information risks.

Creating a retention policy involves outlining the types of records your organization must manage and defining how long each record should be retained. Begin by reviewing regulations, including the Maryland Records Retention Policy, to ensure compliance. Once you have this information, draft the policy document, specifying storage methods and destruction protocols to protect sensitive information. Finally, train your staff on the importance of following the policy diligently.

The first step in establishing a records retention program is to conduct a comprehensive audit of your existing records. This will help you understand what documents you have, how long you’ve been keeping them, and their relevance under the Maryland Records Retention Policy. By mapping out your records, you can identify areas that may require immediate attention and ensure compliance with applicable regulations. Regular audits also help keep your program effective.

To create a document retention policy, start by identifying the types of documents your organization generates. Then, consider the legal requirements associated with those documents, including the Maryland Records Retention Policy. Next, establish retention periods for each type of document based on these requirements and your organization's operational needs. Finally, communicate this policy clearly to all employees and implement a process for regular reviews.

The IRS does not automatically destroy tax records after seven years; rather, they recommend keeping them for that period to support your tax filings. The Maryland Records Retention Policy aligns with IRS guidelines to help you retain essential documentation for audits or disputes. By staying informed about these regulations, you can prevent potential penalties. Using platforms like USLegalForms ensures that you have the right tools for efficient recordkeeping.

In Maryland, the law typically mandates that you retain employee records for at least three years from the date of separation. However, certain documents such as payroll records may need to be kept for longer, depending on the Maryland Records Retention Policy. Keeping accurate employee records helps protect your organization from potential legal issues. Consider leveraging USLegalForms to streamline the management of these important records.

The 7 year retention policy is a guideline that suggests retaining various records for seven years to satisfy legal and regulatory requirements. This period allows individuals and businesses to defend against potential disputes or audits, and it forms a crucial part of the Maryland Records Retention Policy framework. Adhering to this timeline helps maintain accountability and transparency in your record-keeping practices. Explore the tools provided by USLegalForms for efficient record management.

Under the Maryland Records Retention Policy, it's essential to keep financial records such as tax returns, bank statements, and receipts for at least seven years. This timeframe helps you comply with federal and state regulations. By following this policy, you ensure that you have adequate documentation for any audits or inquiries. Utilizing a reliable platform like USLegalForms can help you manage these records effectively.

Records that should typically be retained for 10 years include contracts, certain tax documents, and any business correspondence relating to significant financial discussions as specified by the Maryland Records Retention Policy. Keeping these records for a decade can provide essential reference points and legal protection. Regularly review these records to ensure they are up-to-date and accurately reflect your business activities. For more detailed records management solutions, you might consider UsLegalForms.