Maryland Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

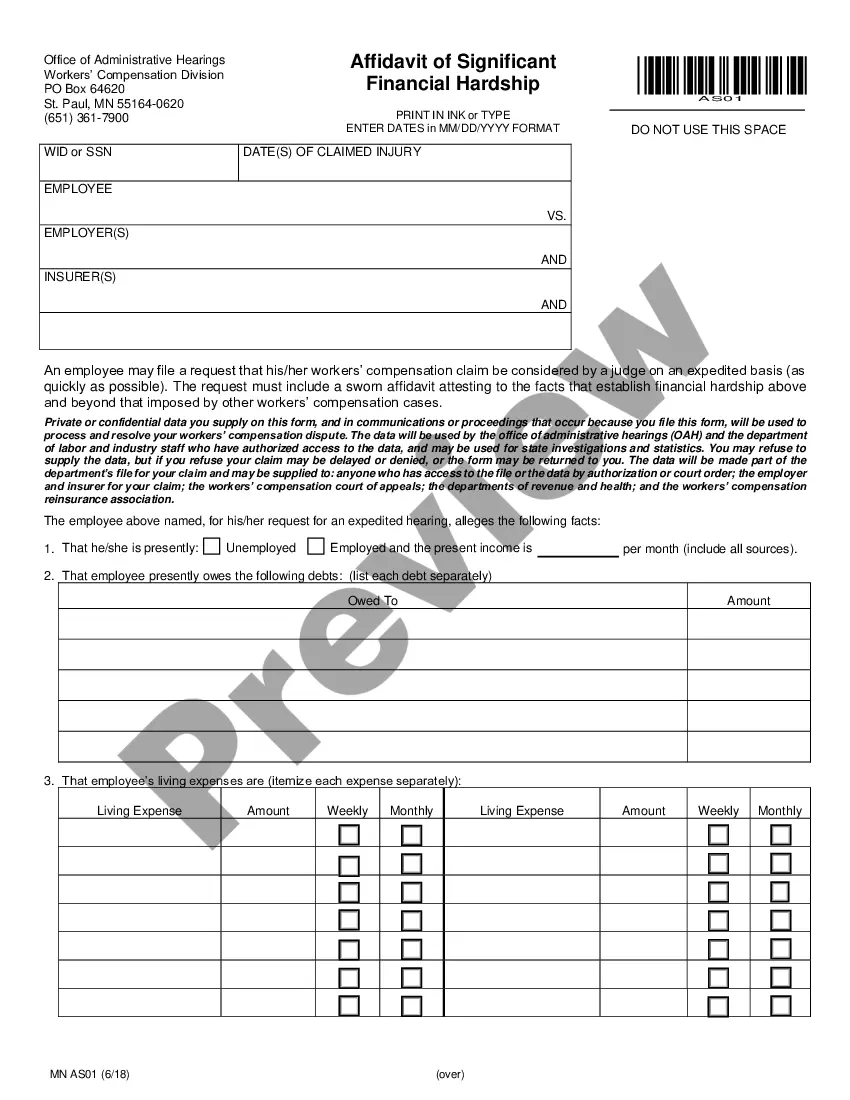

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - among the greatest libraries of lawful kinds in the United States - provides a wide range of lawful file layouts you can download or print out. Making use of the website, you can get thousands of kinds for business and personal reasons, categorized by categories, states, or keywords and phrases.You can find the newest variations of kinds just like the Maryland Notice of Violation of Fair Debt Act - Improper Document Appearance in seconds.

If you already have a subscription, log in and download Maryland Notice of Violation of Fair Debt Act - Improper Document Appearance in the US Legal Forms local library. The Download key will show up on each and every form you view. You get access to all in the past downloaded kinds inside the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are simple directions to help you get began:

- Be sure you have picked the proper form for your metropolis/region. Go through the Preview key to review the form`s articles. See the form information to ensure that you have selected the right form.

- If the form does not match your demands, utilize the Lookup discipline towards the top of the display screen to discover the the one that does.

- When you are content with the shape, confirm your decision by clicking on the Purchase now key. Then, opt for the pricing plan you want and provide your credentials to sign up for the profile.

- Procedure the purchase. Make use of your charge card or PayPal profile to accomplish the purchase.

- Pick the file format and download the shape in your gadget.

- Make modifications. Fill up, revise and print out and signal the downloaded Maryland Notice of Violation of Fair Debt Act - Improper Document Appearance.

Each web template you included in your account does not have an expiry date which is your own eternally. So, if you wish to download or print out one more copy, just go to the My Forms section and click about the form you will need.

Get access to the Maryland Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, probably the most substantial local library of lawful file layouts. Use thousands of skilled and condition-particular layouts that meet your company or personal demands and demands.

Form popularity

FAQ

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

Write the collector a goodwill letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage. There's no guarantee your request will be accepted, but there's no harm in asking. A record of on-time payments since the debt was paid will help your case.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.